Dan, a 42-year-old driver from Bucharest, who has not had an accident in the last 3 years since he bought the car, found out this fall when he renewed his RCA policy that he was considered a high-risk insured. This is in conditions when all offers on the market exceed the maximum value allowed by law. There are many like him, and the law protects them, but few know what to do.

By law, policyholders who receive quotes from at least three different insurers within a 12-month period whose RCA premiums are 36% higher than the base rate for the risk segment they belong to are considered high-risk policyholders and can apply Bureau of Motor Insurers (BAAR) who choose an insurer who will sell them a policy at a price within the legal limits.

Accident free drivers should pay more for RCA

Last yearin the complete bankruptcy of City Insurance, the former leader of RCA with more than three million customers, many drivers had to pay significantly more when renewing their RCA policy, even if they had no traffic accidents.

HotNews.ro then presented a real case, but with the fictitious name of Dan, who, although he had no traffic accidents, was considered a high-risk insured. Dan lives in Bucharest and owns a 2006 1686cc Opel diesel.

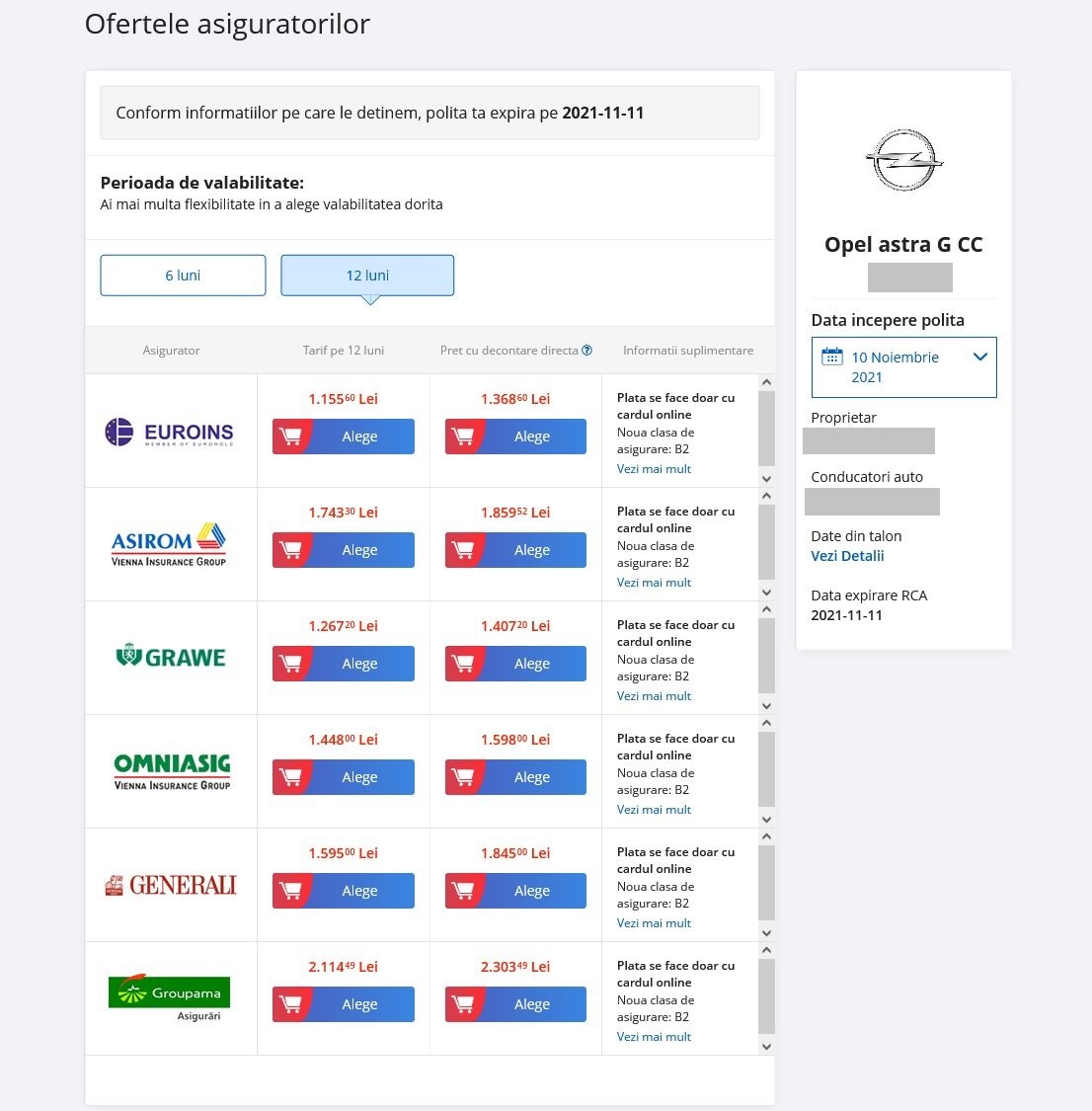

With prices ranging from 1,156 lei at Euroins to over 2,100 lei at Groupama, our man couldn’t get a lower price than going to BAAR arbitration.

In the end, he didn’t go to BAAR, but got RCA on Grawe with direct settlement even for about 1400 lei.

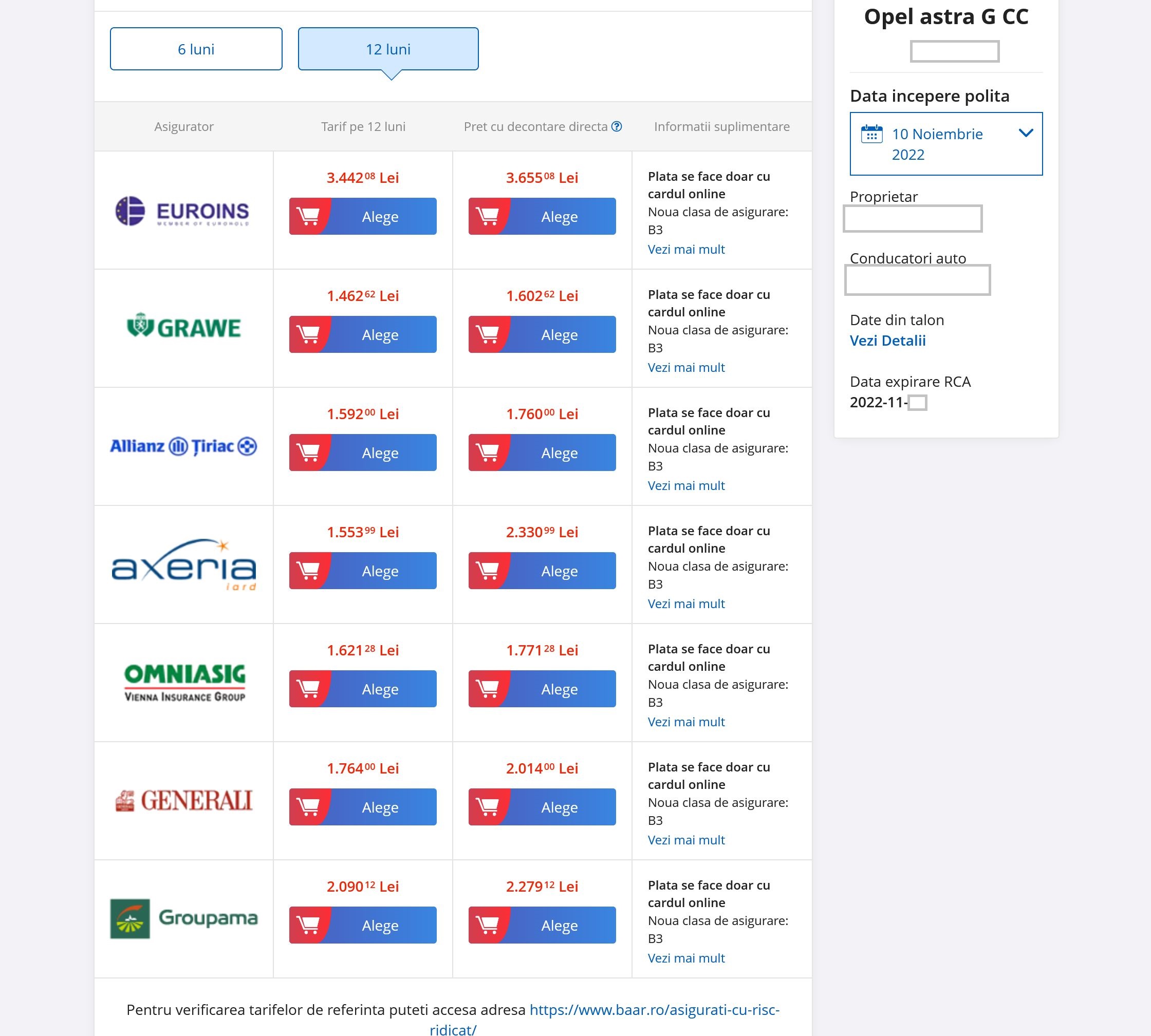

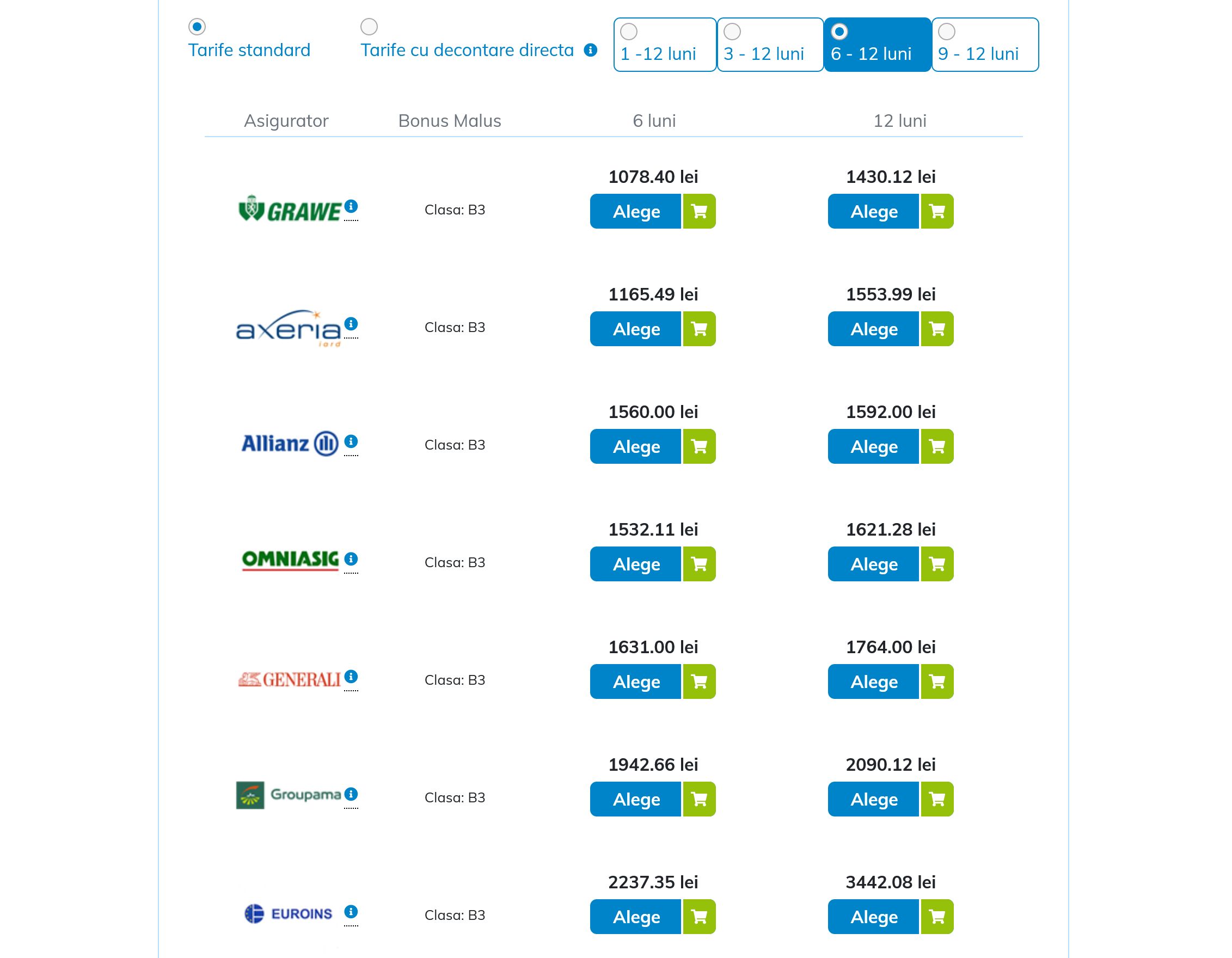

A year has passed since then, our “Den” has been accident free and has been promoted to B3 bonus class, City Insurance bankruptcy is over, he should renew his RCA policy, possibly at a lower price. But surprise: he has to pay significantly more and is again considered a high-risk insured!

Buying a 12-month RCA policy online without direct settlement through Pint.ro or eMag.ro would cost between 1,430 lei at Grawe and over 3,400 lei at Euroins.

You will say that it will cost you less if you take out the RCA policy directly from the insurer’s website. That’s right and we wanted to see what price we get directly from Euroins. Result: RCA policy over 3000 lei for 12 months.

That’s why this year Dan will try to contact the Bureau of Motor Insurers to get a cheaper RCA.

Other policyholders also noticed the explosion of Euroins prices. What does the insurer say?

Dan is not the only one who has noticed the aggressive price growth of Euroins.

Olena (real but fictitious name), 36 years old, with last year’s license, drives a 2010 Suzuki Swift with a cylinder capacity of over 1300 cc.

It didn’t hurt, it went up to bonus grade B1 so it should get a 5% discount, but it now has a 12 month RCA payout from last year. Prices on eMag.ro in her case range from 1,257 lei at Grawe to more than 2,600 lei at Euroins.

- importantly! Other insured persons from Bucharest with better bonus classes, namely B5 or B8, still have the lowest RCA prices in Euroins, and for some the prices are down compared to last year.

A policy of high prices to avoid certain categories of insured persons who are considered more risky than others is neither illegal nor singular.

Generali is another insurance company that has gradually withdrawn from the RCA market, charging rates that are several times the lowest price in the market, a trend we are now starting to see at Euroins.

Asked by HotNews.ro to explain why RCA prices increased for some drivers in Bucharest who were not involved in an accident, Euroins representatives sent the following:

- “Euroins strives for proper risk management and the application of a long-term vision. In this way, Euroins continues to balance its RCA portfolio in a sustainable and permanent manner, contributing to the stabilization, competitiveness and balance of the RCA market. The updated figures presented a few days ago are a sign that the insurance market is stabilizing in a more balanced distribution on the RCA, where Euroins has a stable and strong position.” This was reported to HotNews.ro by representatives of Euroins Romania.

Euroins, RCA’s new leader after the bankruptcy of City Insurance, recently reported that in the first 7 months of this year, RCA’s policies grew by just 3.2%.

- “RCA’s market share in 1H2022 was 31.81% compared to 31.15% in 1H2021. Current developments show that Euroins will reach RCA’s market share below 29% by the end of the year,” the company said.

The insurer claims that the number of complaints has fallen significantly (84% fewer complaints in the second quarter of this year) and the number of optional policies has almost doubled compared to the same period last year.

Advice from an insurance broker: Change your city and see what offers you get

Each insurer can set its own RCA prices according to the risks it assumes under RCA insurance. Thus, prices differ depending on the age of the driver, city, damage history, car power, bonus-malus system, etc. You, as an insured person, choose where you think is best for you.

The insurance broker advised us to conduct an experiment when requesting a price on the insurer’s website: change the city of residence.

I conducted this experiment and instead of Bucharest, we went to Cluj-Napoca.

Well, in the case of insured Dan mentioned above, the cost of the RCA policy offered by Euroins dropped from over 3,000 lei to over 950 lei.

We may have seen more or less differences on other insurers’ websites.

Why RCA policy is more expensive if you are from Bucharest

Insurance brokers contacted by HotNews.ro also explained why the city you live in matters for the RCA price.

- “15% of RCA’s insurance company revenue comes from the Bucharest region, but the same drivers living in the capital generate 40% of RCA’s total claims. In addition, insurers have problems with those auto repair shops that use tariffs of 450-480 lei per working hour when the market average is 250 lei. All this is reflected in the higher prices at RCA for those living in Bucharest.” This was reported to HotNews.ro by a broker who wished to remain anonymous.

How to find out for yourself whether you are considered an insured risk group

Well, when you see that you have such high rates at RCA, it is good to know if you are considered a high risk insured. Don’t expect your brokers to tell you if you are in this situation as they are interested in selling you an RCA and getting a commission rather than referring you to the Bureau of Motor Insurers (BAAR) who will then assign an insurer if you sell a cheaper one RCA.

The Bureau of Automobile Insurers of Romania (BAAR) presents instructions on its website to help you find out if you are considered a high-risk insured, in which case you may be able to access a cheaper RCA policy.

- Calculation formula is relatively simple: RCA base rate for vehicle X factor N (1.36) X factor for the bonus-malus class applicable to the vehicle for which insurance is sought.

To find the base rate using the formula above, you need to go to the Financial Conduct Authority (ASF) website, which displays the latest current RCA base rates calculated by an independent post-auction auditor.

In particular, in the case of “Dana” (42 years old), the owner of a car with a cylinder capacity of 1686 cubic meters.

The new bonus class is B3, so its price should be reduced by 15%.

There are 8 bonus classes (B) and the discount level for each class is as follows:

- B1– 5%

- B2 – 10%

- B3 – 15%

- B4 – 20%

- B5 – 25%

- B6 – 30%

- B7 – 40%

- B8 – 50%

In Dan’s caseapplying the formula, we have: 1.164 X 1.36 X 0.85 = 1,345 lei.

This should be the RCA’s minimum insurance value for the above case, but since the reality is different, the only option the policyholder has in this case is to go to BAAR.

In the case of Elena, (36 years old) with a car with a capacity of more than 1300 cmc will have a base rate of 933 lei.

Given that it has a bonus class (B1 – therefore a 5% discount), the calculation formula will be as follows: 933 X 1.36 X 0.95 = 1205 lei.

All insurers’ offers presented on eMag.ro refer to her case for more than 1,205 lei. Even if they went directly to each individual insurer’s website to avoid the eMag.ro or Pint.ro commission, there would still be at least 3 offers higher than 1205 lei. Therefore, she can also approach BAAR.

Referral of the insured to the insurer, who will sell him the RCA policy at the price according to the legal norms, is 20 days, if the request is accompanied by complete specified documentation. More details HERE.

Broker: It is an anomaly that non-accident policyholders are considered high risk

It is an abnormal situation to offer such high prices for policyholders who do not have an accident and increase the bonus class.

- “Trucks were usually included in the category of insurance of increased risks. Today, this is an anomaly that cannot be classified as high risk. This is not normal what is happening. M8 malus customers who drive trucks should fall into this category, but as the exception, not the rule.

- Or we also have high risk private clients over 43 with a B4 bonus. This is an anomaly. At the moment, the rates are double compared to normal,” an insurance broker told HotNews.ro on condition of anonymity.

—

- A week ago, HotNews.ro asked the ASF for its opinion on increasing RCA prices for non-accident drivers, and we’ll be back with answers as soon as we get them.

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.