The highest level of the price/wage ratio in the case of apartments is in Cluj county, say BNR representatives, where we are seeing the highest increase in house prices. On the other hand, the price/salary ratio has the lowest values in Giurgiu, Teleorman and Karash-Severin counties, BNR reports

Housing prices are also affected by the intensification of geopolitical tensions caused by the military conflict between Russia and Ukraine, according to the annual report of the National Bank.

In general, the residential real estate market in Romania is characterized by two things, Isarescu’s people say. The first is related to the huge discrepancies between the demand and supply of real estate in the regions of the country, and the second – to the regional concentration of mortgage loans in the context of the level of poverty in less developed regions.

Regional differences in the price-to-income ratio are determined both by the level of real estate prices and wages.

In some cities of the country, sales for the first 5 months of 2023 are falling

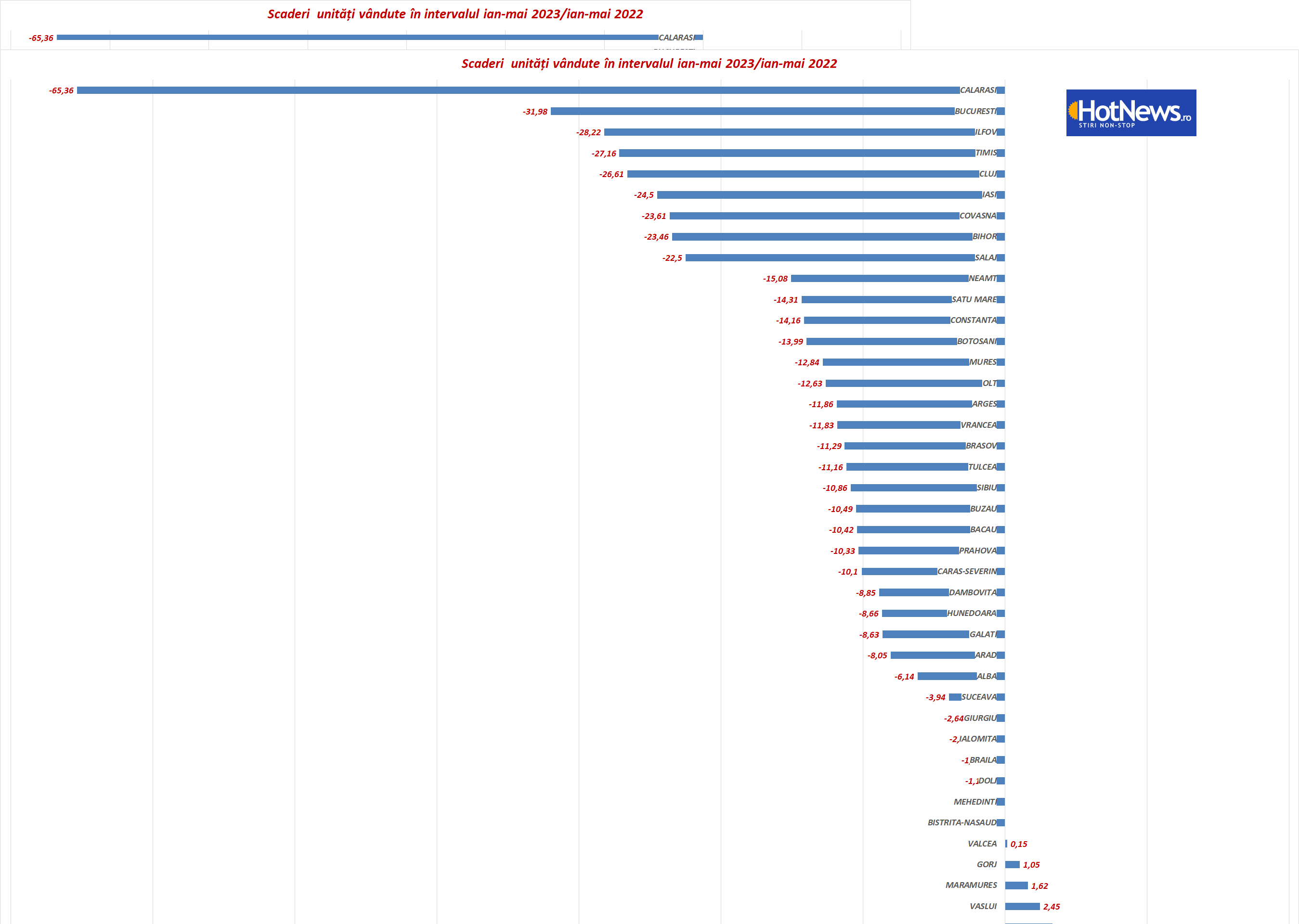

According to data from the National Agency for Cadastre and Real Estate Advertising, during the first 5 months of this year, housing sales are decreasing in most counties. The most pronounced failures are observed in Calarasi, Bucharest, Ilfov and Timisoara. In 4 districts, sales increased, albeit slightly.

Below is the diagram:

The case of Ioana and Marian Popescu

Two years after their wedding, Ioana and Marian Popescu got tired of living with their parents and decided to move into their own house. The bad thing is that their income was only enough for a modest loan, with which they could barely buy a one-room apartment.

This is because banks look at your income and give you a loan so that the bank rate does not exceed 40% of your income.

Or, if you have a net income of 3,700 lei, it is difficult to dream of a 3-room apartment, as two would like. It took them about two months to find the little room they had been dreaming of for a long time, and that’s because many real estate agents presented them with houses that were more expensive than they could afford, or some dilapidated ones that demanded thousands of euros more. become functional.

True, inflation has worsened the situation from the point of view of a potential buyer. The National Bank strengthened its main tool to fight inflation by raising the monetary policy interest rate and putting an upward trend on the market, which will be reflected in higher rates for those who already borrowed in lei with variable interest rates.

See here How affordable is a home loan? Affordability index of each county in Romania

The Bucharest-Ilfov region accumulates 35% of the total volume of loans

In terms of regional concentration of housing loans, the Bucharest-Ilfov region accumulates 35% of the total volume of loans, while the next 4 counties (Cluj, Constanta, Brasov and Timișoara) represent more than 20% (data as of December 2022).

On the contrary, the districts with the lowest share of mortgage loans, both in terms of volume and flow, are Harghita and Kovasna (0.3% of the total).

However, without resorting to bank financial support, the time required to purchase a 2-bedroom home nationally reaches 11 years, according to the latest financial stability report published by BNR.

At the county level, the degree of indebtedness ranges from 38.3 to 40.9% (data as of December 2022), maintaining an appropriate level from a prudential point of view, BNR also notes.

Conversely, the degree of coverage of loans with guarantees (loan-to-value – LTV) shows very large differences. The lowest degree of loan coverage by guarantees is registered in Bacău county, and another 9 counties record LTV levels above 80%.

Disagreements also appear regarding access to the mortgage market. Among the 5 analyzed development centers, only Timisoara and Bucharest register a value of the indicator above one.

Cluj-Napoca records the lowest availability of the mortgage lending market

Brasov and Constanta show a similar level of access to the mortgage lending market, while Cluj-Napoca registers the lowest level of access.

The increase in interest rates creates additional pressure on the solvency of borrowers, an increase in the interest rate by 4 pp. leads to a decrease in the affordability index from 1.2% to 0.86% in the case of the capital.

These factors are likely to reduce potential demand from the public and, implicitly, help to contain the rise in property prices. Banks’ vulnerability to the real estate market recorded an annual increase of 4% at the end of 2022 compared to the same period of the previous year and remained at a high level (69%).

The quality of the portfolio of mortgage loans issued to the population is not a cause for concern yet, but it is being carefully monitored. The default rate fell to 1.4% in December 2022, and key macroprudential indicators remained within appropriate limits.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.