Of the more than 8.04 million participants in pension level II, the value of assets exceeded 103.2 billion lei in the first quarter of this year, but 70% of these assets belong to only 25% of participants, while 20% of participants have less than 1,030 lei in their accounts, according to with data published on Monday by the Financial Conduct Authority (ASF).

- SEE THE PRIVATE PENSION EQUIPMENT MARKET IN THE FIRST QUARTER OF 2023

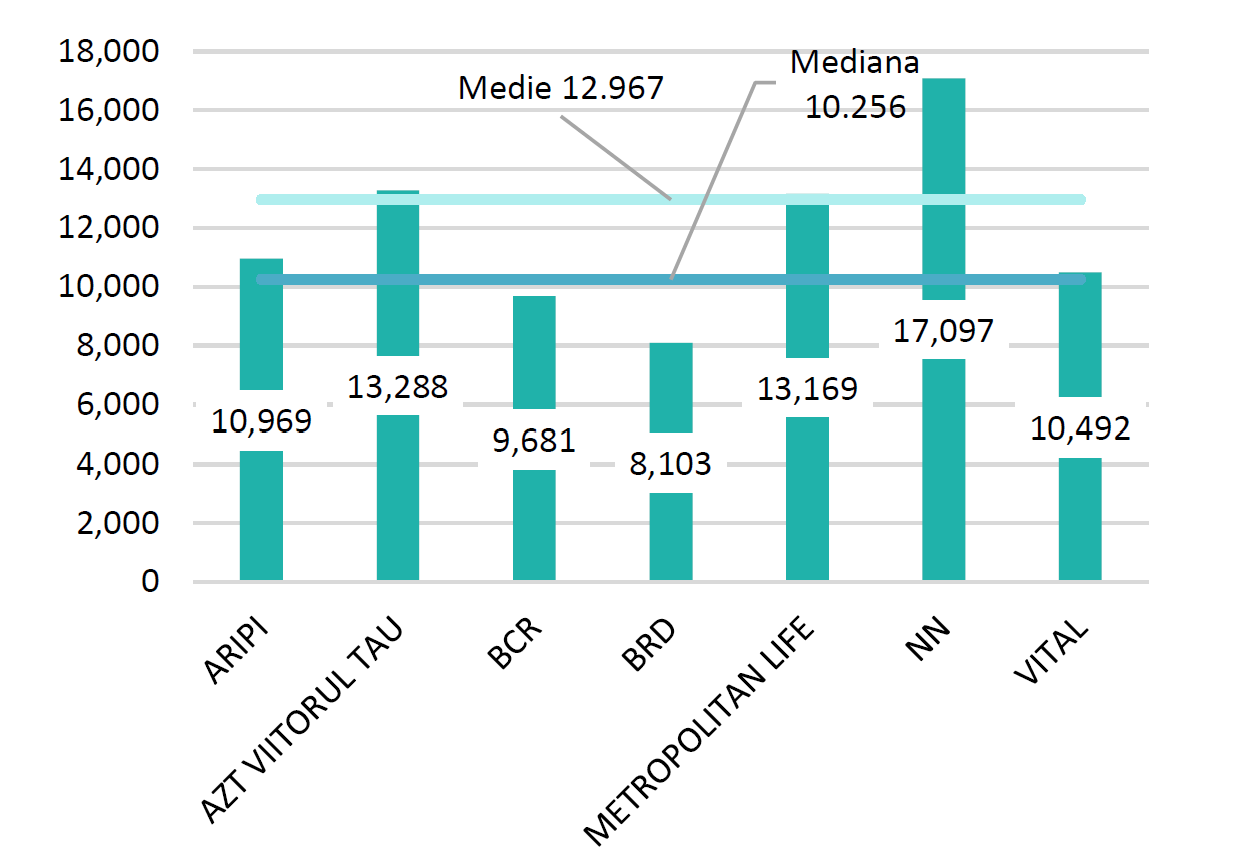

How many Romanians participate in Pillar II. The average value of the account is 12,967 lei

As of March 31, 2023, the number of participants in the private pension system (Level II) was 8.04 million people, compared to 7.96 million people at the end of the previous year.

At the end of March 2023, seven private pension fund managers managed assets worth more than 103.22 billion lei, which is about 15.46% more than the same date in 2022 and 7% more than last December.

At the end of March 2023, the average value of assets of a member of a private pension system was 12,967 lei, registering an increase of 12.39% compared to the same period of the previous year and an increase of 5.92% compared to the end of 2023. 2022 year.

The average contribution is 249 lei/month: the smallest and largest account in the second level

The distribution of the value of the participants’ accounts shows a high concentration: 70% of the assets belong to only 25% of the participants. The largest account has a value of 1.78 million lei, and the smallest – 1 lei. At the same time, 20% of participants have assets worth less than 1,030 lei.

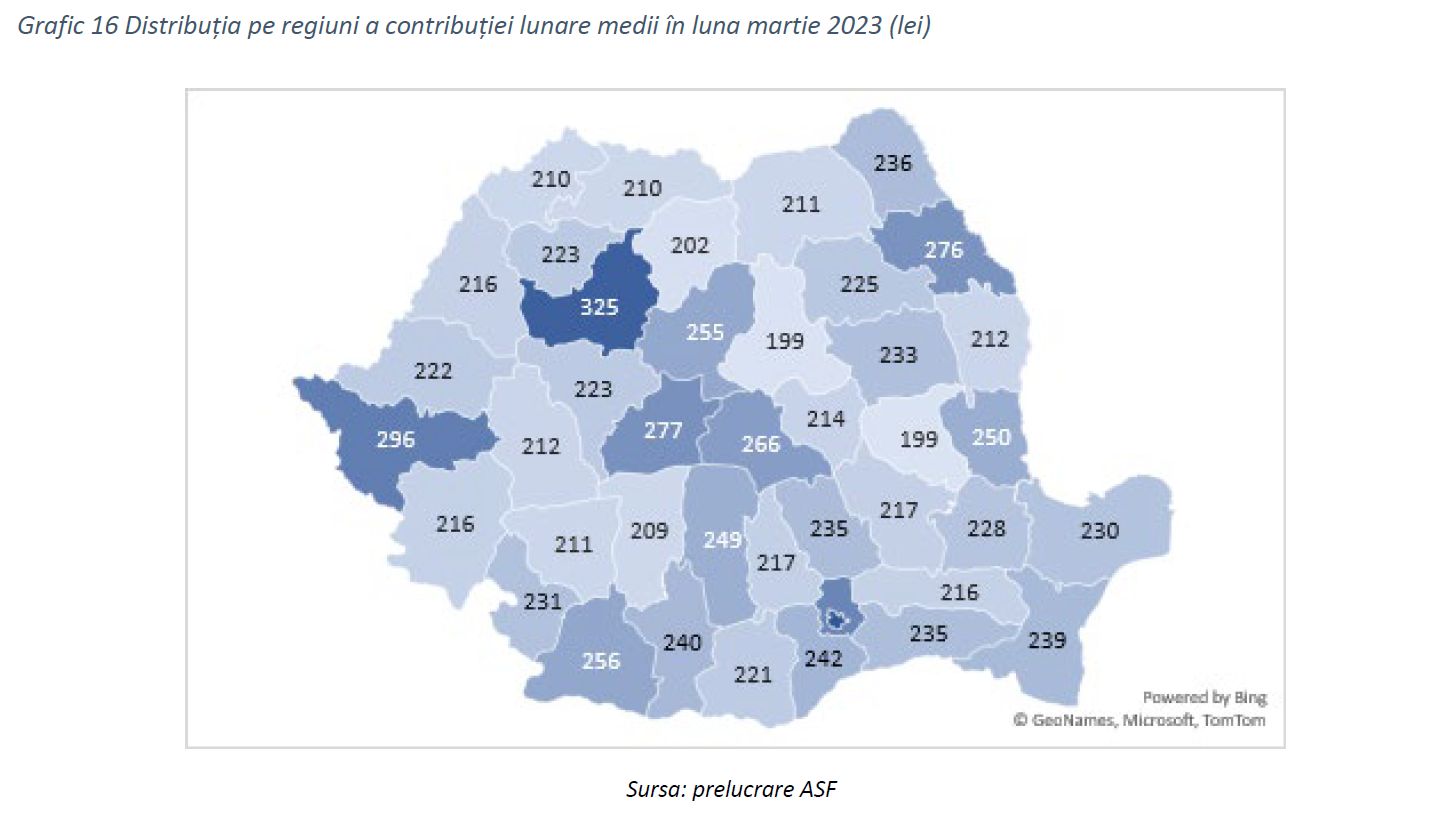

At level II, the average contribution of participants with transferred contributions in March 2023 was about 249 lei/participant, while on December 31, 2022, its value was 237 lei/participant.

In the first quarter of 2023, contributions transferred to the private pension system amounted to 3.17 billion lei, which is about 19% more than in the same period last year.

The average monthly contribution varies considerably depending on the district, the highest values being recorded in the municipality of Bucharest (336 lei/participant), Cluj (325 lei/participant), Timișoara (296 lei/participant), Ilfov (288 lei). /participant) and Sibiu (277 lei/participant).

The lowest average monthly contributions were recorded in Harghita (199 lei/member), Bistrita-Năsăud (202 lei/member) and Vranca (199 lei/member).

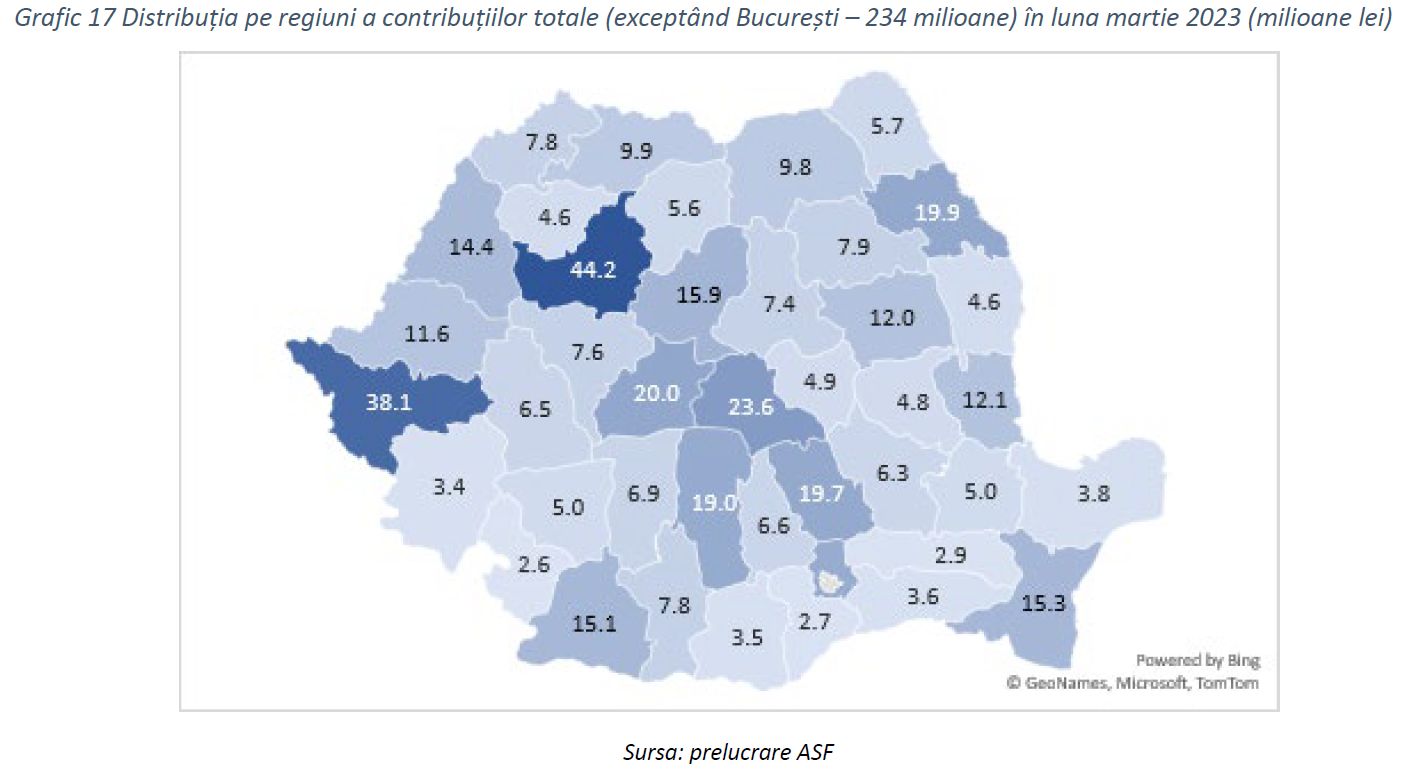

Regarding the total monthly contributions, a sharp difference between regions remains, with the municipality of Bucharest registering the highest values (244 million lei), followed by Cluj (44 million lei) and Timișoara (38 million lei). At the opposite pole is the south of the country – Teleorman, Karash-Severin, Jalomitsa, Giurgiu and Mehedinci, where the lowest values are registered (from 2.6 to 3.4 million lei).

What payments were made to the II level of pensions for the first three months

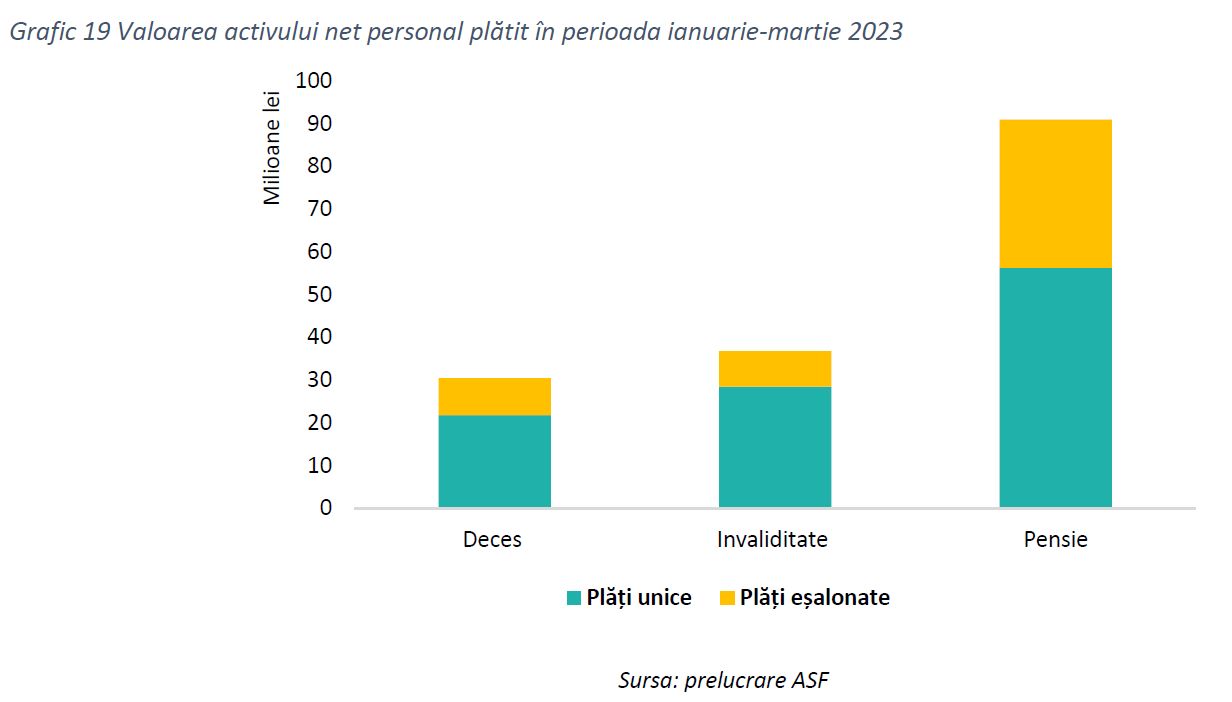

During the first quarter of 2023, net payments of personal assets amounting to approximately 158 million lei were made to 8,712 participants or beneficiaries.

Of the total amount of payments made, 57% are related to the opening of the right to a pension, 19% – as a result of the participant’s death, and 23% – in connection with disability.

In the first quarter of 2023, 67% of participants/beneficiaries preferred lump sum payments over installments as a method of paying their net personal assets.

As a result of the opening of the right to pension, one-time payments in the amount of 56.2 million lei and phased payments in the amount of approximately 34.7 million lei were made.

One-time payments in the amount of 21.8 million lei and deferred payments in the amount of 8.7 million lei were recorded to beneficiaries of net personal assets due to the participant’s death.

For disability, the amount of personal net assets paid was approximately 28.5 million lei related to lump sum payments and 8.3 million lei in the form of phased payments.

Photo source: Dreamstime.com

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.