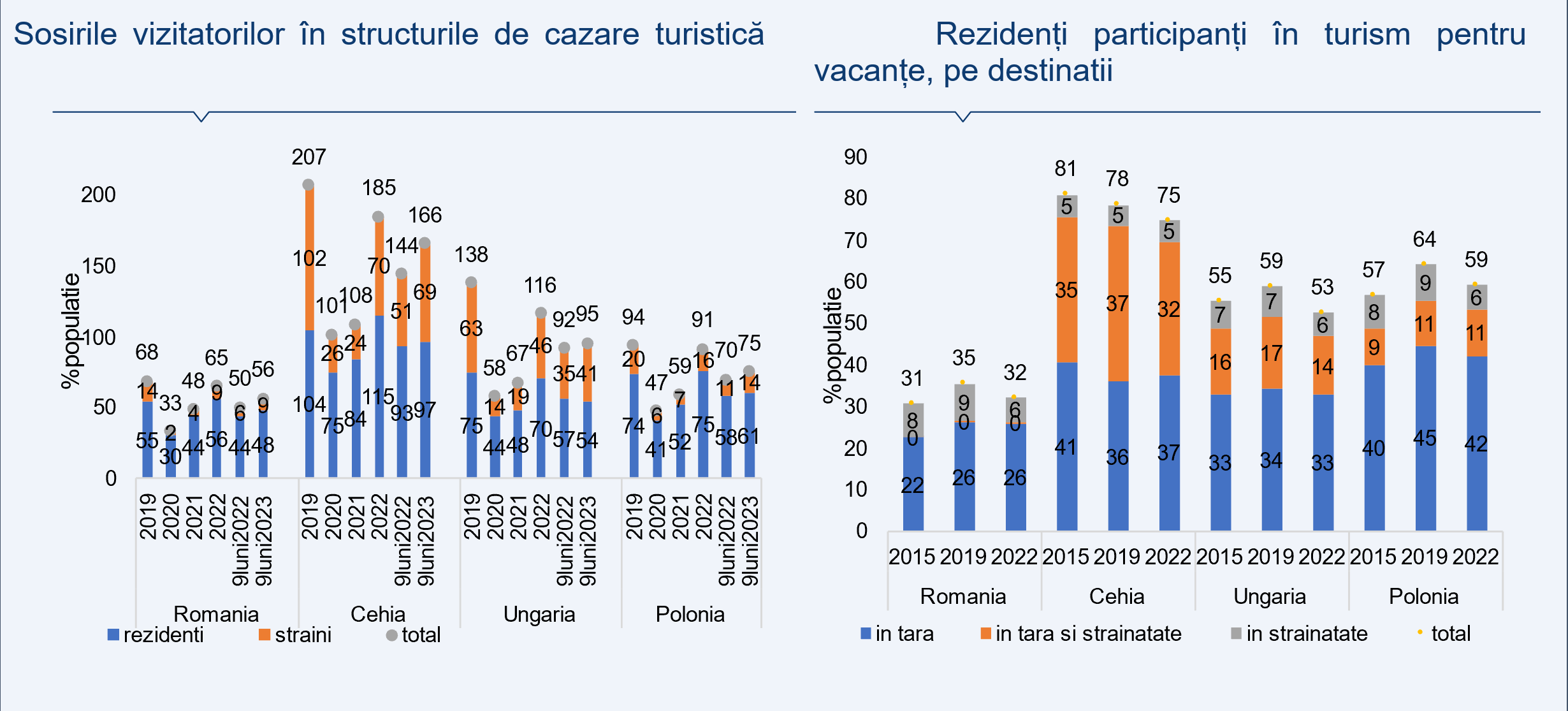

The decrease in purchasing power is the reason that in Romania vacations are spent during the year either only in the country (26% of the population in 2022) or only abroad (6% of the population in 2022), but not in both directions. According to the analysis sent on Thursday by Ella Callai, Chief Economist of Alfa Bank.

Hotel and catering services have potential for development both in Romania and in the countries of the region. The sector’s contribution to GDP was 1.7% in 2022, as in Hungary, more than the Czech Republic (1.4%) and Poland (1.3%), and less than the European average (2.3 %). As in the EU and the countries of the region, with the exception of Hungary, the contraction caused by the pandemic has not recovered.

Given that labor productivity in tourism is half the European average, as in other countries in the region, but labor costs are the lowest in the region (23% of the European average compared to 52% in the Czech Republic, 41% in Hungary and 30% in Poland), tourism in Romania has the highest profitability in the region.

The cross-border component of tourism creates a deficit only in Romania

The value of products and services purchased by residents of Romania during visits to other countries (representing imports of tourism services) exceeds the value of products and services purchased by non-residents during visits to Romania (representing exports of tourism services), a deficit balance of tourism services. In 2022, the deficit level was 1% of GDP. In contrast, the Czech Republic had a balanced balance sheet, while Hungary and Poland had surpluses of 1.8% and 1% of GDP, respectively.

The import of tourist services in Romania can be compared with the import in the countries of the region. Relative to GDP, the annual import of tourism services over the past decade was 1.7%, compared to 1.4% in Hungary and Poland and 2.1% in the Czech Republic.

Although most of these imports (60%) were driven by private tourism, the share was much lower than in other countries in the region (80%), reflecting lower purchasing power.

Romania’s export of tourism services is significantly lower compared to the countries of the region. Annual exports accounted for only 1.2% of GDP over the past decade, compared to 3.7% in Hungary, 2.6% in the Czech Republic and 2.1% in Poland. The reasons are the lower capacity of tourist accommodation per thousand inhabitants (22 in 2022), similar to Poland, but much lower than in the Czech Republic or Hungary (74 and 38, respectively), the arrival of foreign tourists is much less (9% of the population compared to 16% in Poland, 46% in Hungary, 70% in the Czech Republic in 2022), shorter stay of foreign tourists in Romania (2.2 nights per tourist in 2022 compared to 2.5 nights in the Czech Republic and Poland, and 2, 8 nights in Hungary).

And domestic tourism in Romania is more limited compared to domestic tourism in the countries of the region. The arrival of Romanian tourists in accommodation structures was 56% of the population in 2022 (115% in the Czech Republic, 70% in Hungary, 75% in Poland), of which only half were for recreation, and the number of overnight stays per tourist was 2.1 (2 .5 in Hungary, 2.6 in Poland and 2.7 in the Czech Republic). Thus, the net occupancy rate in tourist accommodation remained the lowest in Romania after the partial recovery from the pandemic (32% compared to 38% in Hungary, 39% in the Czech Republic and 42% in Poland). Stimulating the demand for domestic tourism (vouchers for rest, vouchers for treatment in sanatorium-resort facilities) can accelerate the development of the structure of tourist reception and tourist accommodation, which will ultimately attract foreign tourists and thereby increase the export capacity of tourism.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.