Two twin houses, built on a plot of 1,000 square meters in the north of the capital, in a village where real estate development has been booming for the past five years, have been unsold for almost a year. First, the developer put them up for sale at a loss, then, as they still weren’t selling, he completed them and now he has them listed on almost all the profile sites at €144,900 each, but nobody seems to want them, even though they made “like ours”. When starting them, the developer did not even think that they would stand unsold for so long, judging by how quickly the village street turned into a real block of villas.

But when he started building houses, the war had not yet started, the energy crisis had not been predicted, and in terms of interest rates, ROBOR and IRCC, there was no indication that they would double the rates of the Romanians.

In recent months, signs have begun to emerge that the real estate engine may be malfunctioning. This is evidenced by the statistics on the number of real estate transactions on the ANCPI website, the number of credit reductions on the BNR website, as well as the stories of people who see their credit rates increasing from one month to the next.

June has fewer sales to date than last year at this time

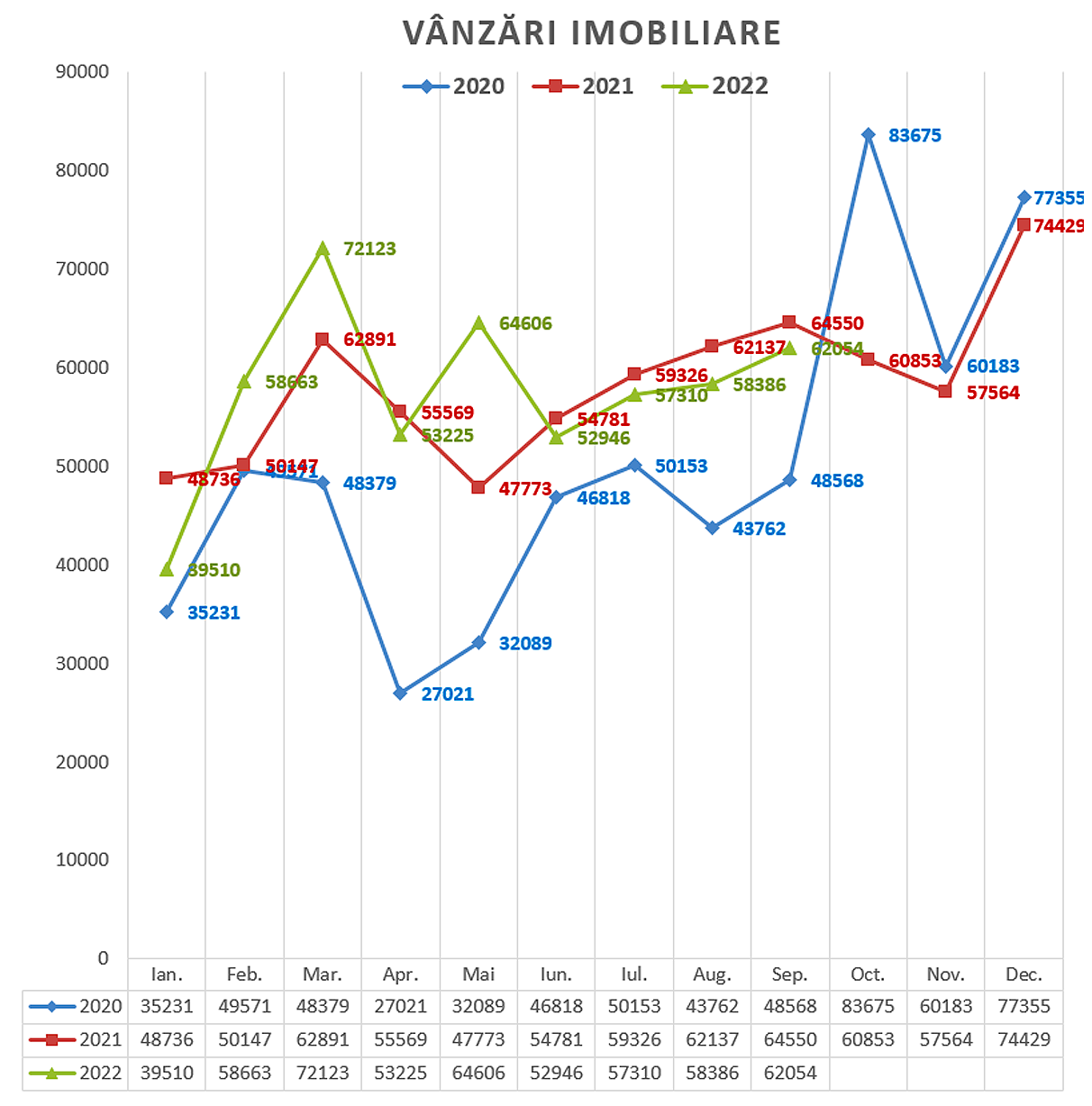

Statistics published monthly by the National Agency for Cadastre and Immovable Property (ANCPI) show that sales of real estate (land and buildings) this year had spikes in February, March and May, but were lower in other months until today. than in the same periods of 2021. The year of war does not seem to have affected the real estate market as much as the year of the pandemic (2020), but it is not the best year of all – 2021.

(graph made with ANCPI information)

A total of 602,805 real estate transactions in 2020

A total of 698,792 real estate transactions in 2021

A total of 2,022 – 518,823 real estate deals by September

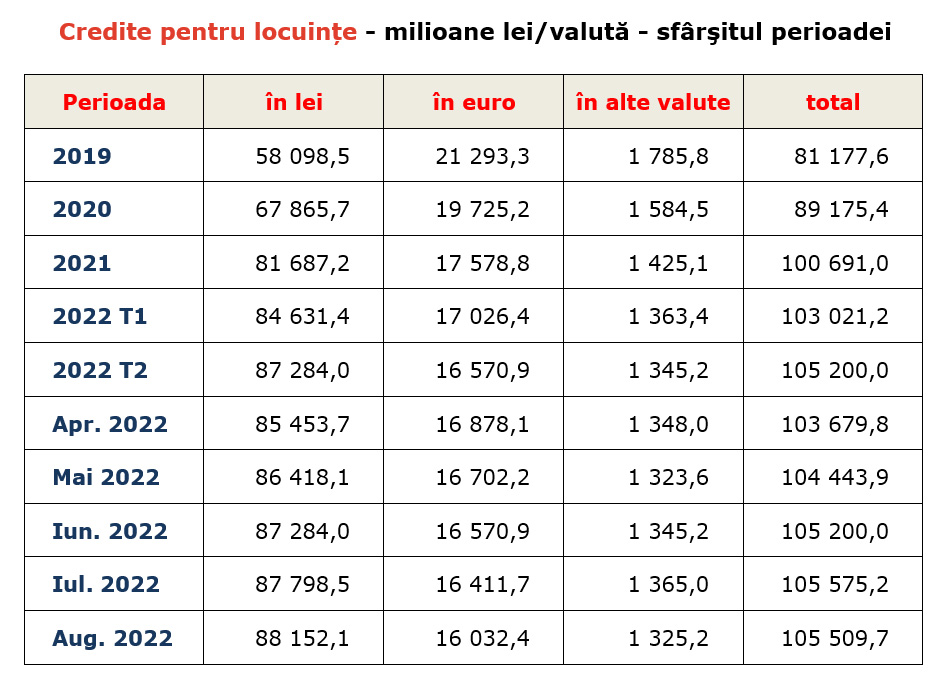

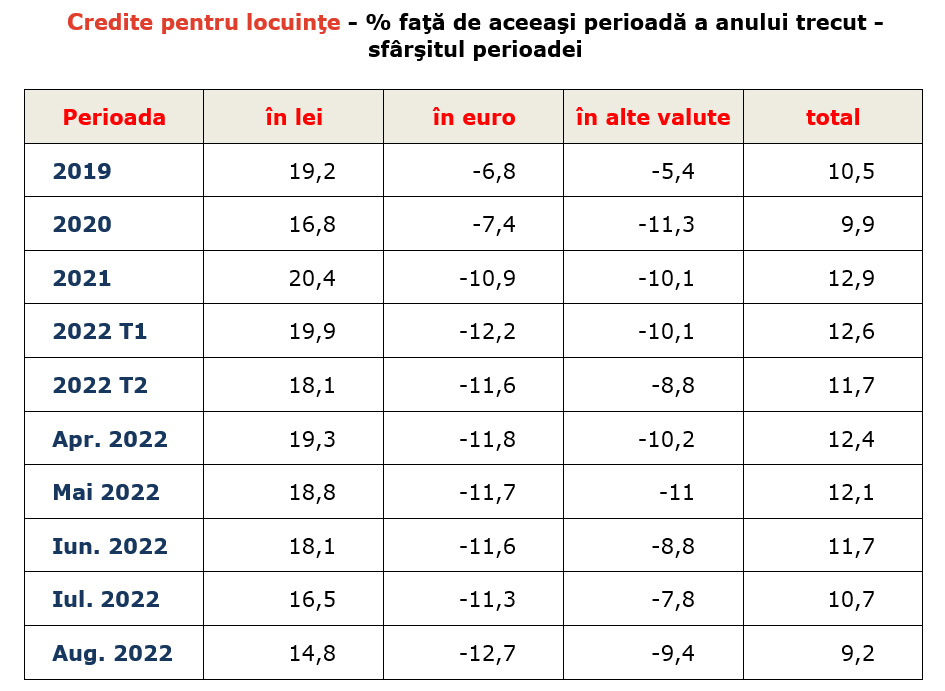

Loans in foreign currency are decreasing, in lei are slowing down

The downward trend in recent months (May-August) also shows the level of loans, in BNR statistics. Compared to the same period in 2021, loans in euros and other currencies decreased significantly (by -11-12%), and loans in lei, even if they are more than in 2021, seem to be headed for a decrease in value, compared to the same period last year.

(info from tables from the BNR source)

This trend is explained by the base interest rates, which the NBR has raised several times this year, as well as the impressive increase in ROBOR and IRCC. Only in the last month, the BNR raised the interest rate of the monetary policy by 0.75 percentage points to a record level of 6.25% in the last 12 years.

The 3-month ROBOR, the index used to calculate variable interest rates on loans in lei, was around 1.5% in October 2021 and has now reached 7.93%. The rates of those who were slow to switch to IRCC increased by 70-80%, according to simulations carried out by several large banks in Romania.

However, IRCC has not weakened either, doubling its value in the last month alone, from 2.65% to 4.06%.

In this context, some borrowers say that they regret trusting bankers and choosing loans in lei, when it seems that the euro is at least standing still, and everything around is growing.

But the euro won’t stay that way for long, some say, while others call for moderation and a waiver of loans, because even worse times will come.

Can the current bill make houses cheaper?

However, longtime real estate agents don’t seem worried. That being said, if you survived the 2008 crisis, you’re just playing now.

Costel Popa, a well-known real estate agent whose face has appeared flawlessly on a sign right in the Romanian market since 1994, says that the market is good, thank you, sell, buy, as always. “For sale, for rent, I have properties that sell for 5 years, but I also have properties that sell in a few months. The market is working normally. I understand from the notary that August 2022 exceeded August 2021 in terms of operations, this is simply incredible. I hope so (not as the ANCPI statistics above show! -No). I have a sale almost every day, the phone rings. Loans taken. Look, on Monday I’m selling in Dorobant, a lady who buys 2 rooms for 72 thousand and took a loan from the CEC for this,” Mr. Popa assures.

The agent does not agree with colleagues who predict a drop in prices in the near future, because “there is no reason.” Only if, he added ironically, “the government will leave us in the hands of energy corporatists. Then you can sell out of necessity. But there is no way…. As long as Germany is not going to pay any electricity bills in December and has capped energy prices, I don’t know what our people are defending that they are okay with. They tend to do what Brussels tells them to do. In my portfolio there are indeed objects with high bills, so energy prices can affect the real estate market, but they shouldn’t, I really don’t understand what our people expect with these restrictions?!” – concludes Mr. Kostel Popa.

Mr. Marcel Bordeiu of K Imobiliare is also concerned about the current account. But he is not as optimistic as Mr. Popa. On the contrary, it is certain that this winter many will give up their apartments in Bucharest due to the price of a gigacalorie, which has almost doubled compared to last year, and will go “to a small house for 10-15,000 euros with a small yard, from neighboring counties In the spring I expect a massive drop in apartment prices and many will be put up for sale,” predicts Mr. Bordei.

It would be nice if that were the case. Because it is not difficult to buy a house for 10-15,000 euros outside the city, but in addition to the sums that need to be invested in such a house to make it livable, the firewood used to heat you in the country has doubled. price this year. Even if the state limited the price, in fact, the wood is sold, as usual, without documents.

Those with cash negotiate, those without cash think again

Bordei says the market is locked in at the moment and he can no longer estimate the minimum/maximum selling period as he used to. “In September, I sold a house from the interwar period, which I looked after for a year and a month. Someone took it with the cash. In general, apartments in Bucharest are rented for about 3 months. The crisis has not hit us yet, to be clear, but we have a warning,” says Mr. Bordeyu.

Home sales periods can be longer now because those who have cash and can afford to negotiate seem to stay on the market longer, while people who rely on credit (about half of the nation’s real estate transactions are done with credit) have hesitation before the banks.

“I have very good friends who had a rate of 1,260 lei in January 2022 for a two-room property loan in Prelungire Ghencea, and now they have 2,100 lei. And everyone is afraid, naturally. On the other hand, in March of this year, I signed a pre-contract for an apartment on June 11 for 125,000 euros, and a war broke out, and the buyer withdrew from the purchase so that he would not be stuck with money. in house. He said he preferred to have cash, that he didn’t know what was going on. Look, almost a year has passed, and the war there is history…”

Loan or rent?

Theoretically, there is no fainting in lending either. I also support estate agents as well as a financial advisor who wished to remain anonymous knowing why. A year ago, at a real estate fair in Bucharest, he was handing out flyers and engaging people in discussions about profitable financing, now he admits that banks continue to issue loans, but customers are beginning to be reluctant.

It is true that the terms of lending have also changed this year, in the sense that you need a more consistent down payment than before, 35% compared to 25% for loans in Euros and 25% compared to 15% for loans in lei.

But first, people don’t really know what to choose: between a loan in euros and a loan in lei, between fixed and variable interest rates, and recently between a loan and a lease. And we have to admit that even in the marketplace, there aren’t many voices that give them the right advice and that they feel they can trust.

A September 2022 survey by the Center for Alternative Dispute Resolution in Banking (CSALDB) shows that 39% of respondents would prefer a fixed interest rate, even higher, than a variable one. People actually want stability, to know in advance how to plan their expenses, although in today’s world nothing can be predicted, not even a fixed percentage.

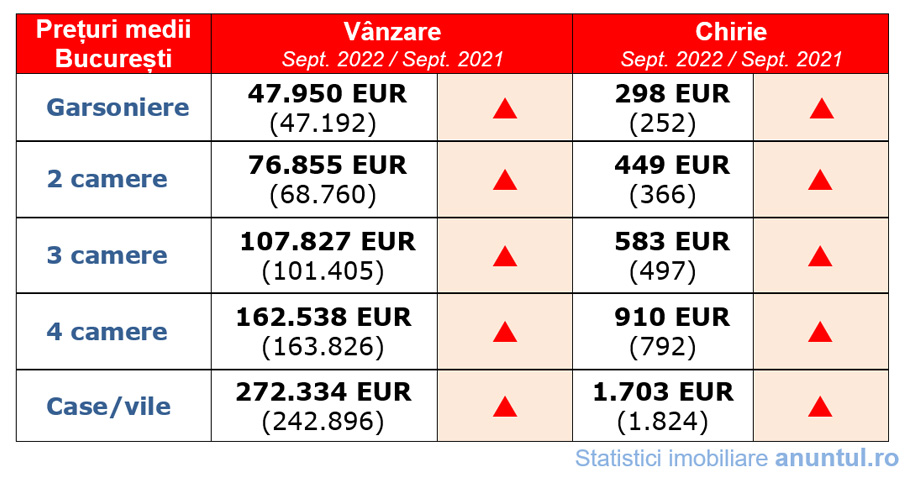

Wartime housing market price/rent

September 2022 (compared to September 2021)

As a real estate agent, Mr. Bordei, for example, recommends fair rent rather than fluctuating credit. “Renting is still fine, but not everyone can afford 500 euros for an installment in the bank. If I had a child who wanted to take out a loan to buy a house right now, I wouldn’t let him. We will wait for spring and see what will happen.” On the other hand, our statistics based on ads posted on the site show that rents don’t seem to stay lower than lending rates for long either.

The price is growing below the European average, the profits are above average

By spring we have European statistics showing us that house prices in Romania have increased by 8.5% this year compared to the same period in 2021, a percentage point below the European average of 9.9%. For the most independent people in the EU, this does not seem like much (96% of houses in Romania are privately owned), but for the closeness in which we Romanians have lived since we have known each other, there is probably still room for growth, so that people still need better houses than those that have been made so far.

Figures from the latest 2021 housing stock report of the National Institute of Statistics show that despite tens of thousands of houses being built in the country every year, the living space remains mostly old and cramped – 17.5 square meters. rooms and 48.5 square meters of an average house in Romania.

It is also true that after the census, one would think that for 18 million people, the 9.5 million houses that are in the housing fund should be enough for us, if only one were given so that it reached everyone.

But reality on the ground does not always coincide with statistics. At least in the big cities (Bucharest, Cluj, Constanta, Timisoara), where most houses are built year after year, the need and demand are still unsatisfied. There are signals in the market that people who would normally go for a bank loan are now turning to “developer direct installments”, which is a risky and reluctant move.

It remains to be seen how supply and demand will match up going forward, given inflation and historical interest rates, as well as the reluctance to lend. Perhaps a solution that would combine people’s need for houses and the real estate business would be a decent reduction in the builders’ profit rate, which even according to one of them will be 40%, that is, much higher than the average European level.

We remain at the disposal of all, as we have been since 1990, sellers, buyers, tenants, real estate agents or developers. You can always find us at www.anuntul.ro or at newsstands three times a week. You can also find us at Târgul Național Imobiliar TNI 2022 Autumn Edition this weekend, October 28-30.

Summary provided by Telephone Advertising

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.