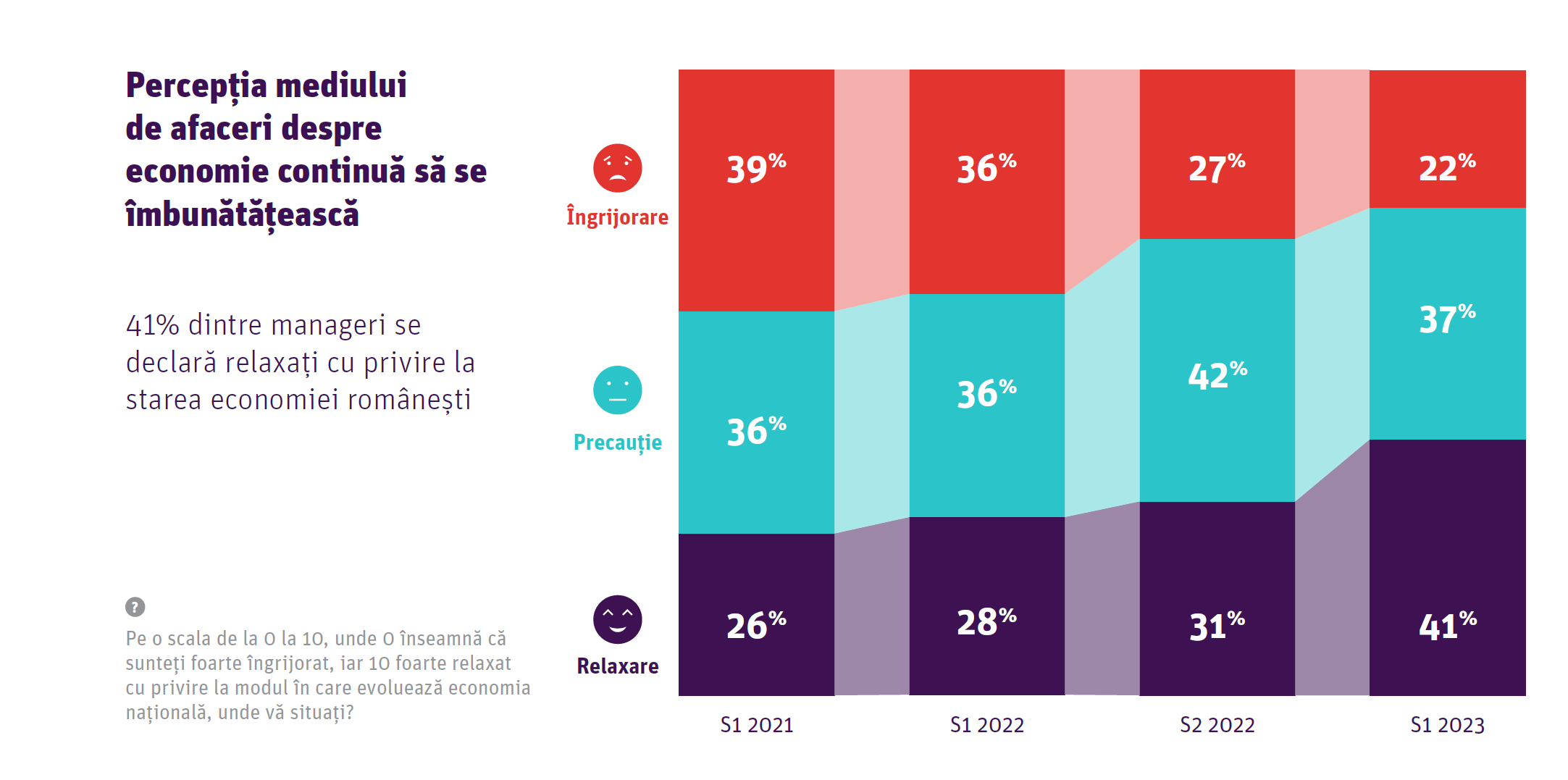

After the pandemic, the conflict in Ukraine, the energy and commodity crisis, although there is still a lot of uncertainty in the economy, managers are declaring themselves more and more optimistic and calm, which is a sign of maturity and lessons learned from the experience of the last 3 years.

“For the first time since we measure this index of confidence of businessmen in the economy – the Confidex index -; its value has increased to 50.2, which indicates optimism,” Impetum Group founder and CEO Andriy Chonka said on Tuesday, presenting the results of a survey of confidence in the economy in the first semester and their expectations for the end of the year. year.

At first glance, the results of the study may seem illogical. We continue to live in a period of high political, social and economic uncertainty. In addition, Romania’s main economic partners are also going through a tough time – but Romanian business people seem to say that the worst is behind them and times on the horizon now seem rosier than last year.

“Last year, we talked to entrepreneurs who told us that uncertainty was high, that they (then) did not know how the winter would pass, how energy prices would be set, how much more inflation would rise, etc. Our group has more than 60 companies – industry, agriculture, IT – and we are very connected to the real economy. I can tell you that we have a mature optimism, from my point of view, this is very good for the economy because, again, even if today’s situation does not match that mood, we can influence it by being optimistic; we spend more, we invest more…” – says Andrii Chonka.

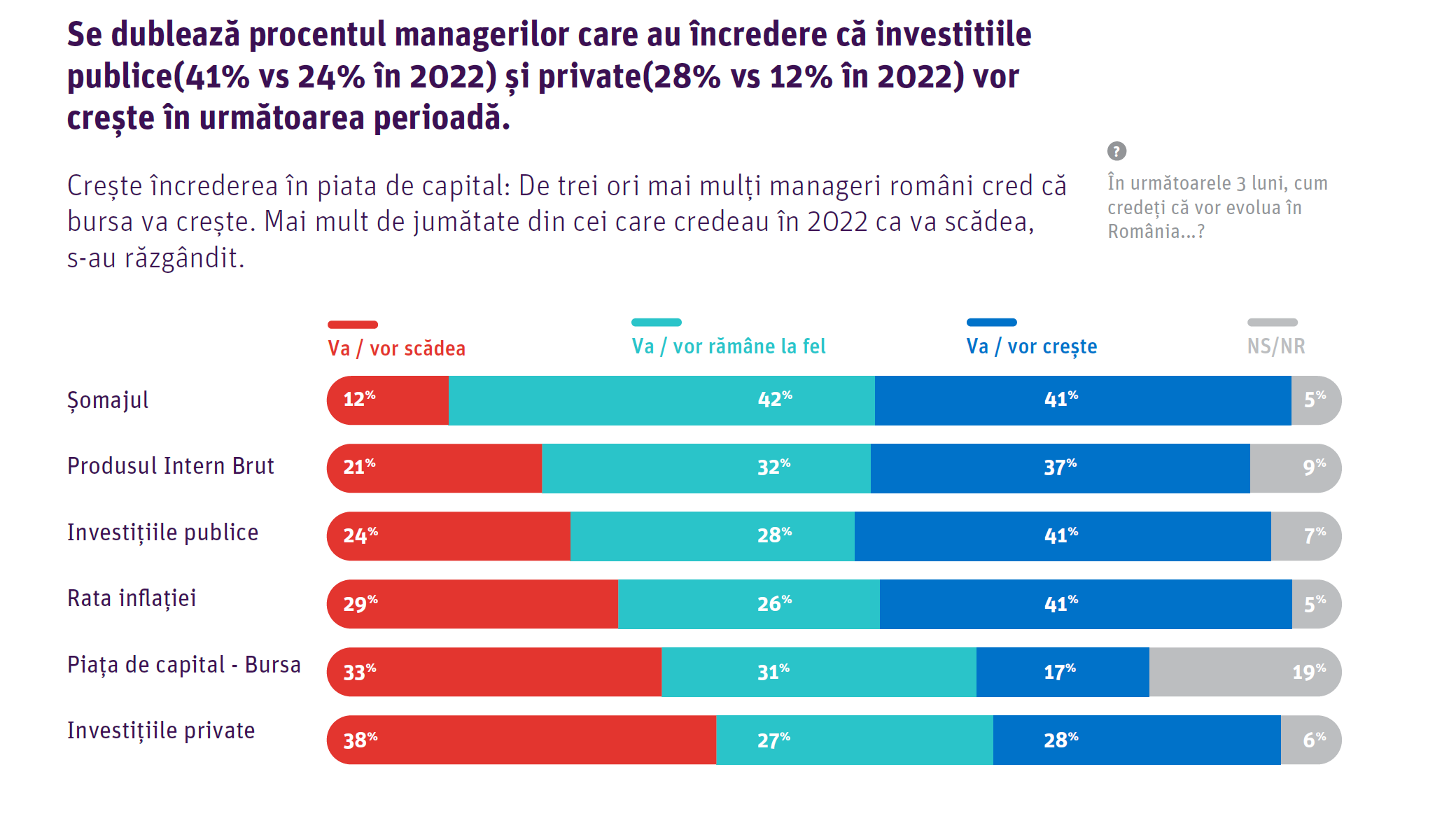

We have a large number of executives who believe that inflation will rise – 41%, for example. Instead, we are pleased with the dynamics, because in the second half of 2022 we had more than 60% who believed that the inflation rate would rise, the CEO of Impetum also explained on Tuesday.

State investments will increase. Private investment as well. We have many more respondents who say they will increase. We had 12% of executives who at the end of last year believed that private investment would increase. Now we have 28% of those who believe in it, says Chonka.

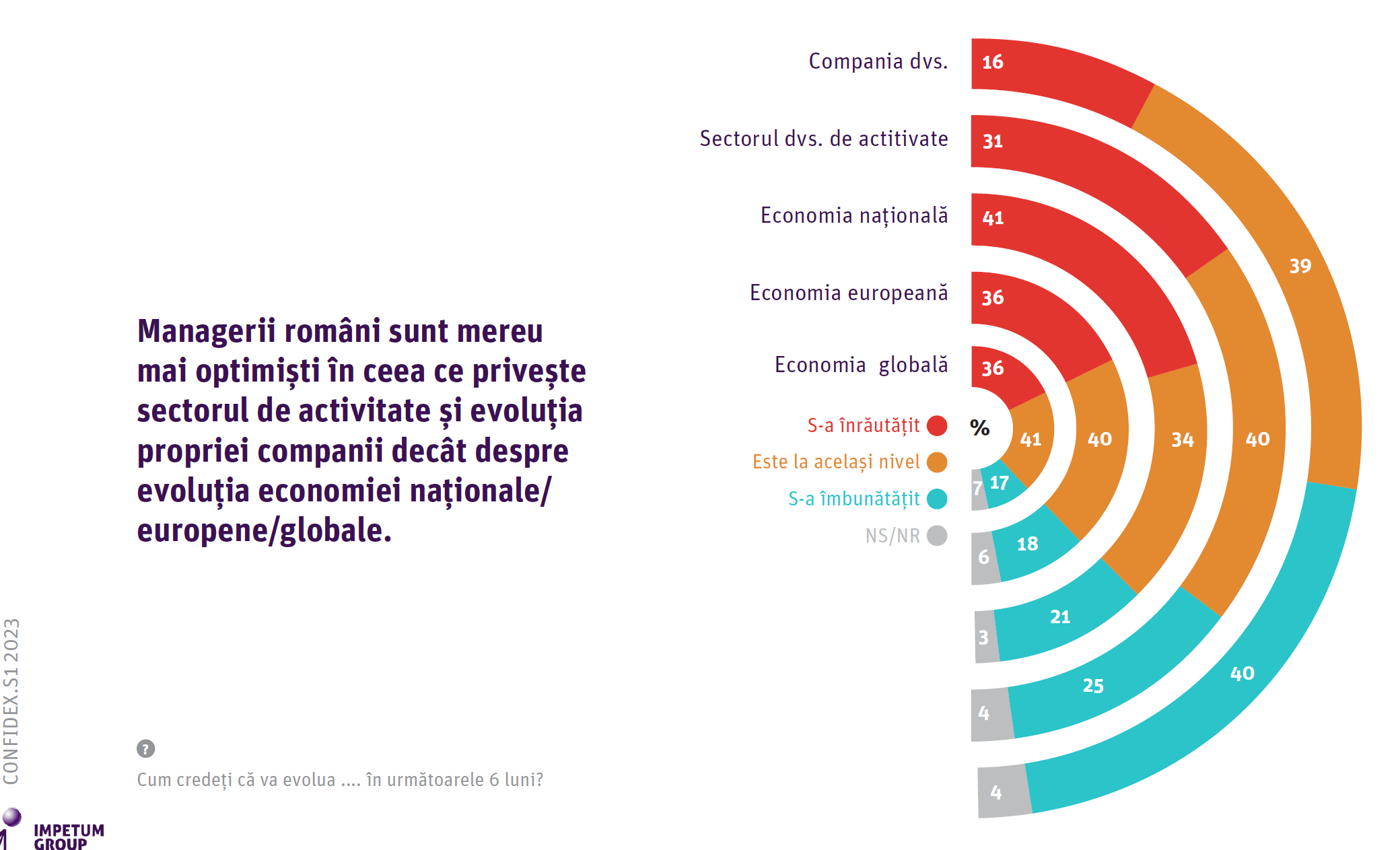

Managers of large companies are much more optimistic than managers of medium and small companies

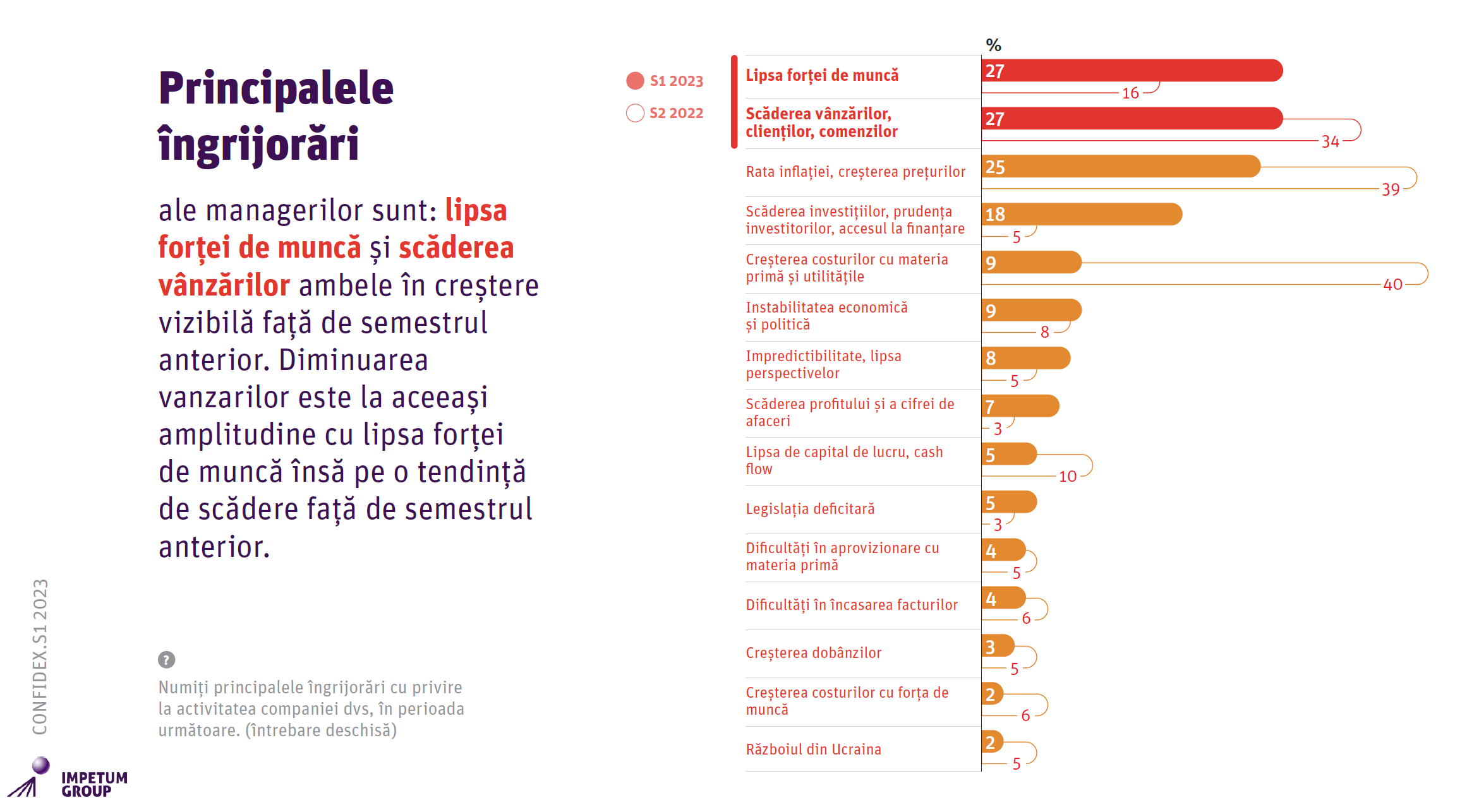

Executives are also concerned about labor shortages, which suggest they need to hire agriculture amid increased orders. And the poor results of work in agriculture are largely due to the situation in Ukraine, the cheap grain that left there and which greatly reduced the price on the market.

More than 57% of executives see a significant downturn in the real estate sector as likely or very likely. Energy crisis, raw material crisis, we see that the intensity of manufactured concerns is decreasing. In addition, only 6% still believe that a food crisis could follow.

“A very important positive signal is that our managers’ export orientation is growing,” Andriy Chonka also says.

Where does optimism come from?

The optimism of managers is based on the stability and maturity that have emerged in recent years:

managers are concerned about what is happening today, but they are optimistic about the future and are more confident in their own abilities. For the first time, CONFIDEX emphasizes the orientation of Romanian managers towards exports and foreign markets.

Confidence in the capital market is also growing: three times as many Romanian managers believe that the stock market will grow. More than half of those who thought in 2022 that it would decrease have changed their minds.

In the next period, twice as many executives expect to see an increase in public (41% vs. 24% of executives in 2022) and private (28% vs. 12% of executives in 2022) investments. At the same time, only 21% of executives (versus 43% in 2022) I still believe that GDP will decrease.

What worries Romanian managers?

The CONFIDEX study also sheds light on some indicators of recession risk. On average, the turnover of CONFIDEX respondents has grown below the rate of inflation and is still expected to grow below the rate of inflation. Moreover, the company’s profits have been developing negatively for the 3 years since Impetum Group has managed CONFIDEX.

Access to credit and the working capital situation are deteriorating for about a third of managers, and M&A transactions have stagnated over the period.

About three-quarters of managers believe that a labor crisis is more likely than rising inflation (62% of managers), and the potential for an energy crisis (as seen by 48% of managers) outweighs the potential for a financial crisis (60% of managers) or real estate (57% of managers).

“The labor crisis comes from two areas: we have an acute shortage of skilled labor and we have jobs that Romanians don’t want and no one can do. These two crises are intersecting, as they did many years ago in the West, and are putting pressure on Romanian managers.

The primary need of the Romanian business environment is real support from the authorities to solve this labor crisis. We can do this both with domestic resources, increasing the percentage of the population working in the labor sector to reach the European average (69% Romania vs. 75% EU) and by relaxing immigration procedures for professions that are not attractive to Romanians (from 100,000 work permits annually to at least 300,000)”. concluded Andrii Chonka, CEO of Impetum Group.

See the results of the Confidex study here

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.