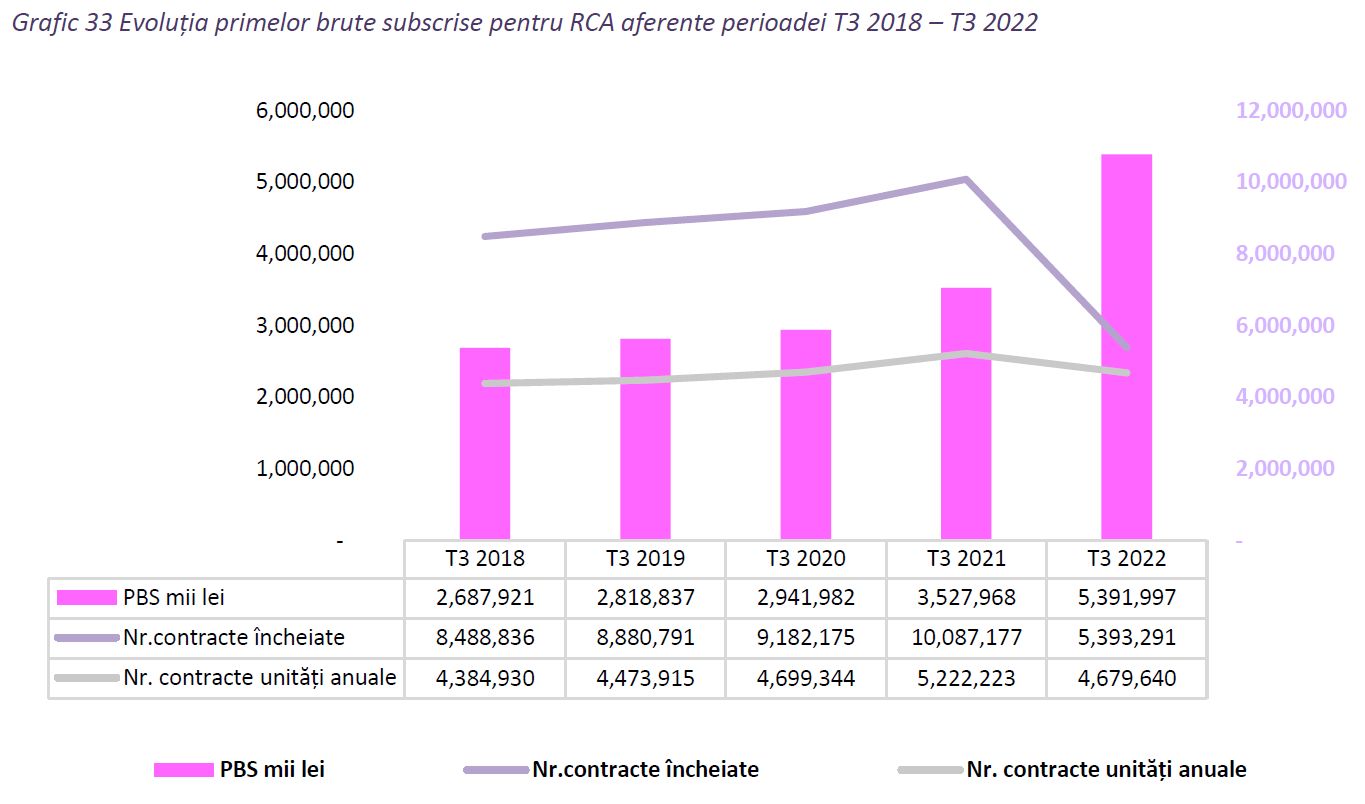

Insurers selling RCA insurance received record revenues of 5.4 billion lei in the first nine months of this year, which is 53% more than in the same period last year, given that the average annual premium paid by Romanians for RCA insurance , increased by 71% to 1,152 lei, according to the latest report of the Financial Supervision Authority (ASF).

8 insurance companies share revenues of 5.4 billion lei from RCA

The number of insurers authorized by the ASF to carry out RCA insurance business has decreased from 9 to 7 following the revocation of City Insurance’s license and, subsequently, the withdrawal of Uniqa Asigurări from the RCA market.

As a positive element, in the fourth quarter of 2021, the branch of Axeria Iard started operations in the RCA market, based on the right of establishment on the territory of Romania (FoE).

In the first nine months of 2022, it recorded a volume of gross premiums written on RCA of approximately 319 million lei, which represents 5.6% of the total volume of gross premiums written in the RCA segment.

In the first nine months of this year, the total value of insurance premiums signed for RCA insurance amounted to 5.4 billion lei, which is 53% more than in the same period last year.

“Gross premiums written on RCA have had an upward evolution since 2018, reaching a new high at the end of September 2022,” the ASF report said.

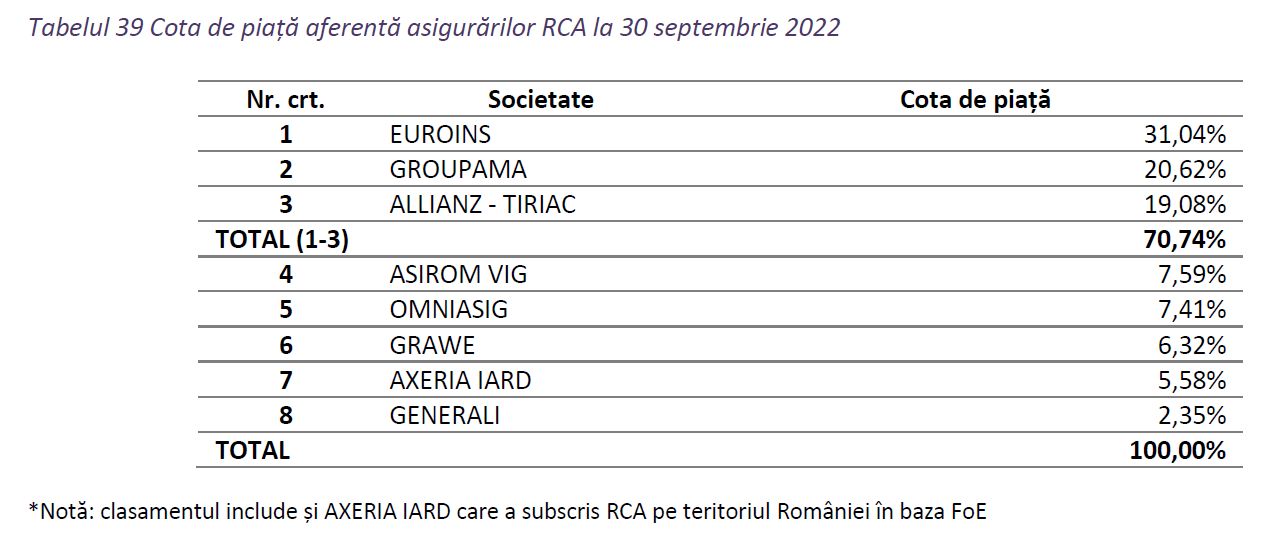

Euroins, Groupama and Allianz occupy almost 71% of the RCA market

The degree of concentration remains high for the first leading insurers at the end of September 2022, so that the first 3 insurers accumulated approximately 71% of RCA’s insurance portfolio in Romania.

Thus, Euroins had 31% of all RCA contracts in the first 9 months of this year, followed by Groupama with 20.62% and Allianz-Țiriac with 19.08%.

During the reporting period, Romanians actually concluded more than 5.3 million RCA contracts. On the other hand, expressed in annual units (taking into account different durations of policies), the number of RCA contracts concluded until September 30, 2022 was 4.68 million contracts, which is 10% less compared to the same period of the previous year. .

Romanians paid more for RCA, but insurance benefits also increased

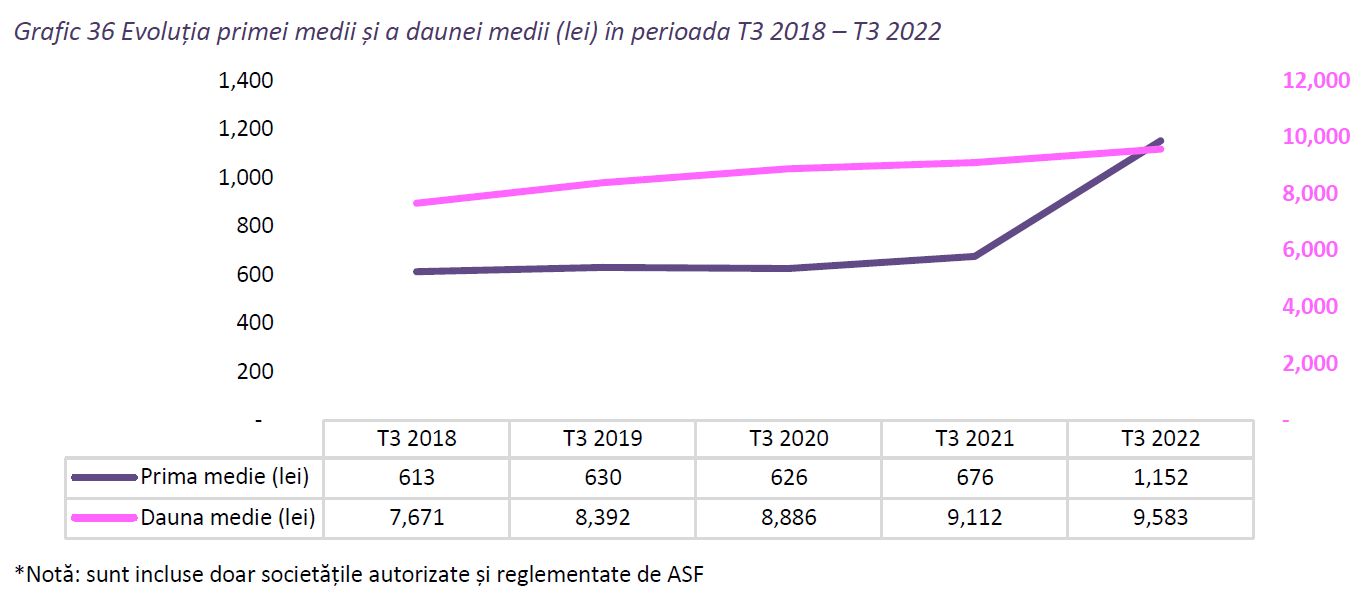

In the entire market as a whole, on September 30, 2022, the first annual average value of RCA was about 1,152 lei, which is 71% more compared to the same period of the previous year.

RCA’s annual average premium is calculated as the ratio between gross accrued premiums (5.4 billion lei) and the number of RCA contracts expressed in annual units (4.8 million contracts).

On the other hand, at the end of the first nine months of 2022, while the average RCA premium increased by 71%, the average claim level increased by 5% to 9,583 lei.

The average claim paid for RCA is calculated as the ratio of claims paid to the number of claims paid during the reporting period.

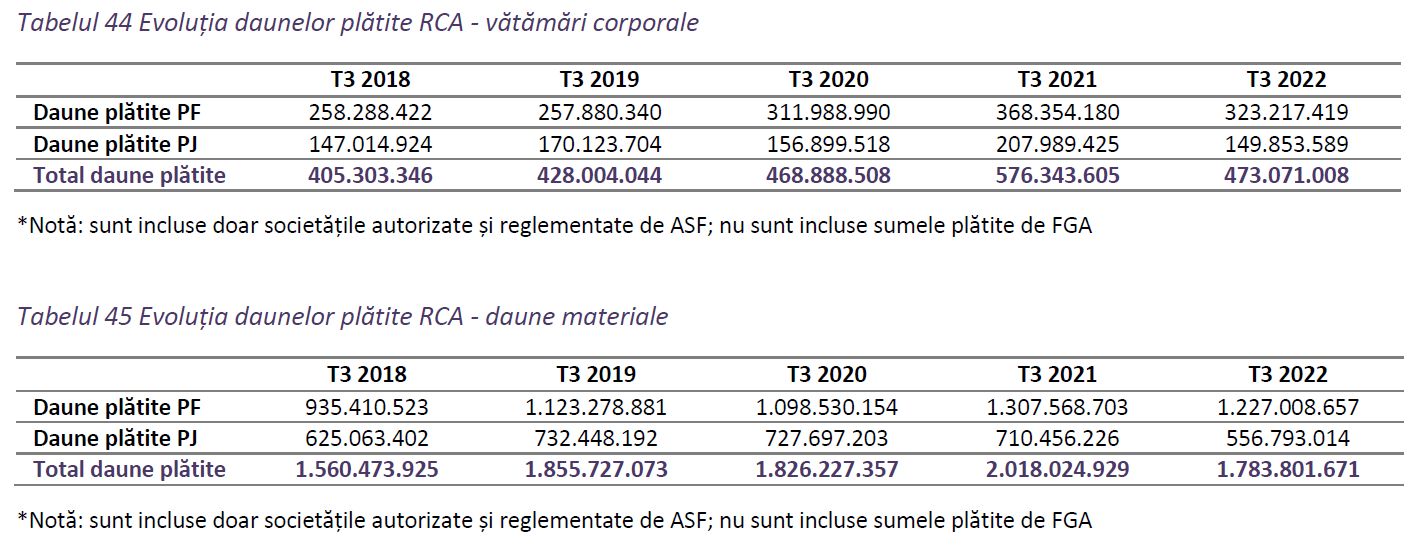

According to the ASF data, compensation to individuals was higher than to legal entities, both for bodily injuries and for material damages in all analyzed periods.

Thus, in the first 9 months of this year, insurers paid RCA claims for personal injuries in the amount of more than 473 million lei and material damages in the amount of more than 1.78 billion lei.

Regarding the average damages paid by RCA, calculated as the ratio between the compensations paid and the number of damage files paid, the average compensation paid for bodily injuries was about 85,269 lei, and the paid material damage was 7,757 lei.

RCA insurers must also have funds for future claims

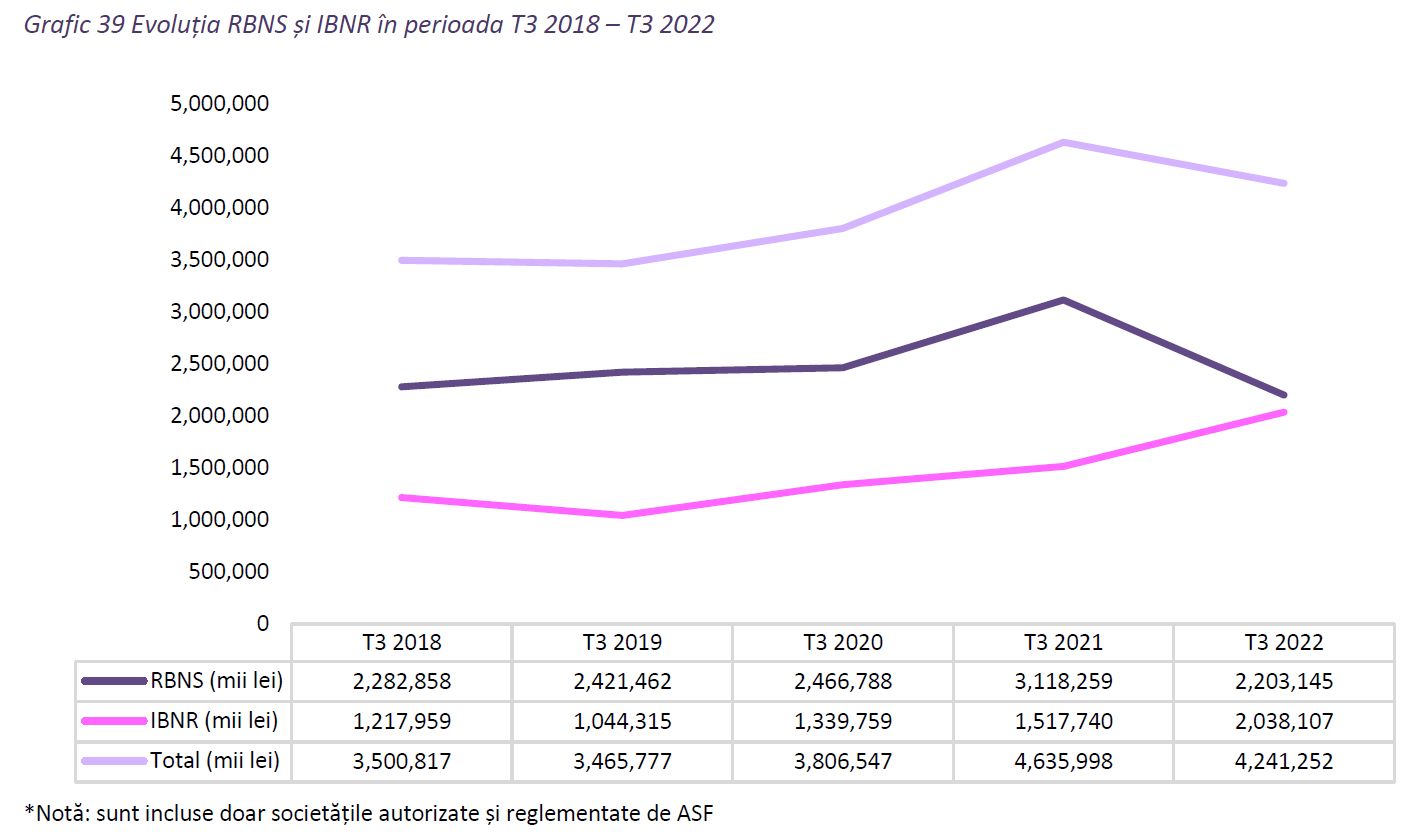

In addition to paying claims, insurance companies are also required to create technical reserves, effectively funds to be used for claims approved and not yet paid (RBNS) and for claims incurred but not yet approved and unpaid (IBNR).

The value of technical reserves created by companies for approved and not yet paid claims (RBNS) decreased to the level of 2.2 billion lei in the first 9 months of 2022, compared to 3.1 billion lei (for the same period of the previous year).

As for technical reserves for incurred but not yet approved and unpaid claims (IBNR), they increased from 1.5 billion lei to 2 billion lei.

Insurers cashed in on RCA

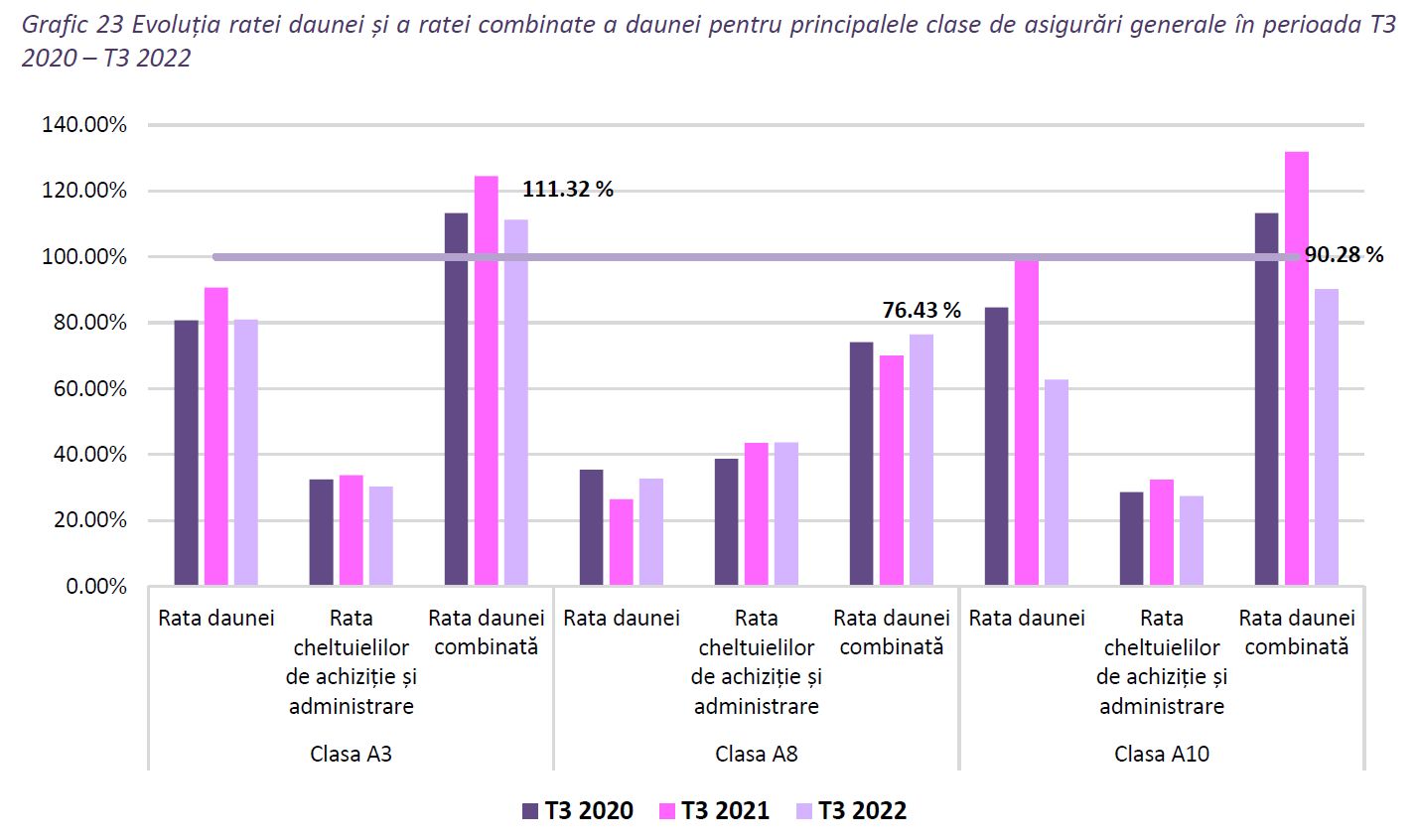

The combined loss ratio for an RCA is the value of claims and reserves in relation to the premiums earned on the RCA, and when this ratio is greater than one (over 100%), it means that the insurers have to bring money in from home, so they are at a loss.

According to ASF, the combined loss rate for Class A10 (RCA and CMR) on September 30, 2022 decreased compared to September 30, 2021 in the overall market and was 90.28%.

6 out of 7 companies authorized by ASF to practice RCA in the analyzed period recorded combined subunit damage rates for class A10.

Life and Non-Life Insurance Market: Revenue vs. 9-Month Claims Paid

In the first 9 months of 2022, insurance companies authorized and regulated by the FSA and branches present on the Romanian market (FoE) generated gross premiums of approximately 13.4 billion lei, which is 28% more than in the same period of the previous year.

Thus, the total volume of subscriptions for general insurance activity amounted to 10.8 billion lei, which is 34% more than in the period January-September 2021, accounting for 81% of the total value of gross premiums (PBS) of authorized insurers and regulated by the ASF and branches

In the life insurance segment, the total value of gross premiums amounted to 2.6 billion lei, which is 5% more than in the first 9 months of 2021.

Gross compensations paid by insurers authorized and regulated by the ASF, branches and the Insurance Fund (FGA) amounted to 6.3 billion lei in the first 9 months of 2022.

Gross claims paid in the general insurance segment amounted to 5 billion lei, while gross claims paid in the life insurance segment amounted to 1.3 billion lei.

Amounts approved for FGA damages amounted to approximately 484 million lei, of which approximately 94% are amounts approved for RCA damages (455 million lei).

Source: Hot News

Mary Robinson is a renowned journalist in the field of Automobile. She currently works as a writer at 247 news reel. With a keen eye for detail and a passion for all things Automotive, Mary’s writing provides readers with in-depth analysis and unique perspectives on the latest developments in the field.