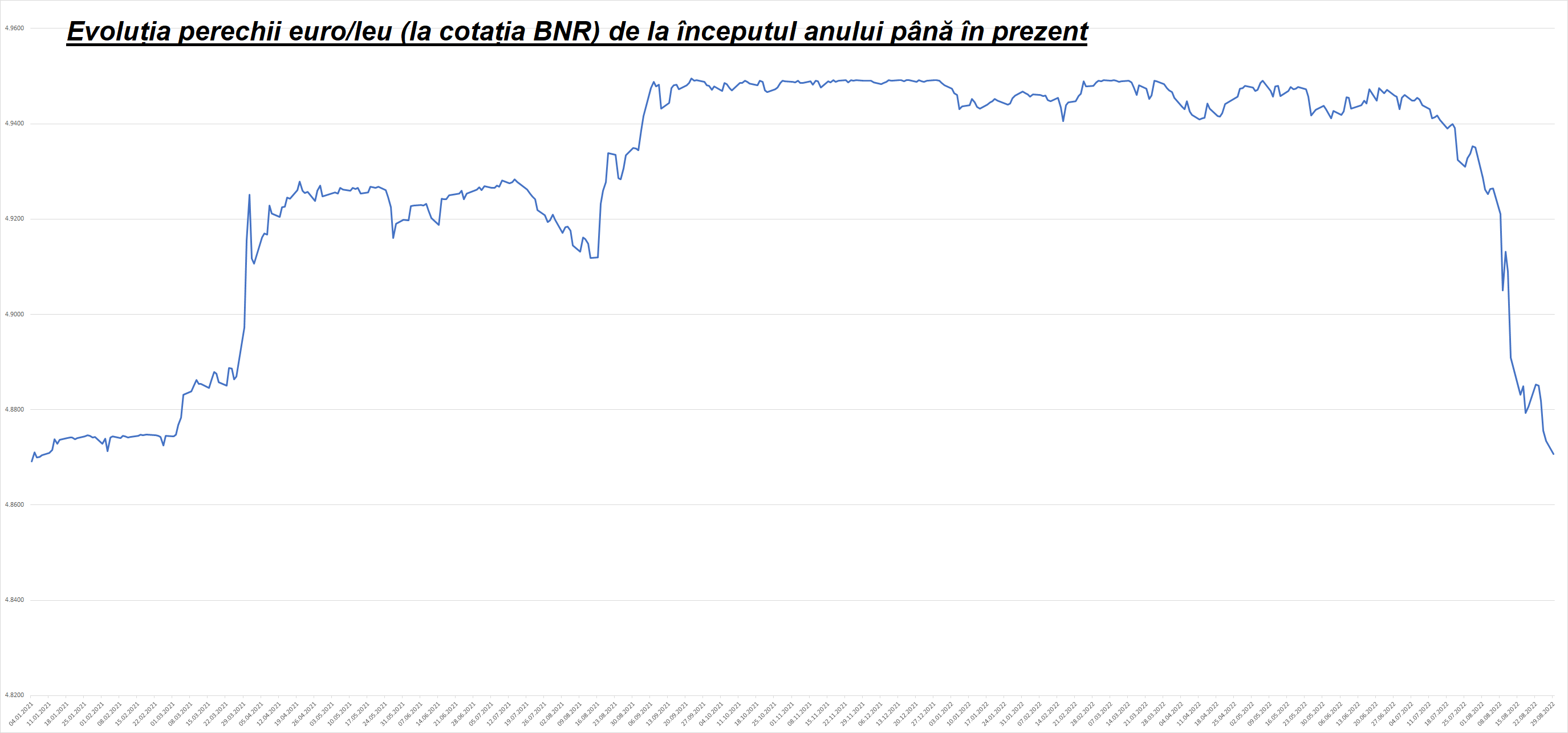

Although the economic picture does not look great, the lei continues to strengthen against the euro, somewhat controversially. What economists say about the evolution of the euro until the end of 2022 and why Iserescu does not allow the leu to depreciate.

What could be the evolution of the euro in the coming months from 2022

According to the textbooks, the lei should depreciate as long as we have huge twin deficits, high national debt and we are also on the brink of war. However, the leu has been strengthening against the single European currency for some time. Economists have different explanations for this movement of the lion, somewhat against the current.

BCR: We expect the EUR/RON exchange rate to be at 5.00 by the end of this year

“We expect the EUR/RON exchange rate to be at 5.00 by the end of this year,” says BCR Chief Economist Ciprian Daskalou. “We consider the recent appreciation of the lei against the euro to be temporary, driven by the supply of additional currency during this period mainly due to net inflows of lei-denominated government securities from non-residents and seasonal wheat exports after the summer. harvest. We also take into account the increase in remittances from abroad during this period.

We expect the current account deficit to widen to -8% of GDP in 2022, mainly due to faster growth in the prices of imported goods. This should continue to exert devaluation pressure on the national currency,” says Ciprian Daskalou.

BT: EUR/RON exchange rate may fluctuate between 4.8173 and 4.9117 in the near future

On the BNR, EUR/RON ranged (4.8734 – 4.8853) last week, highlighting the continuation of the depreciation trend towards the low since February 2021. The USD/RON exchange rate continued to increase by 0.6% from August 19 to August 26 to 4.8739. From the point of view of technical analysis, the EUR/RON exchange rate may fluctuate in the range (4.8173 – 4.9117) in the next period.

According to BT’s updated central scenario, the average annual EUR/RON exchange rate could increase from 4.92 in 2021 to 4.94 in 2022, 4.98 in 2023, respectively, and 5.02 in 2024, according to the Banca report Transilvania, sent on Monday.

BRD: We see the euro at the end of the year between 4.9-5 lei

At the beginning of the 2nd quarter of 2022, the EUR/RON rate increased slightly, which was facilitated by the partial easing of tensions in the global market and the strict liquidity management practiced by the NBR, as well as the expectation of further interest rate hikes.

At the same time, the US dollar has risen significantly against many regional currencies, including the lei, in recent months, thanks to a larger-than-expected impact of the war on the European economy and a faster and stronger tightening of US monetary policy than the euro zone.

The future trajectory of the exchange rate will depend on: i) geopolitical factors (extent/duration of the war and related international sanctions), ii) the state of international trade, iii) dynamics/financing of the twin deficits, iv) the government’s ability to implement reforms and launch investment projects foreseen in the Recovery Plan and stability, v) implementation of the monetary policy of the main and regional central banks.

The NDB will remain vigilant on changes in the exchange rate, addressing the risk of excessive volatility caused by speculative activities, thereby enhancing the role of the exchange rate as a pillar of confidence/stability in the current volatile and uncertain environment.

We expect the euro to fluctuate between 4.9 and 5 lei at the end of the year, according to the BRD report.

ING Bank: The evolution of the euro/lei exchange rate over the last period is really a bit surprising in terms of amplitude

The evolution of the euro/lei exchange rate over the last period is really a bit surprising in terms of amplitude. Even the head of the National Bank of Romania pointed out the main economic factors in the presentation of the latest inflation report: the inflow of currency for the purchase of government bonds, as well as the inflow of currency from Romanians who return to spend their holidays in Romania, they told us luni Valentin Tetaru, chief economist of ING. Added to this is the possible reluctance of the National Bank to intervene in the purchase of euros from the market, as this would improve liquidity in the local monetary market, which is still undesirable from the point of view of monetary policy, says Tataru.

However, from a fundamental point of view, we believe that a sustained appreciation of the lei is unlikely. The twin deficits (current account and budget) remain large and there is little prospect of improvement in the short to medium term. The conduct of fiscal policy – and, as a result, the budget deficit – is particularly subject to uncertainty during this period.

Taking this into account, we see the EUR/LEU exchange rate at the end of the year in the range of 4.94-4.95, after which during 2023 – to the extent that inflation confirms the bearish BNR forecast – we will approach the psychological level of 5 .00 without Par is moving significantly above this level, concludes the chief economist of ING Bank.

Why Iserescu does not let the lion depreciate

The current regime of the lei exchange rate is a regime of controlled floating, which allows the National Bank to intervene in the foreign exchange market in order to “correct” excessive fluctuations of the national currency. The NBR’s interventions are a taboo topic, no Central Bank official talks about the scale or frequency of these interventions.

Who does a strong lion help? First of all, on importers, who are easier to pay for imports. And just as it would be unusual for lower import prices to be reflected in the shelf price, there is every reason to believe that importers and retailers will hold down prices and increase your margins. In a clear translation, the state budget is the one that benefits, because that is where the taxes and duties paid by traders who make a profit go.

On the contrary, a devalued lei would make imports more expensive and would immediately be transferred to prices (in the sense of their increase), which would terribly confuse Iserescu in the fight against inflation. Moreover, while a weak lei would help exporters, it would be a spurious boost in competitiveness rather than a real boost from innovation or expansion into new markets.

And another reason why the BNR prefers a stable exchange rate and does not allow the leu to depreciate is related to trust in the Central Bank. After a number of economists chided the NBR for behaving like a short-sighted man by talking about transitory inflation (which was not transitory), the exchange rate loss represents the surrender of the last anchor of confidence. In any case, when it comes to a central bank, trust is the last thing you want to lose.

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.