RCA prices increased last year for both individuals and companies, according to the latest ASF data, the average annual premium was 1,219 lei, up 7% from 2022 and 54% from 2021. In the same period, the average loss increased by 8% to 10,750 lei. With no claims paid out by the FGA, claims and claims declined and insurers profited from the RCA.

Revenues of RCA insurers last year increased to 9.3 billion lei / Groupama and Allianz have more than 47% of the market

Income from gross premiums paid by insurers from the sale of RCA, including the activities of Axeria Iard and Hellas Direct (HD Insurance) affiliates, last year amounted to approximately 9.3 billion lei, which is 16% more compared to the volume of corresponding underwriting 2022 (approximately 8 billion ley, including branches).

The level of concentration remained high for the first leading insurers in 2023, so that the first 3 insurance companies accumulated approximately 57% of RCA’s insurance portfolio in Romania. Groupama and Allianz-Țiriac together had 47.1% of revenues, while Grawe came in 3rd place with 9.7% of the RCA market.

“However, there is a decrease in the degree of concentration compared to previous periods, taking into account the dynamics of subscriptions of branches present in the local market, which had a cumulative share of 14.5% in 2023,” ASF notes.

On December 31, 2023, seven insurers received ASF permission to carry out RCA insurance activities: Allianz-Ţiriac Asigurări, Asirom Vienna Insurance Group, Eazy Asigurări, Generali, Grawe, Groupama and Omniasig Vienna Insurance Group.

On the RCA market in Romania, there are two branches operating by right of foundation: Axeria IARD and Hellas Direct.

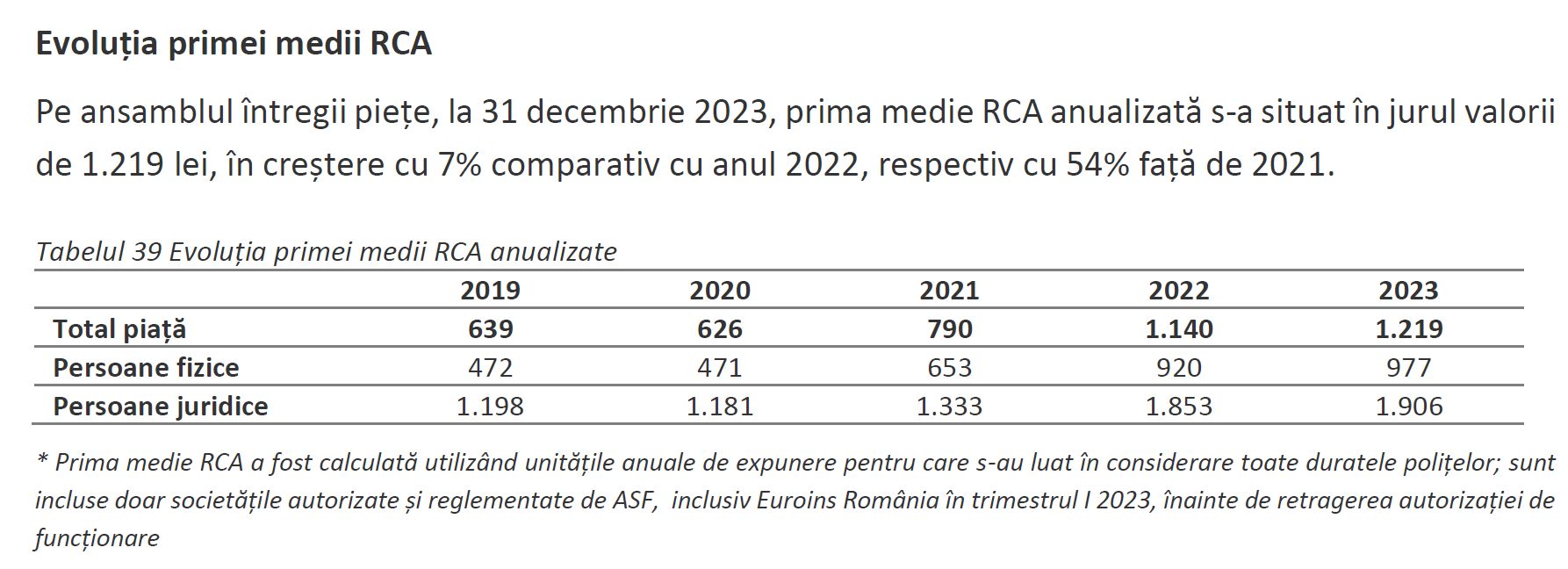

Evolution of RCA prices in 2023: average premium increased by 7% to 1,219 lei

In the whole market as a whole, on December 31, 2023, the first annual average value of RCA was about 1,219 lei, which is 7% more compared to 2022, respectively 54% compared to 2021.

Individuals paid an average of 977 lei for RCA last year, compared to 920 lei in 2022, while companies paid an average of 1,906 lei, compared to 1,853 lei in 2022.

In 2023, the largest share was occupied by policies with a validity period of 12 months (86% of RCA contracts were concluded for 1 year).

Average loss increased by 8% to 10,750 lei / how much FGA paid after the bankruptcy of City Insurance and Euroins

The amount of gross compensation paid by insurers amounted to 3.1 billion lei in 2023 for paid claims in the RCA segment.

The Fund for Insurers’ Guarantee (FGA) has approved an amount of approximately 794 million lei for the payment of RCA claims in 2023, of which 757 million lei represent payments made to the RCA segment in 2023 as a result of the bankruptcy of City Insurance and Euroins. Romania.

In 2023, insurance companies authorized and regulated by the FSA paid out about 3.1 billion lei for about 292,000 claims, resulting in an average claim amount of about 10,750 lei, which is 8% more than the previous year.

Excluding the data recorded by the FGA, gross claims paid for RCA decreased by 7% and the number of claims paid decreased by 14% compared to 2022.

The average amount of claims is the ratio between the gross compensation paid and the number of claims paid.

In comparison, in 2022 insurers paid out compensation of 3.38 billion lei on approximately 340,000 claims, so the average RCA claim was 9,963 lei.

RCA’s average personal injury claim paid in 2023 was approximately 76,741 lei (down more than 11% compared to 2022), and property damage was 8,867 lei (up 8% compared to 2022).

Most insurers profited from RCA, with an overall loss rate of 97.25%

An indicator that shows how successful insurance companies have been for the year is the cumulative loss ratio.

If this combined loss ratio is sub-unit (below 100%), it means that the insurers are making a profit from RCA activities.

The total claims rate includes, in addition to the compensation paid, the contributions paid to the Policyholder Guarantee Fund (FGA), the National Defense Fund (BAAR), and distribution and administration costs.

In addition, in the process of calculating the amount of damages, both already settled or partially paid claims are taken into account, as well as established claims reserves, technical reserves, which are required by law.

Last year, the total RCA loss ratio was 97.25%, meaning that on average insurers made a profit. The report did not say which insurers lost.

RCA’s loss rate was 74.76% last year, and its acquisition and administration expense rate was 22.49%.

By total insurance activity (including RCA), insurance companies had gross technical provisions of 15.3 billion lei at the end of 2023 (excluding technical provisions related to Euroins Romania), which is 6% more than at the end of 2022 .

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.