When the 2008-2009 crisis hit, Petrutsa Constantinescu had a small boutique on the first floor of the house where she lived. Less than a year later, she was forced to close her shop as customers dwindled and the business became unprofitable. It reopened in 2018, but the pandemic again choked its business. Since then, Petrueta’s relationship with money has changed radically. Forever.

If earlier he vacationed abroad twice a year, this year he will not be able to afford even a week. Because he has nothing to do. With all the problems and financial pressure she is under, Petrutsa is afraid of going crazy one day.

But she is not an isolated case. According to data presented Monday at the BCR conference, almost 40% of survey respondents (a nationally representative sample) confirm Petrutea’s fears.

5 events that caught us in the wrong place

Over the past 100 years, 5 events took place that caught us by surprise. The Depression of 1929-1933, World War II, the Revolution of 1989, the financial crisis of 2008-2009 and more recently the Covid-19 pandemic.

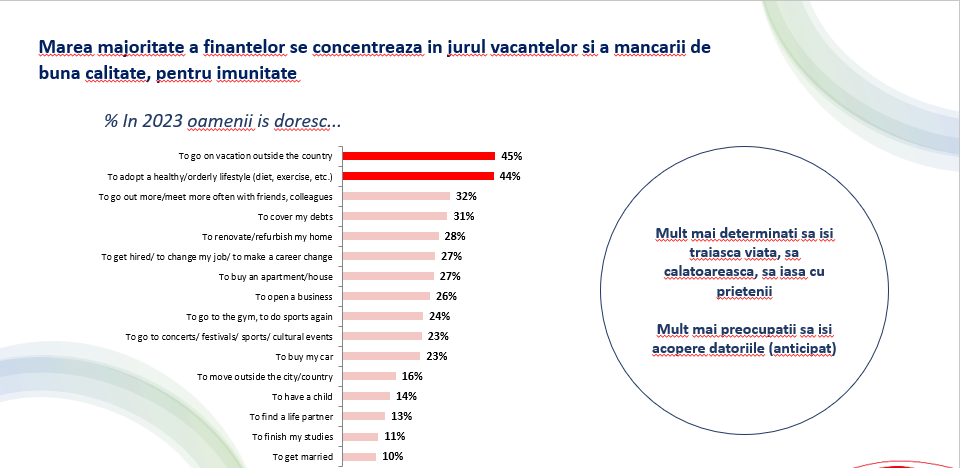

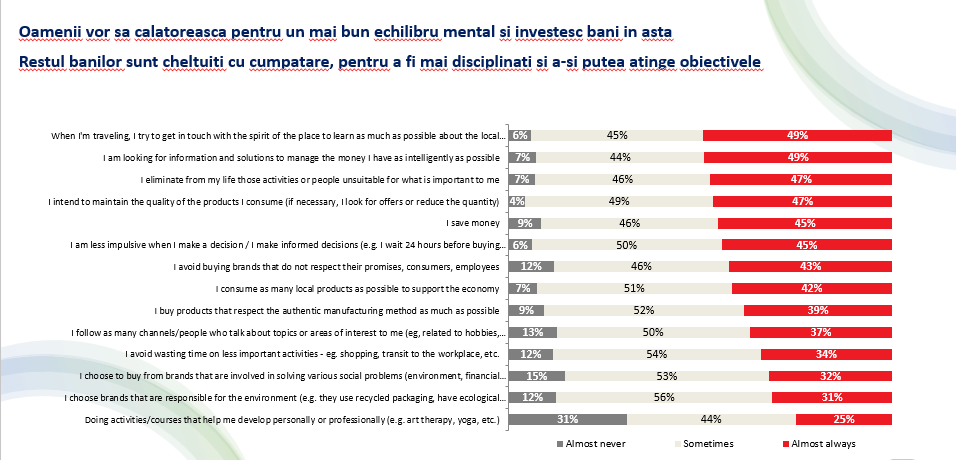

Following the last two, Romanians want to go on vacation, “wash” their brains, eat healthy and hang out with friends.

The financial crisis gave the first lesson of balance in resource management, say the authors of the survey. “The pandemic has stopped life as we knew it and forced people to take a break for introspection. Many saw this as an opportunity to start over on a personal level and realign their priorities

There are also some myths, explains Adina Vlad, managing partner of Unlock Market Research. “While saving money has never been a bad idea, some of us seem to be stuck in the mindset that only high earners can save. People should know that everyone can save, a little at a time,” the authors of the study say.

Low returns on deposits, savings practices that may be inconsistent in their social circle (especially in the case of the youngest and more consumer-oriented) or the lack of a healthy savings strategy are also real obstacles for some. There is still a need for education regarding this aspect,” says Vlad.

In loans, the problems seem to be identical

A block was detected for Romanians who want to take a loan from the bank:

- No benchmark or counseling to help them set the right rate amount/end amount/spending level to meet other life needs (but keep the debt level under best terms)

- The emotional impact of the difficulty of managing a loan tends to spill over into their social circle, thus creating an aversion to the idea of bank debt

- There is still some mistrust of the transparency of banks (the famous “provisions written in small letters”), because ultimately they are interested in making as much money as possible, and not in being a financially healthy person.

By the way, in the book “Psychology of the Romanian People” Daniel David (Rector of Babes-Boliai University) confirms these things.

“The desire to save and get things is noted by 39.4% of Romanians; the same importance is given to the Chinese (50.7%), Germans (38.1%), Japanese (47.8%), Poles (49.5%), Russians (50.3%), Spaniards (29.6% ), Turks (39.4%), Ukrainians (45.1%) and Americans (31.6%).

As for randomness, Romanians report this value significantly less often, but the frequency with which they mention it is significantly higher than in the case of Americans. According to Professor David’s work, compared to all other nine countries/cultures analyzed worldwide, Romanians are significantly less likely to mention wanting to save money and get goods.

- Most important goals overall: 57.6% of Romanians chose economic stability as the most important goal, 17.4% – the fight against crime, 14.7% – a more personal/humane society, and 8.8% – a society where ideas are more important than money. The goal related to economic stability also dominates in China (53.3%), Germany (49.5%), Russia (63.3%), Japan (59.4%), Poland (57.8% ), Spain (63.9%), Turkey (56.5%). , Ukraine (75.8%) and the USA (74.4%).

To promote the financial maturity of customers, banks participate in financial education programs. To help you save, almost all of them provide tools for customers to automatically save an amount (which you set or choose to have a percentage of the purchases you pay for transferred to a savings account using the card).

The latest initiative was organized on Monday by BCR, which met with the media to promote its financial coaching service. This is what used to be a private banker, the one who took care of your investments, only now this service is being “Uberized”. Basically, bankers talk to each client individually to help them understand the best way to use their money, depending on the client’s goals (house, car, bigger retirement, etc.).

According to bank representatives, since the beginning of the year, more than 130,000 Romanians have benefited from this experience and have been able to develop a plan for long-term financial well-being, explained Dana Dima, Vice President of Retail & Private Banking BCR, on Monday.

“We believe that the bank should no longer be a place where you only go to pay bills or deposit money into your account. But the space from which you draw ideas about how to change your life, how to make it better for you and your loved ones. We encourage a financial dialogue instead of a commercial one. We open simple and honest discussions about money with people who cross our threshold with a desire to offer concrete solutions for their life plans and goals. It’s a paradigm shift we’ve been working on for years, learning from the interactions we’ve had over the past six years with 600,000 people in the Money School program.

The platform uses data analytics and can provide concrete insight into past, present and future financial life. It was initially in a pilot phase, but in January 2022 it is 100% operational across the entire BCR network. “These are people from whom I learned, I learned what worries them, their plans and especially their goals for the future. In the near future, we intend to meet even more clients who will use the free financial coaching service,” said Dana Dima.

According to BCR representatives, people have made a number of decisions about their short-, medium- and long-term financial plans after engaging with financial coaching.

- More than half of those who used the financial coaching service decided to create an emergency fund. Others chose a regular savings product registered with the bank

- 22% of people who went through the platform wanted to grow and diversify their investments

Finally, we also say that money is a very personal and emotional topic to discuss. Talking about money can be stressful for many of us because talking about money isn’t just about how much we have left on our credit card, but also about the effects (positive or negative depending on our financial situation) on our marriages, social relationships, etc.

Culturally, we are more comfortable talking about health, work, and social life than discussing how much money we have and how we spend it.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.