Unlike developed European countries, in Romania there are no real estate loans with fixed interest rates for 25-30 years, with one exception. That’s right, people aren’t even flocking to access it because of the obviously higher interest rate.

Bankers say it is difficult to have fixed interest rates on loans with such high maturities because of the complexity of managing interest rate risk. Interest rate risk is the probability that interest rates will change, which is exactly what we see in all markets today. Fixed rates protect you from this volatility, while variable rates have the advantage of giving you a lower loan rate when they fall, but a higher rate when they rise (the current situation)

“The ability of banks to offer mortgage loans with a fixed interest throughout the entire lending period (as, for example, in the USA) is related to the ability to manage the interest rate risk at the appropriate repayment terms. Given the degree of development of the instruments available in the Romanian financial markets, local banks tend to offer fixed interest rates only for a limited period of time. In developed financial markets, some of the main tools and conditions that allow us to manage interest rate risks over the long and very long term are:

- Availability of a very liquid government bond market in the relevant currency (maximum maturity of government bonds in lei in Romania: 14 years, there are only two issues over 10 years)

- Availability of a liquid market for interest rate swap contracts with medium and long maturities (does not exist in Romania)

- An active securitization market through which banks can create instruments that make mortgage loan portfolios available for sale (does not exist in Romania)

- An active corporate bond market, through which banks can finance themselves, in turn, with fixed-rate instruments (early stage in Romania, but with maturities of less than 10 years in any case)’.

– a commercial banker told HotNews.

As I said, there is, to our knowledge, only one type of loan with a fixed interest rate for 30 years. It is among the top 3 commercial banks, but people don’t flock to access it. The standard interest rate is 10.14%. People always prefer the option with the lowest rate (offer loans with variable interest rates, although fixed interest rates are recommended during fluctuating periods).

“In the bank’s ALM (Asset and Liability Management n.red) model, it is assumed, for example, that part of the current accounts and time deposits are stable. Therefore, an econometric analysis is carried out and those stable components are considered long-term resources (for 10 or even 20 years). So you have long-term “synthetic” liabilities. Bașca equity component that is modeled for a long period,” HotNews explained how a 30-year fixed-rate loan could be created, even if it is more expensive.

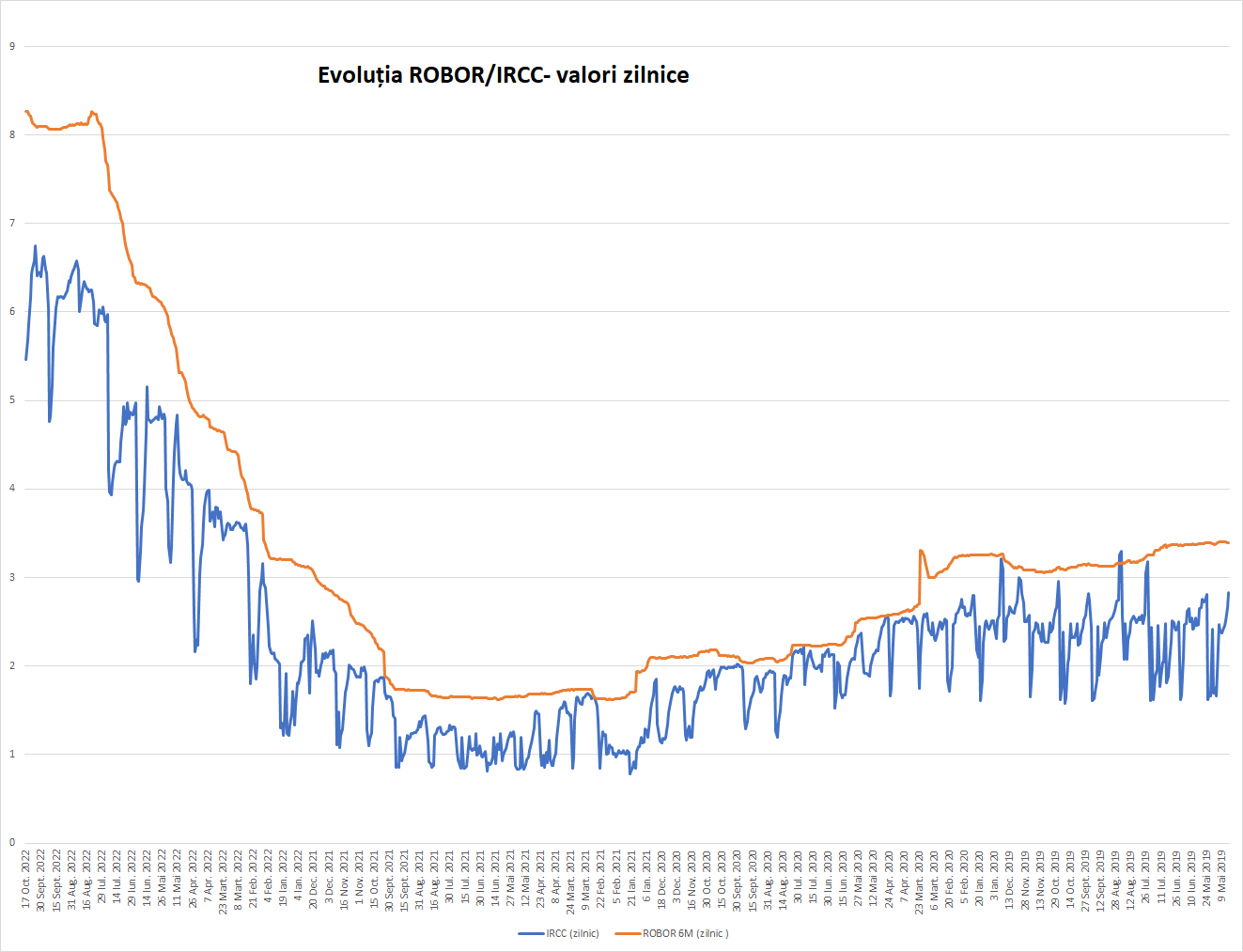

ROBOR vs IRCC – What the numbers show over time

Romanian consumers are among the most affected in the EU by the increase in variable interest rates, both in lei and in euros. “This is because unlike consumers in other member states who have had access to fixed rate mortgages throughout the loan term and thus benefited from the low interest rate environment of recent years, for us this, unfortunately, it was impossible,” says . Alin Iacob, President of the Romanian Association of Users of Financial Services (AURSF)

And now, says Yakob, a tsunami of ROBOR increases is hitting those who borrowed in lei, as they were repeatedly advised by everyone, including BNR, to borrow in the currency in which they receive income. But the interest rate risk is not inferior to the currency risk, which has seriously affected them in the past, especially Romanians with loans in Swiss francs.

Imagine the shock of a family that took out a loan in Swiss francs before the crisis, saw the exchange rate increase by 2.5 times and paid significantly increased rates until 2018, and now has to deal with a huge increase in the ROBOR money index.

All those who have not already done so should switch to IRCC to at least take advantage of the slightly lower rates for now. I believe that there is an urgent need to pass a regulation that obliges financiers to inform consumers of what the rate level will be if they switch to IRCC (the information should be carried out for the whole year 2022 to also see how much they have paid extra, so far away), he also considers Alin Jacob.

IRCC has been lower than ROBOR for the past 850 days, except for 3 days when IRCC was slightly higher, Jakob concludes.

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.