ANAF is already undergoing a reorganization approved and published a few weeks ago (OG 23/2024), in connection with which the Ministry of Finance has prepared a draft Decision with some additions in this regard.

According to the document, anti-fraud inspectors will be equipped with “personal self-defense equipment”:

1. Paralyzing gas cylinder (spray) with a bottle holder on the belt to equip each inspector

2. electric shock: – a maximum of 500 small pieces; – no more than 500 units of pistols/sticks for equipping inspectors)”.

The draft also states that “it is reasonable that the FISCIF Fraud Inspector General may approve the release of such funds to other individuals within the Fiscal Fraud Controlling Office if they participate in the activities and only under time to act.”

They had these things until now. Basically, the novelty is that they have had their firearms confiscated, respectively:

1. service weapon: a pistol with a magazine; one piece for each inspector;

2. leather holster for a gun;

3. combat ammunition for each pistol loader for each shooting, as well as in the case of special actions;

Thus, in case of special actions, the inspectors will be able to take with them the gendarmerie and the police of Romania at the request of the ANAF president.

Draft decision on reorganization of ANAF – click to open

In addition to the new anti-fraud positions and other positions provided for in this Order, the new organizational chart provides for a maximum number of 22,507, including the president, vice presidents and offices of senior officials. Now the number of posts is 22,287.

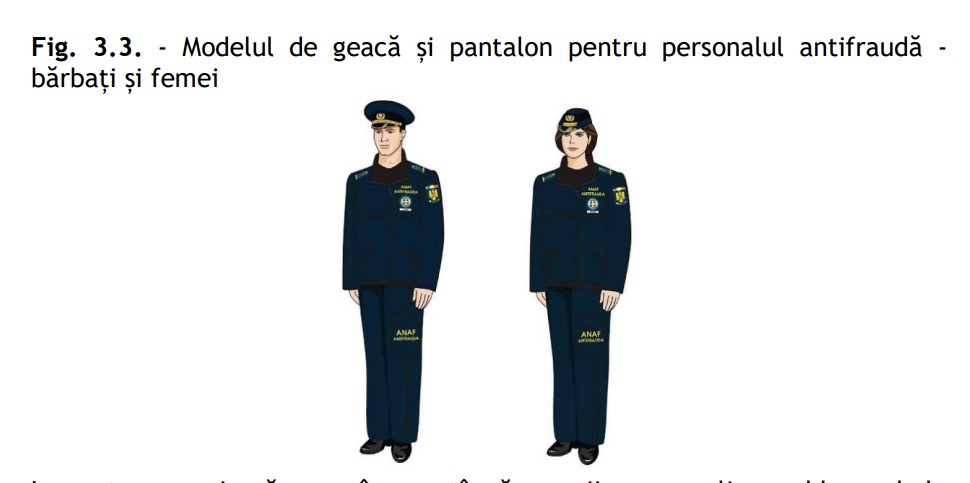

What does the ANAF form look like?

See the entire wardrobe for ANAF employees – click to open

Anti-fraud will have more employees

Another 220 employees will appear in the anti-fraud department. The Ministry of Finance motivates this with the introduction of e-Seal.

It is about the system of tracking cargoes that are exposed

tax evasion.

“To this end, the implementation of the national RO e-Seal system will ensure compliance with the traceability of road transport of goods with customs/fiscal risk in the territory of Romania, it will improve the activities of authorities with specific powers from the central administration by modernizing and adapting procedures/methods of customs supervision/fiscal control to the current reality, it is extremely necessary to increase the number of ANAF positions,” the Ministry of Finance reports.

Municipal tax authorities do not cancel, but change the name

We would like to remind you that from 2025, ANAF will have district anti-fraud structures. The first step should have been the elimination of commune fiscal offices from the structure of county state financial offices.

According to the explanatory note, this cannot be done in the same context as the abolition of the office as a component structure of the department/service, which is motivated both by the specifics of the activities carried out at the level of city tax inspectorates and by their importance in the fiscal apparatus as collection tools revenues to the state budget.

They perform the role of facilitating the collection/receipt of revenues for the state budget, the specifics of their activity cannot be confused with the concept of “service/office” defined by current regulations.

The Municipal Fiscal Services derive from the 2013 reorganization of the Municipal State Financial Administrations, mentioned those Municipal Fiscal Services (6 in number) as ANAF fiscal units that cannot be abolished due to their concrete and specific situation in the DGRFP,

based on the criteria of geographical distance from neighboring municipal/city tax offices, the number of managed taxpayers, access to the relevant territory, implementation of budget revenues and their share in total revenues, etc.

In this context, it is proposed to change the name of tax services/administrations to tax units,

which will be stored.

Territorial structures at the district level, because inspectors walk 100 kilometers every day

Inspectors travel 100 kilometers a day in certain areas, and ANAF wants to reduce travel costs. As I said above, from January 1, 2025, regional territorial structures to combat fraud will appear.

According to the Ministry’s project, regional anti-fraud departments will operate as part of the General Anti-Fraud Department, which will be headed by the Deputy Inspector General of Anti-Fraud.

Also, the Office will be headed by the Inspector General for Combating Fraud, who will be assisted in his work by the Deputy Inspector General for Combating Fraud.

The main headquarters of regional offices for combating tax fraud are established in various municipalities.

Within the framework of the regional offices for combating tax fraud, regional territorial structures based in the regions of their sphere of activity will work. The headquarters and the number of structures at the level of each county are established by the order of the President of the Agency.

Persons holding certain public positions used in the Agency for the general management of the fight against tax fraud have the power to exercise control throughout the national territory.

The names “operational-unexpected control”, “current control” and “thematic control” disappear.

The phrases “operational and unexpected control”, “current control” and “thematic control” are used to

will now be replaced by the phrase “anti-fraud control”.

In addition, the phrase “customs” disappears, given that it has been removed from the remit of the ANAF, respectively, the General Directorate for the fight against tax fraud, given that the customs activity belongs exclusively to the Romanian Customs Service.

The transfer of the Office of Large Taxpayers to the NAFP, due to which it loses its legal personality, will be carried out according to the acceptance-transfer protocol.

According to the draft Decision, the activity, number and staffing of the GUADMV is entrusted to the National Agency for

Fiscal administration based on the reception-transfer protocol.

The activity of asset recovery structures in civil cases at the level of the DPAU’s own apparatus is entrusted to regional GUs of finance on the basis of a protocol of acceptance and transfer with approval of the number of positions.

Placement of personnel in the limited number of approved positions and in new organizational structures is carried out within the terms and in the manner prescribed by the law for each category of personnel, within at least 30 days from the date of entry into force of the decision. .

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.