13 years after the mandatory insurance of houses against earthquakes, floods and landslides began, on Wednesday, November 15, the threshold of 2 million insured houses was exceeded for the first time, announced PAID Romania, the company that issues these insurances.

- “While we celebrate this achievement today, more than 7.4 million families are still at risk of being left with nothing if their homes are destroyed by a major natural disaster.” PAID Romania announced on Facebook.

It will be recalled that according to Law 260/2008, house owners are obliged to insure their houses against earthquakes, floods and landslides, and the first catastrophe insurance contracts (PAD) were concluded in the summer of 2010.

Theoretically, the fine is from 100 to 500 lei. However, in practice, no fine has been imposed so far. Applying the sanction is up to mayors, who, however, need people’s votes and avoid being negative characters.

The price of compulsory insurance for buildings with a more stable construction, especially in cities, has increased from 100 lei to 130 lei per year, starting from Saturday, November 11, while the maximum compensation in the event of a disaster caused by an earthquake, flood or landslide has remained unchanged – 100,000 lei.

For adobe or thatched houses, the price of compulsory insurance remained at 50 lei, the amount for which owners can receive compensation of up to 50,000 lei in the event of a disaster.

5 legislative changes that could force homeowners to insure their homes

As people are not required to have home insurance and mayors have never imposed fines, the authorities have recently made some changes to the new law to force owners to take out these PAD policies.

Cosmin Tudor, the development director of PAID (compulsory home insurance company), clarified for HotNews.ro which 5 legislative changes that came into force on Saturday are aimed at increasing the degree of coverage of housing insurance.

1. Any registration or change in the Land Register – only in the presence of PAD insurance

ANKPI will first check the PAD policy regarding registrations and changes to the land register.

- “In order to register or change the registration of a house in the land register, its owner is obliged to present a contract of compulsory insurance of the house.

- Registration or making changes to the registration of housing in the land register is conditioned by the existence of a mandatory housing insurance contract valid on the date of the application,” the law states.

Read also: Only 20% of Romanians have mandatory home insurance. What solution did the state find to force them to issue policies

2. The fines that the mayors have to charge for the lack of a PAD policy are fully covered by the local budget

In theory, the fine prescribed by law for not having PAD insurance is between 100 and 500 lei. However, in practice, no fine has been imposed so far. Applying the sanction is up to the mayors, who, however, need people’s votes and not to be negative characters.

If the fine had been calculated until now, 60% of its amount would have gone to the central budget, and 40% would have remained in the local budget.

Thanks to the changes made to the law, the fines will now go entirely to local budgets.

3. Notification schedule for uninsured owners

The law introduced a strict calendar for the first time, which municipalities must adhere to when notifying owners of the lack of PAD insurance – every six months, starting on January 15, 2024.

- “Professional departments of city halls once every six months, starting from January 15, 2024, send notification letters with confirmation of receipt to persons who have not concluded PDP contracts for their housing,” the law states.

4. PAD policies will also be able to be sold by City Hall employees. What kind of money can I get?

Another change is that employees of city halls and subordinate institutions will be able to distribute the PAD policy.

- “They can engage in distribution business according to current legislation, becoming either assistants of a broker in the market, or agents of an insurance company, or employees of such structures.

- Therefore, remuneration for the distribution of PAD insurance will also be discussed with these specified entities.

- PAID currently offers a 10% commission to intermediary insurers and will offer the same commission to contract brokers.

- Current laws require insurance distributors to take specialized courses, pass exams and obtain an ASF authorization in the form of an RAF code.” said director of PLATA HotNews.ro.

5. Brokers will be able to sell PAD without the mediation of an insurer

Last but not least, another change aimed at increasing sales of PAD insurance is aimed at insurance brokers who will be able to distribute PAD without the intermediary of another insurance company under a direct contract with PAID.

Record compensations after the Gorja and Arad earthquakes: payments against rejected cases

PAID Romania, the company that issues and manages compulsory home insurance, sent on Tuesday, upon request to HotNews.ro, details of claims opened this year and in 2022, payments made, rejected documents and reasons for non-payment. corresponding requirements declared by the insured.

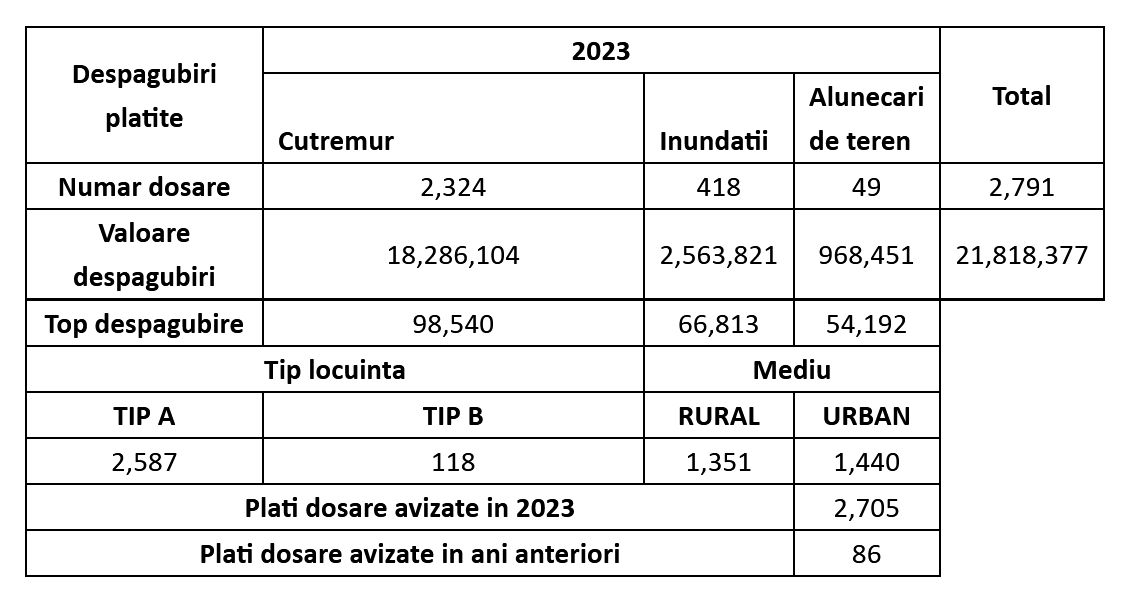

According to these data, compensations in the amount of more than 21.8 million lei were paid this year in the number of 2,791 damage cases, of which 2,705 cases were approved this year.

The largest compensations, over 18.2 million lei, were paid for damages caused by earthquakes.

We remind you that this year there were two strong earthquakes, one in February in Gorzh County, and the other in June in Arad.

In comparison, in 2022 PAID paid compensation of almost 3 million lei, most of this amount for damages caused by floods.

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.