Several banks have already informed customers that they are going to increase fees for cash withdrawals or cash deposits at counters, interbank and intrabank payments (made at counters). “We would like to inform you that as of January 1, 2024, commissions for cash deposit operations at cash registers and other operations will change,” one of the banks said in a message.

The measure resulted from the entry into force of the law to limit cash in the economy, a controversial decision taken by the Cholaku government.

The measure will affect owners of small shops in rural areas, where payment is mainly made in cash, and traders are obliged to deposit money in the bank in the evening. They will now pay more to have the bank deposit money into their account, which will affect their costs.

“Consider that there are more than 60,000 small traders, many of whom have shops in rural areas where they pay exclusively in cash. Customers come in and pay in cash, some walk down the mountain to stock up. In the evening, the owner went for cash and drove to replenish supplies, and now he lowered our ceiling. So where and how can I put money on the card at that time to pay for my goods with a card?”, explains the founder of Paco Supermarkets and vice-president of the National Association of Small and Medium Businesses, Feliciu Paraskiv, in a discussion with HotNews. Traders the size of Romania – ANCMMR.

What do the data show for Romania?

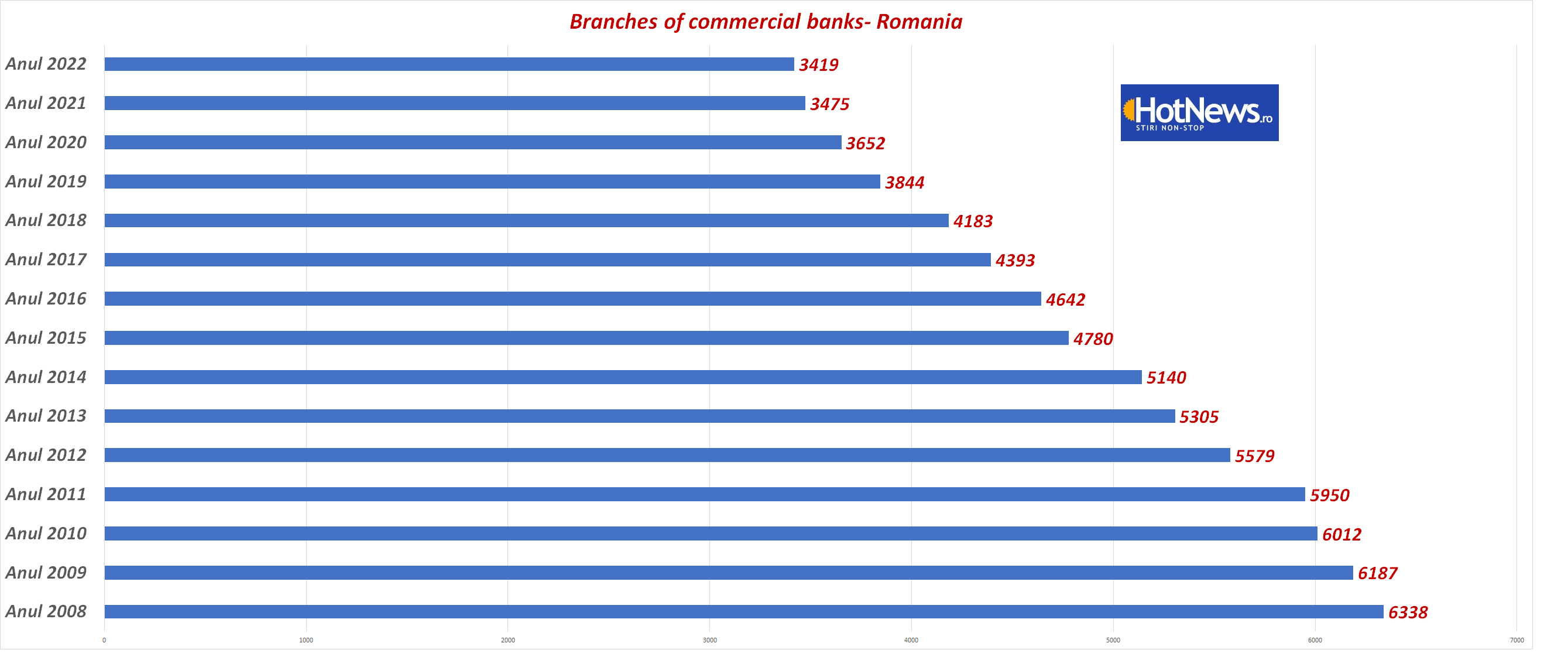

In recent years, the number of bank branches has decreased. Almost half as much. Everything is fine in the cities, but miserable in the countryside or on the coast. There are cities that have been left without banking units, and only with the help of political pressure were they able to reopen some banks that closed the last unit and left due to high costs

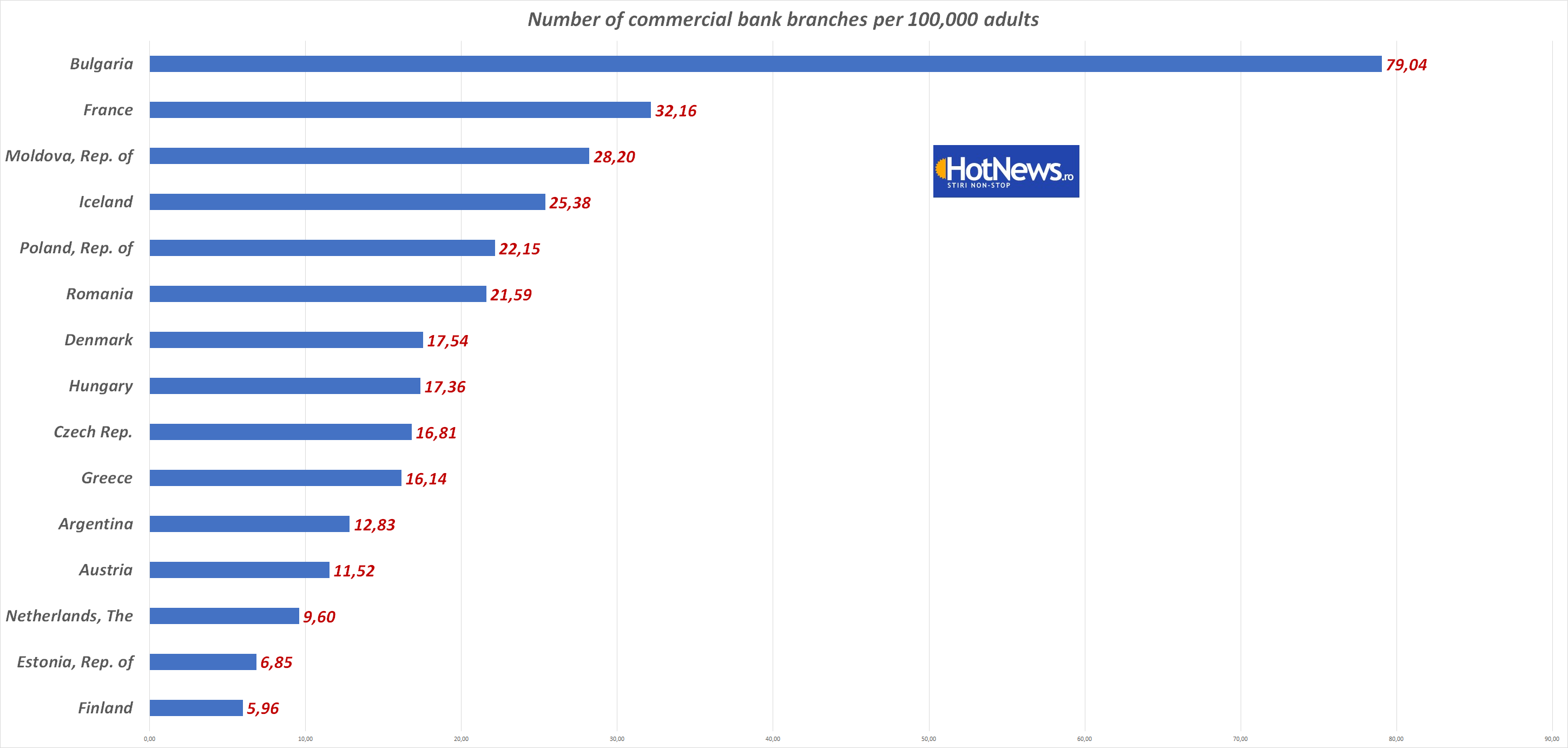

Data source: IMF

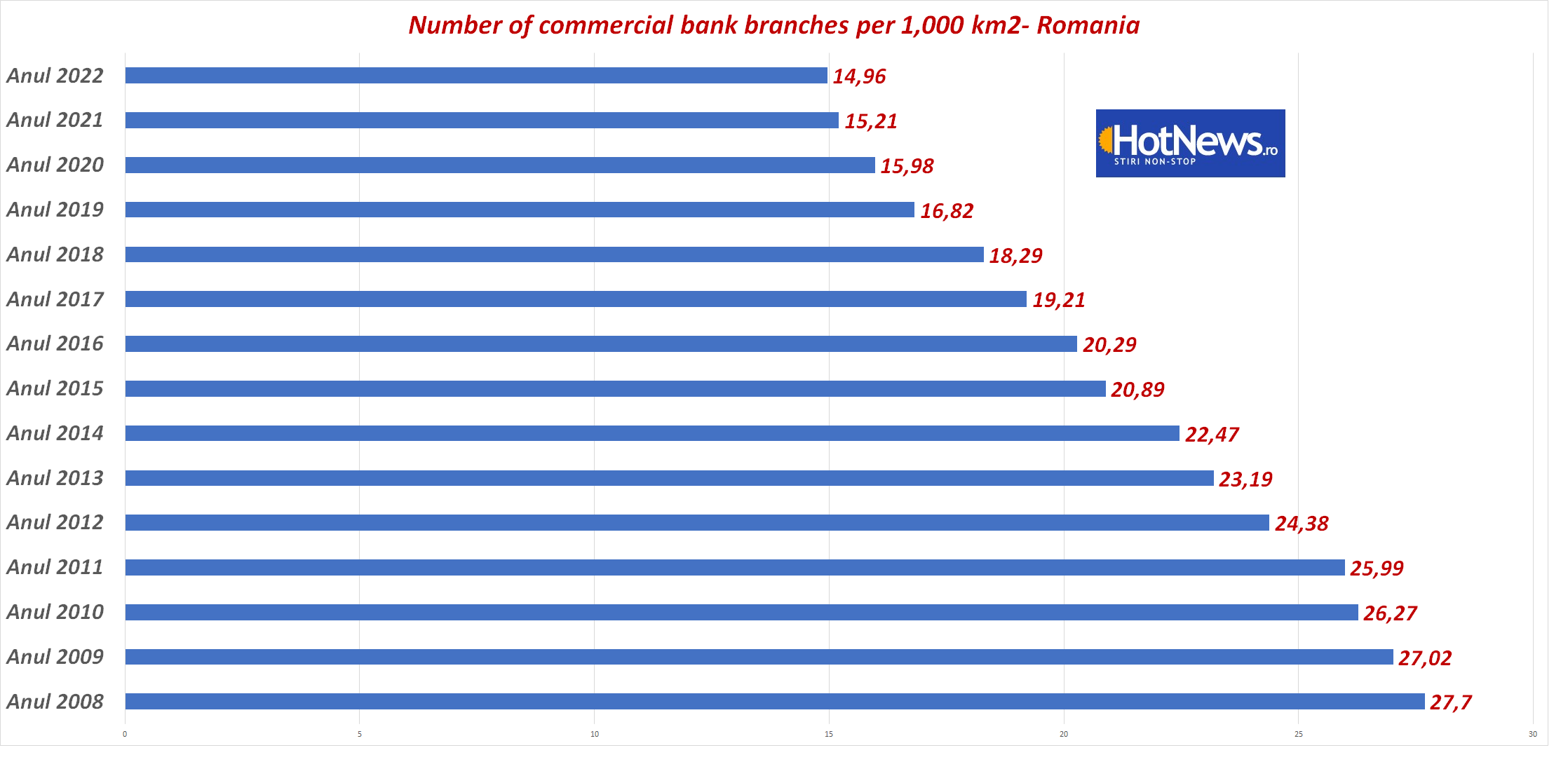

If you look at the number of banking units per thousand square kilometers, they have halved over the past 15 years

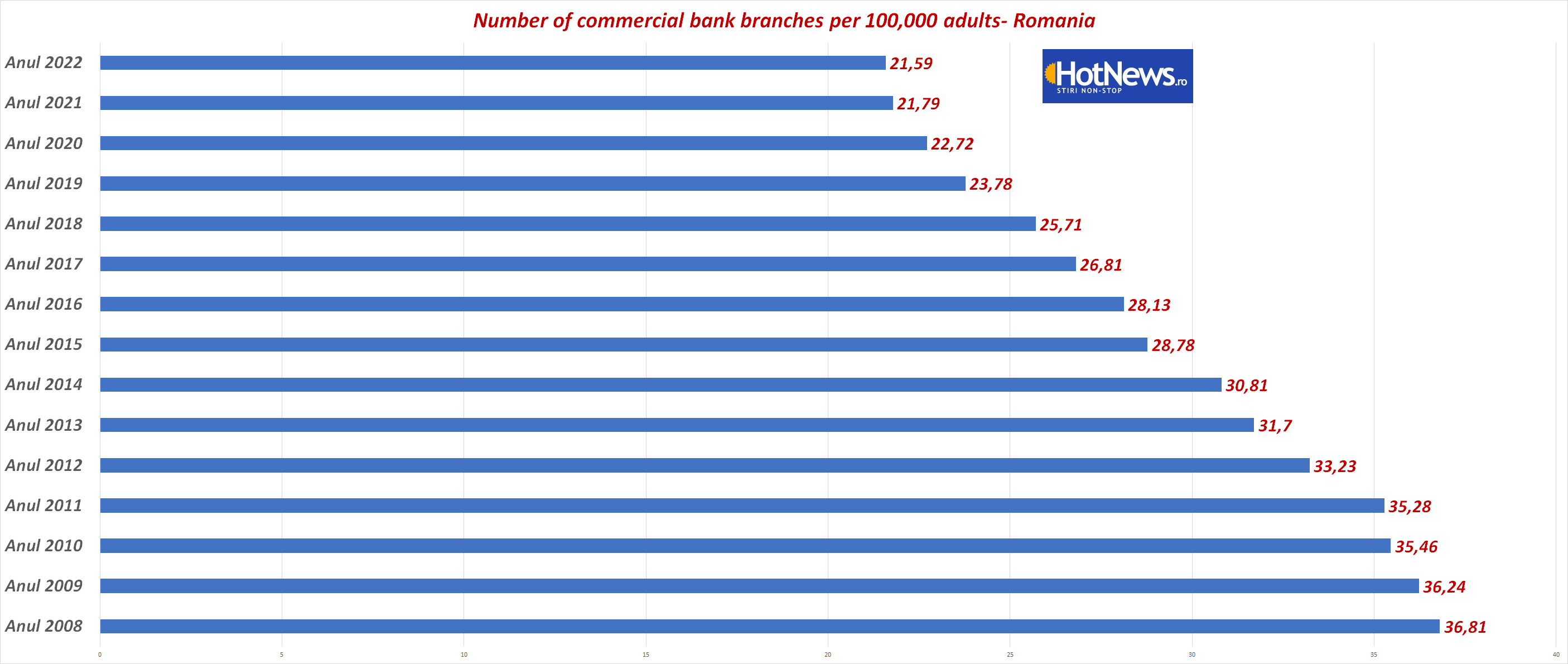

And when it comes to the number of agencies returning per hundred thousand adults, things look just as bad. If you look at the latest IMF statistics – this is an interactive map – you will see that Romania is in worse shape than neighboring countries

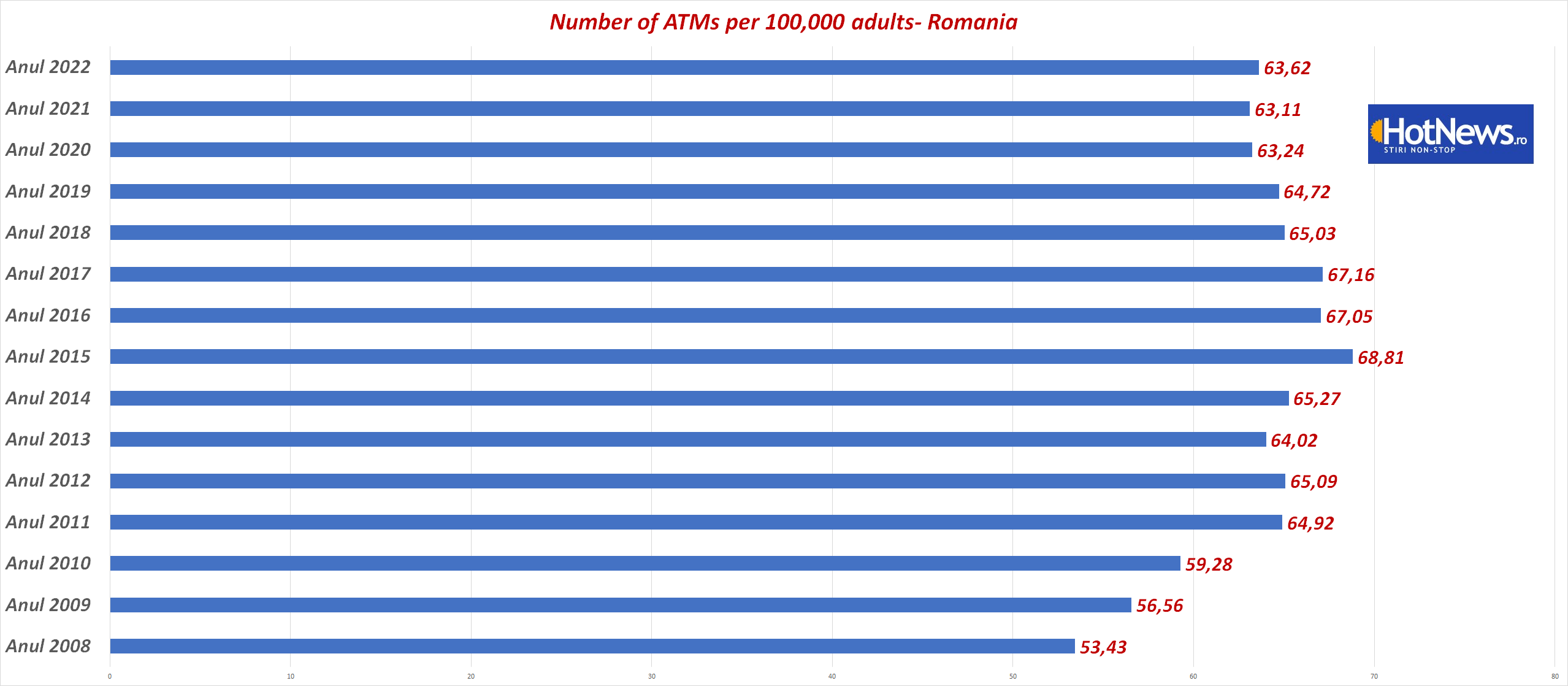

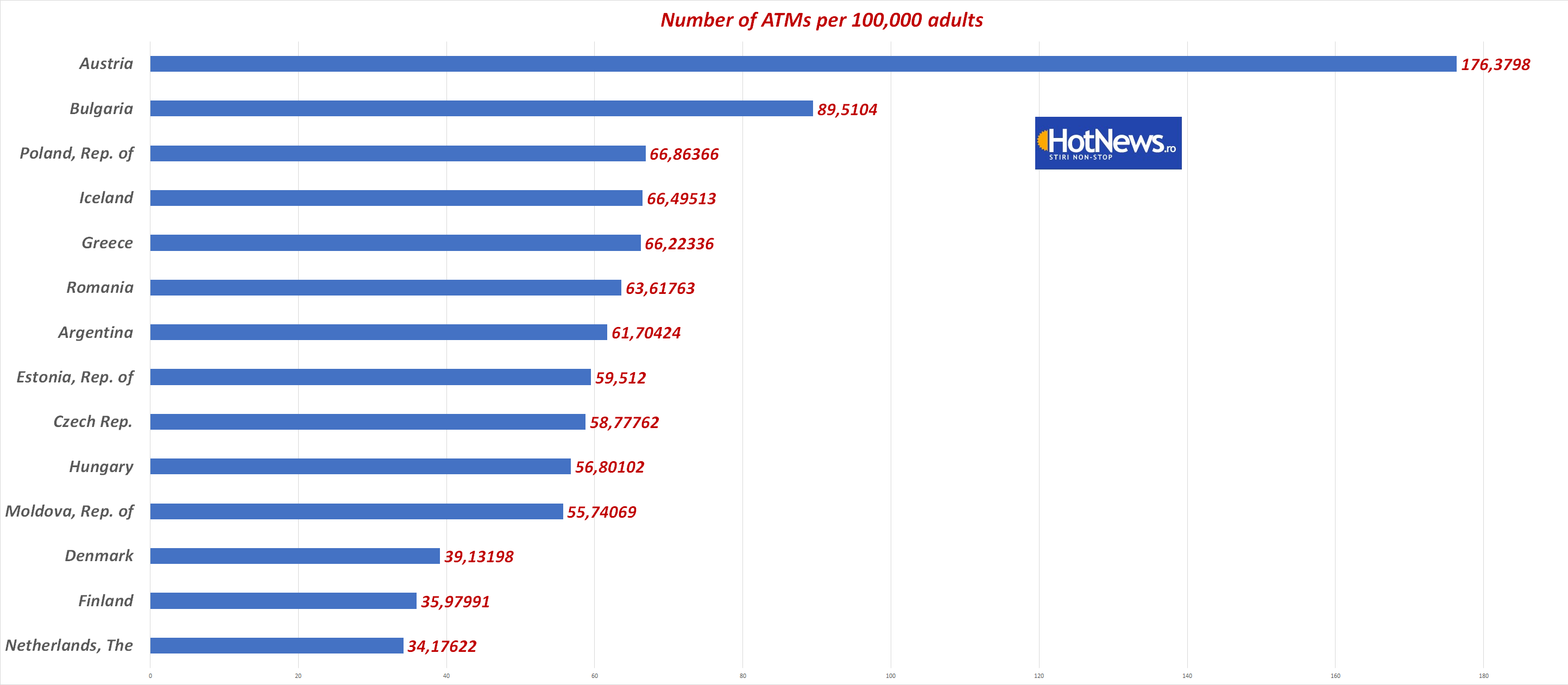

Okay, the number of bank branches has decreased, but ATMs are not all good either:

And with the number of ATMs per hundred thousand adults, we are in a situation where no expert recommends reducing cash payments. When a cash shop owner goes shopping at Metro, where does he load his card?

Below is the ATM situation/hundreds of thousands of adults in several countries around the world:

The current government wants to cap cash payments to stamp out tax evasion that has spiraled out of control, governors say. People don’t like it, merchants are also very unhappy. Complaints aside, we looked at the numbers to show that PSD intentions are coming at the worst possible time. The number of ATMs per hundred thousand adults is decreasing, the number of bank branches is decreasing, and the PSD measure masks the failure to reduce tax evasion.

What is the report of the Competition Council

- In the urban environment, one unit served approximately 4,200 customers in 2015 and currently serves 4,700 customers. The changes are much more dramatic in rural areas, where a single unit served approximately 6,100 customers in 2015 and now serves 9,000.

- In rural areas, the closure of branches and the significant increase in the number of customers that the branch has to serve make access to the banking system difficult.

- The different propensity to use new technologies in the residential environment also arises due to the different degree of availability of self-service units of the territorial network. In 2020, 79% of premises in cities were equipped with self-service points, while only 8% in rural areas.

Romanians love cash

The money stored in the mattress has risen to a record level in Romania: more than 65 billion lei at the end of this summer. Growth since the spring has been relatively strong: over 5% from the first to the second quarter.

For comparison, this amount exceeds the market capitalization of Renault, Volvo or Carrefour. Even denominated in euros, the value of liquidity outside the banking system increased 5 times: from 3 billion euros to more than 15 billion euros this summer.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.