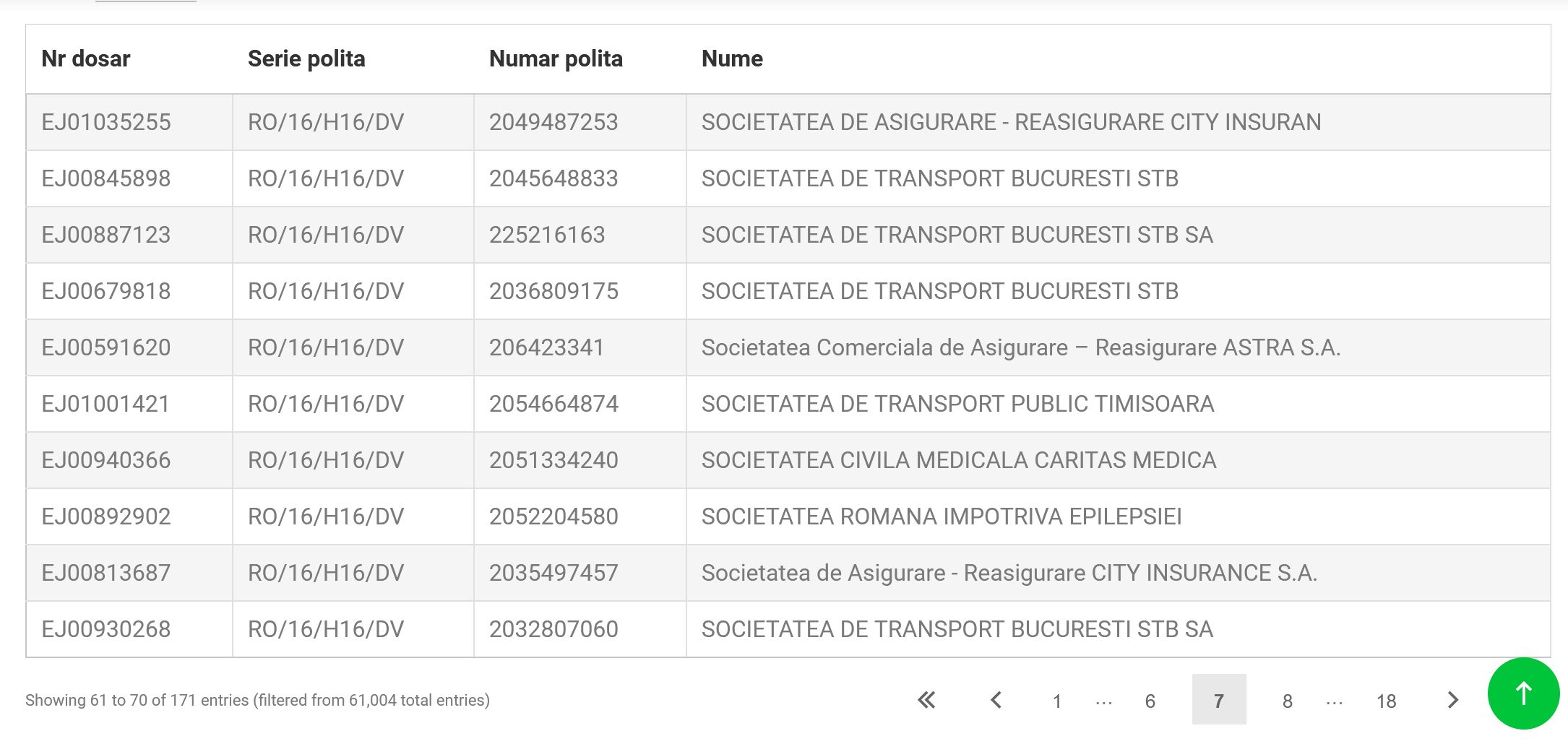

The Insurers’ Guarantee Fund (FGA) published on Thursday a list of potential creditors of Euroins, it refers to more than 61,000 unpaid files by the insurer, including ministries, the Senate, the General Secretariat of the Government, state-owned companies such as Nuclearelectrica, as well as the former bankrupt leaders of RCA Astra and City Insurance.

The FGA has published a list of potential insurance creditors whose claims stem from records submitted by Euroins.

The fund says it has received 61,004 unpaid files from the insurer, as well as a number of 3,950,240 insurance policies, both RCA – 2,782,279 and non-RCA – 1,167,961.

All these potential creditors must now submit payment claims to the FGA, which by law can pay a maximum of 500,000 lei for each insurance claim owed under an insurance contract with an insolvent insurer.

The list of those who have money for restoration includes such ministries as: the Ministry of Internal Affairs, energy, transport, health care, finance, MIPE.

Other unpaid files concern state-owned companies such as Nuclearelectrica, STB, as well as former leaders of the bankrupt RCA, City Insurance and Astra Asigurări.

In the case of insolvent insurers, claims for payment will, in theory, be made by their liquidators or other representatives, if they exist.

Approving or, as the case may be, rejecting the amounts claimed by applicants is the responsibility of the FGA Special Commission.

According to Article 14 of the updated Law 213/2015, any person who makes an insurance claim against an insolvent insurer may submit a reasoned claim for payment addressed to the Fund under the conditions provided for in Art. 121 and par. (4), but no later than 90 days from the date of the final suspension of the decision to open bankruptcy proceedings or from the date of the right of claim, if it arose later, under the threat of confiscation.

Proceedings in the bankruptcy case have not been opened in court, therefore the deadline for submitting claims for payment is not counted.

Payment request forms are available online:

- Appendix 9 – return of the premium: Payment claim for the return of the premium.

- Appendix 10 – Application for compensation: Application for payment of compensation/assistance

The status of payment requests can be tracked online on the FGA website.

First payments in Euroins bankruptcy: more than 650,000 lei in the accounts of some customers who terminated their contracts

The Insurance Guarantee Fund (FGA) announced on May 17 that it had approved the first tranche of more than 1,000 payment requests aimed at refunding premiums for some policyholders who terminated their insurance contracts with the former RCA chief executive.

The first payments amount to 658,562 lei.

Insurance indemnity payments will continue as the FGA will analyze and approve the payment claims of Euroins SA’s insurance creditors registered with the Fund, in parallel with the approval/payment activities of the payment claims registered for other insolvent insurers.

FGA analyzes payment requests in the following categories:

- payment claims based on material damage claim files opened by FGA or Euroins SA;

- prize refund requests;

- claims for payment made for personal injury or death;

- payment claims made on the basis of final court decisions.

Over 71,000 payment requests, of which only 38,000 are officially registered

By 16 May 2023, the FGA had received 71,774 payment requests for Euroins SA. Of them, the Fund registered: 38,492.

Compensation is paid within 500,000 lei for each insurance claim payable under an insurance contract concluded with an insolvent insurer, in accordance with the upper limit of the guarantee regulated by Law no. 213/2015 updated.

According to Article 13(4) of Law 213/2015: “Approving or, depending on the circumstances, rejecting the amounts claimed by the applicants is the competence of the Special Commission of the FGA.”

Any person who asserts the right to an insurance claim against an insolvent insurer may submit a reasoned claim for payment to the Fund, but no later than 90 days from the date of entry into force of the decision to open bankruptcy proceedings or from the date of birth of the insurer. the right to claim when it was born later, on pain of losing the right.

- Read also: Money for payment of RCA lawsuits in the event of Euroins bankruptcy: What special contribution will insurers pay from June 1

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.