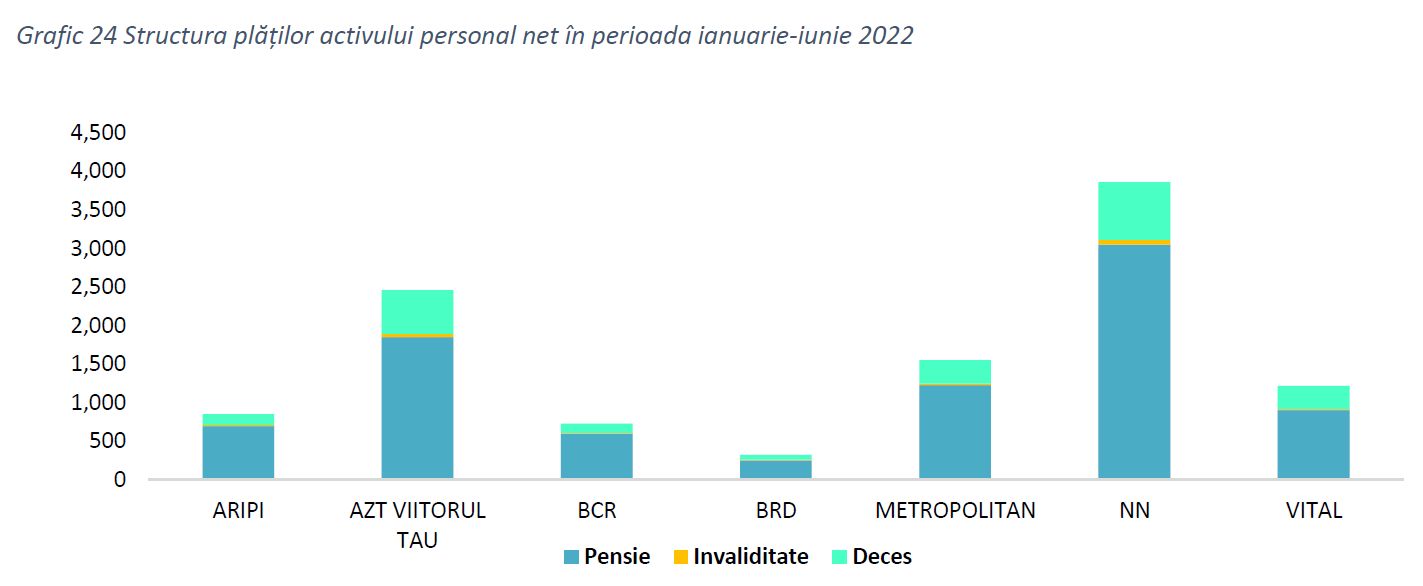

According to the latest data from the ASF, the 11,000 participants or beneficiaries of the second level of pensions (mandatory private pensions) collected about 182 million lei in the first six months of this year. Of the total amount of payments made, 88% is related to the opening of the right to a pension, 11% – as a result of the participant’s death, and 1% – as a result of disability.

- According to the legislation, as a transitional provision until the adoption of the law on the payment of non-state pensions, participants and/or their heirs can receive payments from the pension funds either in one lump sum or in equal installments for a maximum of 5 years.

- VIEW THE RETIREMENT LEVEL II REPORT HERE

In the first half of 2022, as a method of payment for net personal assets, participants/beneficiaries preferred one-time payments to the detriment of staged payments, with a percentage ratio of 70%.

As a result of the opening of the right to pension, one-time payments in the amount of 104 million lei and phased payments in the amount of approximately 56 million lei were made.

As a result of the participant’s death, lump sum payments of 15 million lei and deferred payments of 5 million lei were recorded to beneficiaries of net personal assets.

As a result of the disability, the amount of personal net assets paid was approximately 1.5 million lei related to lump sum payments and 410 thousand lei in the form of phased payments.

FPAP NN (35%), FPAP AZT Viitorul Tău (22%) and FPAP Metropolitan Life (14%) recorded the largest shares of total net personal asset payouts in the first six months of 2022, which are also funds with a larger number of participants.

The opening of the right to a pension accounts for the largest share in the payments of private pension funds.

The total value of assets compared to December 2021 decreased by approximately 2%.

Total net asset value of private pension funds amounted to 87.35 billion lei at the end of June 2022, an increase of approximately 3% compared to the same date in 2021.

Compared to December 2021, net assets decreased by approximately 2%.

- Read also: Reduction of the II level of pensions: how much money Romanians who retired received in the first 5 months, and what guarantees the law provides

Number of participants there were 7.88 million people registered in the non-state pension system as of June 30, 2022, compared to 7.79 million people as of December 31, 2021.

At the level of pillar II, average contribution of participants with contributions listed on June 30, 2022, it was about 235 lei/member, while on December 31, 2021, its value was 204 lei/member.

In the period January-June 2022, contributions transferred to the private pension system amounted to 5.43 billion lei, an increase of approximately 12% compared to the same period in 2021.

As of June 30, 2022, government securities and shares remained the main financial instruments in which private pension funds invested.

Investments of private pension funds in government securities were 59% as of June 30, 2022, and the percentage was 60% invested as of December 31, 2021 in this type of financial instruments.

As of June 30, 2022, investments in shares accounted for 25% of the total value of assets of level II pension funds. In addition, significant weights are also invested in corporate bonds and mutual funds at the end of the first half of 2022.

The weighted average rate of return for all private pension funds was 3.40% in June 2022, down from December 2021 (5.79%).

At the end of June 2022, the average value of assets of a member of a private pension system was 11,235 lei, registering an increase of 1% compared to June 2021 and a decrease of 2.6% compared to the previous quarter.

In the period from January to June 2022, net payments of personal assets were made to participants in the amount of 182 million lei to approximately 11 thousand participants and beneficiaries.

Photo source: Dreamstime.com

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.