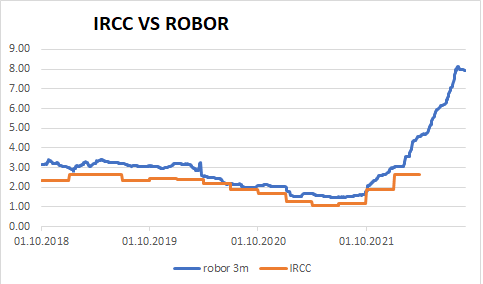

Along with the increase in ROBOR episodes, there have been recommendations in the media for people to “transfer” their variable interest lei loans from ROBOR to IRCC multiplied. HotNews spoke to several banks to find out how many customers have actually switched from ROBOR to IRCC, what the advantages/disadvantages of such a switch are and what needs to be done to change the index.

Comparison of IRCC vs ROBOR in 2022

You don’t need to be a great expert to understand that while ROBOR may be higher than IRCC at some point, the wheel turns and ROBOR will lag behind. The governor expressed himself quite clearly: “We have this IRCC, it will grow.” The transfer will be delayed. He will go, approach ROBOR. Perhaps when inflation eases and interest rates fall, IRCC will remain higher than ROBOR. Maybe. We have two indicators, the population has a choice. There are no miracles in the economy. Neither is an ideal solution. In my opinion, it is good that IRCC and ROBOR are also staying.” he remembered Isarescu

Also, the chairman of the Association of Romanian Banks repeated the same, in other words: “The transition from ROBOR to IRCC in the old contracts in lei is carried out with the consent of both parties. We are trying to convey that if a customer requests to switch from ROBOR to IRCC and this request is approved by the bank, then this process is irreversible. IRCC has a different adjustment period and is a weighted average that after three months is very close to the average ROBOR for the period we are talking about.

We try to tell clients not to expect IRCC to be frozen. We try to explain them and teach customers to try to anticipate, to look at the horizon a little longer next month. Every bank is trying to find solutions for those periods of our lives when we are going through more difficult times.” says Bohdan Neatsu.

How the two indices developed:

What are the advantages/disadvantages of switching from ROBOR to IRCC?

First, although IRCC was supposed to be a market index that expresses the “real” price of actual transactions, it is not. Interest rates from different markets are collected in a “basket”. In another way, we make calculations with “apples” and “pears”. To arrive at a common denominator, it is not enough to weight the value by the volume of transactions, but also to adjust for the maturity for which these affordable offers are offered. According to the method of setting the index, all values of interest rates on the interbank market are taken into account, regardless of the repayment terms for which they are formed.

The interest rate for maturities of one week cannot be considered to express the same as for maturities of 9 months. It’s like if we consider a 2-room apartment at 50,000 euros, then a 4-room apartment at 100,000 euros and consider that the price of the house is 75,000 euros. In other words, a strictly mathematical average of various prices on the interbank market is used. For example, SONIA, the new index to replace LIBOR in the London interbank market, is a volume-weighted average of overnight interest rates, but for long-term contracts, compound interest is used to adjust this rate.

Also, although in theory, taking into account all interest rates, this index should fluctuate less (since for some maturities we may have different directions of interest rates in the “basket”), in the IRCC version it may be more prone to volatility due to registration and interest rates for very short terms (overnight or one week). They have significantly higher volatility than others, expressing the momentary “nervousness” of the market. Wasn’t the new index supposed to bring more stability?

advertising

Another problem with the index is that it takes the average of the previous quarter into account, creating a time lag. He looks into the past, creating consequences in the future! This is also the reason why, after calculations, the value is now lower. Today’s ROBOR values will be reflected over the next three months. So let’s not get drunk on cold water, let’s not have useless illusions! This gap will also create difficulties in managing bank assets and liabilities. In addition, all these changes will lead to additional administrative costs for banks, both with implementation and further management (especially since they will have different products linked to different reference indices), bank intermediation will be more expensive, the exact opposite effect because of what is tracked by this index.

It will also create some anomalies, for example if inflation is falling but lending rates are rising. why Because interest is taken when monthly inflation was higher. From this point of view, it will delay the effects of monetary policy measures, and in certain situations even destroy them, Professor Bohdan Chapraru explainsfrom the Fiscal Council.

What to do to switch from ROBOR to IRCC

It’s simple, you need to go to a bank where you have a loan. Although not many Romanians have done it yet. For example, CIC Bank has several hundred applications registered, the bank informed HotNews.

A simplified procedure for converting loans from ROBOR to IRCC was in effect at CIC Bank. “The client must submit an application at any branch of the bank. Based on the request, an addendum to the credit agreement will be concluded without additional analysis. The margin will remain unchanged. If the client has a “New House” loan, the consent of the National Guarantee Fund will also be required. In the short term, as long as interest rates are rising, due to the way the IRCC is calculated based on data from two quarters ago, the IRCC will lag the ROBOR, so rates will be lower.

But when interest rates return to a downward trend, their decline will be reflected in IRCC with a delay (up to 6 months). In other words, when ROBOR rates start to fall, IRCC rates will continue to rise. The change in the benchmark is irreversible. In other words, you can switch from ROBOR to IRCC, but from IRCC back to ROBOR you cannot.

We present all these considerations to clients and recommend that they analyze the short-term benefits as well as the potential development in the medium and long term so that they can make an informed decision,” CEC Bank representatives explain.

BRD has the same thing. “We have received several hundred such requests from customers to change the monetary index, which is used to calculate variable interest on current loans, from ROBOR to IRCC. The requests were generally approved, and only in some cases where the financial situation of the clients was damaged, the bank offered certain restructuring solutions adapted to the specific situations of the respective clients,” BRD representatives told HotNews.

They also wanted to clarify that changing the index from ROBOR to IRCC, it is not reversible. “Thus, after switching to IRCC, the client cannot request to switch to ROBOR again (as this is prohibited by GEO 19/2019). This is important because in a situation where interbank interest rates increase, ROBOR will first reflect this increase, followed by IRCC a few quarters later. Therefore, these interest rate changes may affect a customer with IRCC interest later than a customer with ROBOR interest. But it should be remembered that these variations of reference indicators are cyclical. Thus, after the period of growth, there will also be a period of decline, when clients with ROBOR interest rate will be the first to benefit from the decrease in interest rates in the market,” BRD representatives say.

h2. What advice would you give to someone looking to get a mortgage: IRCC or fixed rate? Why

“What we would recommend, first of all, to those who want to get a home loan, is to take a cautious approach, especially in the case of loans with variable interest rates. In this situation, the recommended behavior is that the customer does not borrow up to the maximum limit, and also takes into account possible increases in the monthly rate caused by the possibility of an increase in the IRCC money index.

The most important recommendation is to look not only at the level of the monthly rate, but also at the type of interest – variable or fixed. A variable rate loan may look attractive in terms of the monthly payment rate, but it can become quite difficult to pay off over time if the monthly rate increases as a result of the IRCC increase.

BRD offers loans with a fixed interest rate for the first 3 or 8 years, followed by a variable interest rate or a fixed interest rate for a loan term of up to 30 years. Clients should choose a fixed interest period also according to the expected repayment period of the loan, thus protecting themselves from possible fluctuations in the reference index (if, for example, the client believes that he will repay your loan in 10 years, then a fixed interest in the first 8 years, otherwise and 10 years, it may suit him)”, BRD representatives explain.

BCR representatives told HotNews that the number of requests to change the index was about 2,500. “BCR has intensively promoted 5 or 10-year fixed-rate mortgages and refinancing in recent years, both commercially and especially in close discussions. with our clients. The reason is simple: clients can benefit from predictability and are protected over a long period of time from possible outbreaks of volatility such as the current one. This is also one of the reasons why currently 70% of BCR’s new mortgage loan production is fixed rate,” BCR also reported.

It is important to say that the switch from ROBOR to IRCC is irreversible and has a number of advantages, but also disadvantages, and it is our duty to present this to clients as clearly as possible in order to make an informed decision. An increase in ROBOR is followed several months later (6-9 months) by an increase in IRCC, so such a move actually provides a time gain. On the other hand, under conditions where ROBOR may enter a downward trend, the client may remain with a high IRCC until the decline reaches this index in a few months, BCR representatives explained.

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.