With a mortgage loan with a fixed interest rate, even if you are protected from rate fluctuations in the first years, the amount you pay the bank at the end will be higher than in the case of a loan with a variable interest rate, according to calculations made by HotNews.ro.

In the end, it all depends on the willingness to take risks. Do you want a fixed (stable) rate for several years? There’s a cost to everything: you’ll have a slightly higher monthly rate if you opt for a variable rate loan, but you’ll be protected from interest rate rises as the BNR tries to tame inflation. Also, when BNR pays back interest, your rate will remain fixed, while those on a variable rate will pay a lower rate. In addition, you will pay more for the home than if you took it with variable interest.

Hotnews took into account a house worth 265,000 lei (approximately 53,000 euros), a loan cost of 225,000 lei, money borrowed for 20 years.

In the case of a loan with fixed interest during the first years and then with variable interest, the first monthly payment is approximately 1,691 lei, and the final amount you will pay the bank will be 347,707 lei.

In the case of a loan with variable interest, the first installment will be 1,453 lei, and the total amount paid at the end of 20 years will be 323,127 lei.

In addition, the minimum income required for a loan with a fixed interest rate is 4,227 lei, while for a variable interest rate it is enough to have an income of 3,632 lei per month.

Of course, during the 20 years that you will be a client of the bank, you will be able to refinance the loan, which will change these problems.

Since the spring of this year, the number of transactions with apartments and houses began to decrease

The number of transactions with apartments and houses began to decrease from the spring of this year against the background of high energy costs, rising prices of building materials and fuel, to which the growth of costs related to mortgage loans is also added, Colliers consultants note.

In Bucharest, the owners owed the banks 50% of the apartments sold in the first six months of this year. For the entire year 2021, 60% of apartments were bought on credit, which means that not only are there currently fewer transactions that depend on bank financing, but also part of the demand has become non-bankable and does not allow for loan payments. to buy the desired housing, Colliers consultants note.

In the rest of the countries, 44% of transactions were carried out with the help of credit in the first half of the year, the percentage decreased slightly compared to the level of 45% recorded during 2021. Cluj leads the decline in the number of home loan providers, with 48% of real estate transactions completed with borrowed money in the first half of the year, compared to 53% last year, followed by Timisoara, where 48% of properties were purchased on credit vs. 50% last year.

“The decline in housing affordability is becoming increasingly evident amid unprecedented price growth in this economic cycle. Recent demand data suggests that cheaper homes rely more on credit, while the most expensive, luxury ones mostly sell for cash. This means that in the conditions of rising interest rates, the demand for cheaper housing, where a higher percentage was bought with mortgage loans, will suffer the most,” explains Gabriel Blanice, deputy director of valuation and advisory services at Colliers Romania.

The methodology for calculating the reference index of consumer loans (IRCC) allows you to make an accurate calculation for the last quarter of the current year, when interest will reach 4.06%, and estimates for the first quarter of next year put this indicator at about 6%. This evolution will affect the demand for loans and, implicitly, the sale of houses, accelerating the balancing trend between supply and demand that we have started to see since the second quarter of this year, say consultants Colliers.

Over 24,000 units are currently under construction in and around Bucharest, around 7,000 units in Iași and over 5,000 in Cluj-Napoca. A new trend in the market is the construction of residential complexes intended exclusively for rent. As the spread between the rate and the rent narrows, against the backdrop of rising market prices and tighter credit conditions, Colliers consultants see an increase in rental demand. Until now, this demand has been met by small investors who bought packages of apartments and put them on the rental market, but now it is starting to attract the attention of big players as well.

How much can we afford to borrow?

Inflation has thus worsened the situation from a potential buyer’s point of view. The National Bank continued to raise the key interest rate in recent monetary policy meetings to fight inflation.

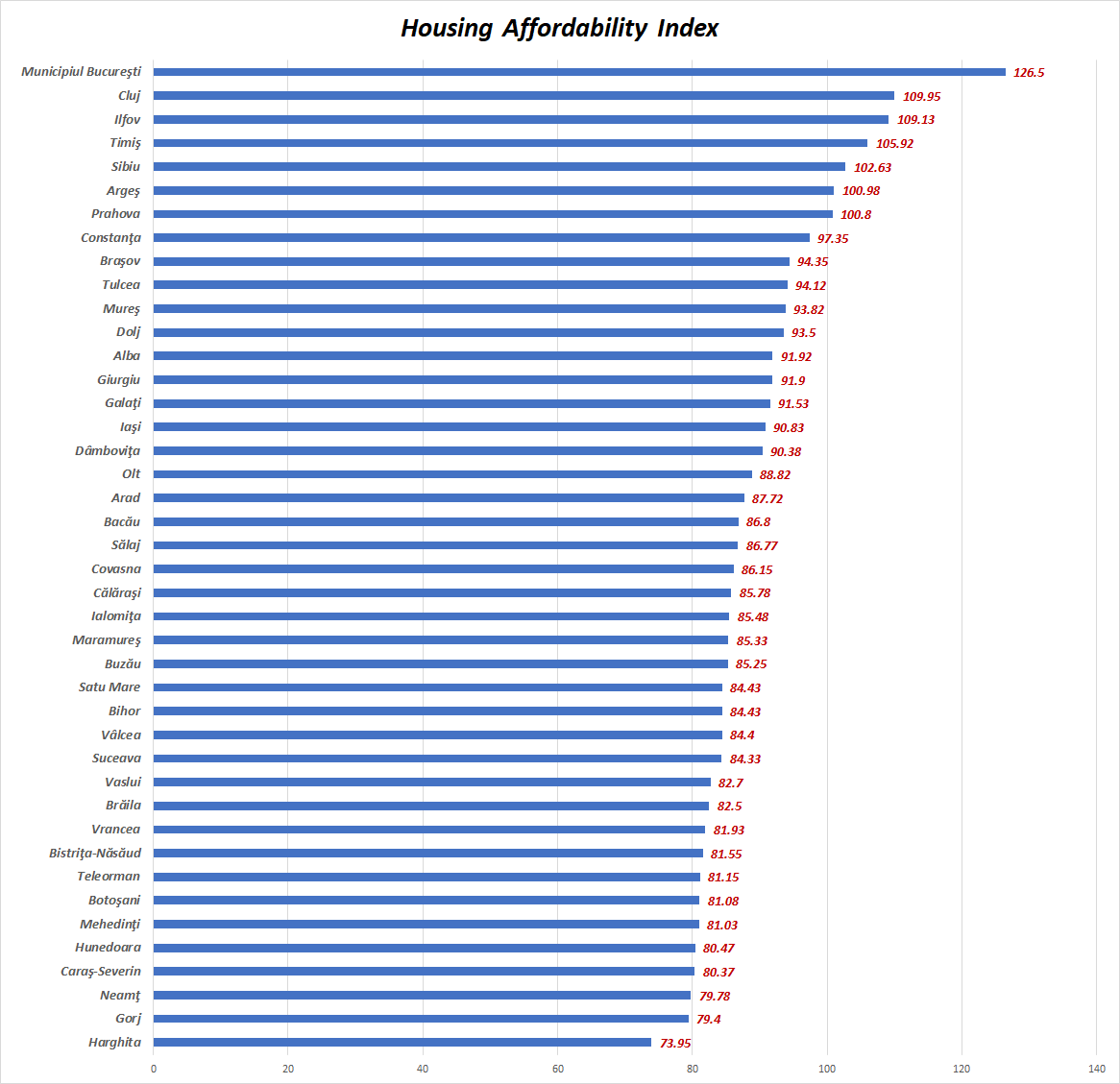

The ease of obtaining a mortgage is calculated using the Housing Affordability Index (HAI). It is obtained by comparing the median income to the minimum income required for obtaining a loan.

Attention, the median salary is not the same as the average salary. The median wage is a wage that divides workers into two equal parts: half have wages below the median wage and the other half have wages above the median wage. In Romania, the average salary is below average because we have many workers with low incomes and few with high and very high incomes. We also say that we are in last place in the EU in terms of median salary.

Going back to the affordability index, the higher it is above 100%, the more affordable the loan is for that person. By default, the lower this percentage is 100%, the more inaccessible the loan is for this person.

HotNews calculated the median salaries in each individual county (based on information provided by the National Institute of Statistics) and took into account the level of access to a loan worth 230,000 lei (equivalent to 46,000 euros), which, together with the down payment, would ensure the purchase of a house of 55,000 euros.

It is obvious that the capital is a city where salaries make it possible to obtain high availability of mortgage loans. Along with Bucharest, we find more than 100% availability in Cluj, Ilfov, Timisoara, Sibiu, Arges and Prahov.

At the opposite pole, we find the districts of Harghita, Gorzh and Neamts, where the accessibility index is below 80%.

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.