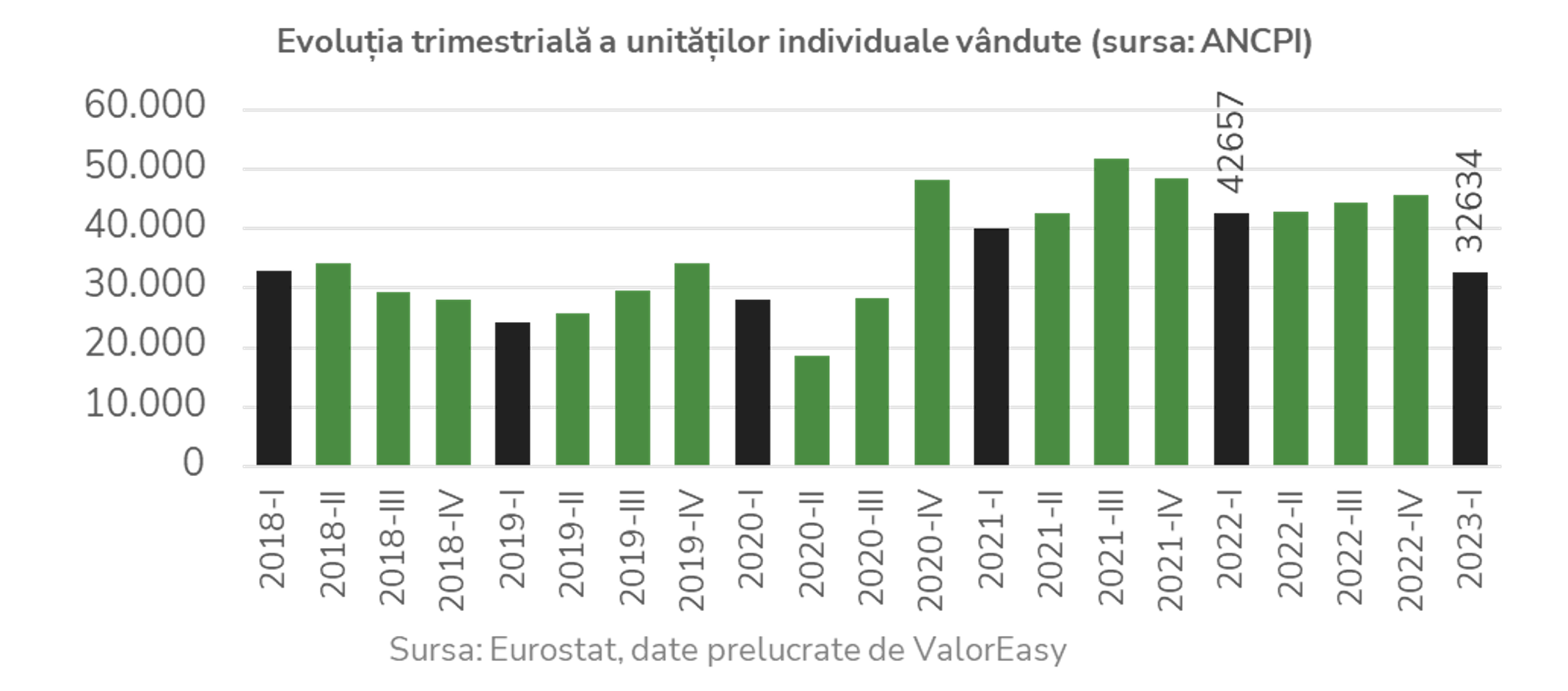

According to data published by the National Agency for Cadastre and Real Estate Promotion (ANCPI), approximately 33,000 individual units were sold in Romania in the first quarter of 2023. The volume of sold units is 10,000 less than in the same period of 2022, having decreased by 23%. This is the lowest quarterly trading volume since 2021.

Thus, the downward trend of transactions observed since the second half of last year is highlighted (in Romania, in the 4th quarter of 2022, 6% less real estate was sold compared to the 4th quarter of 2021)

At the local level, the demand adjustment for the first three months of 2023 compared to the previous year indicates a decrease in 35 counties, including the municipality of Bucharest, and an increase in 7 counties. The largest decrease in the number of units sold was recorded in Ault County, -71% (62 units sold). The highest percentage of units sold was recorded in Alba County, +51% (342 units sold).

Bucharest remains the center of gravity of the real estate market in Romania

Here we find the largest housing stock, the most units for sale and the most apartments and houses being built. In Bucharest, over 10,100 individual units were sold in the first quarter, down 22% year-on-year. The next counties in terms of sales share are Brasov (2,200 units), Timișoara (2,000 units) and Cluj (1,800 units).

In the first quarter of 2023, transactions in Cluj reached the lowest level in the last 7 years

Current market conditions demonstrate quite clearly the fact that the intention to buy in Cluj has fallen to its lowest level in recent years. According to Google data, search interest in Cluj County is 35% lower than at the beginning of 2022 and 45% lower than the level reached in 2021, the year with the most shopping activity. According to data published by the ANCPI, in the first quarter of 2023, 1,832 units were sold in Cluj County. The volume of sold units is 1,025 less than in the same period of 2022, having decreased by 36%. Comparing historical data published by ANCPI, we found that the beginning of 2023 saw the lowest number of individual units sold in the last 7 years.

The decrease in potential demand in the market with the lowest availability in Romania is not considered a surprise by most experts. According to ValorEasy, Cluj-Napoca has the largest difference between the growth rate of real estate prices and the growth rate of household incomes. Prices in Cluj-Napoca increased by more than 90% between 2015 and 2022, double the national average and outpacing wage growth over the same period. According to the National Bank of Romania, in Cluj-Napoca it takes approximately 11 years to buy a 55 square meter house (without financing), and 7.5 years in Bucharest.

After record deliveries in 2022, the new housing market faced major challenges

Nationally, 2022 was a year of record deliveries, with more than 73,000 new homes, up 3% from 2021, according to the INS. In Bucharest and Ilfov County, the number of houses completed last year was 21,000, which is 3% below the level of 2021.

The total floor area of homes completed in 2021 was approximately 2.4 million square meters, up from 2.2 million square meters in 2020. For the Bucharest Ilfov metropolitan region, this is a good signal if appropriate measures are taken to reduce the additional burden on road infrastructure, public services and education.

According to the INS, the housing stock of Bucharest mainly consists of old apartments. Out of a total of one million existing houses, only 130,000 were built after 1989. The share of houses built after 1989 shows a significant difference between the capital (13%) and Ilfov County (46%), so there is a great appetite for expanding the housing stock in neighboring cities.

An annual decrease in the number of leased dwellings in 2022 was also recorded in the Western region (Timiş), -11%, and the North-Eastern region (Iasi), -5%. Regions where significantly more houses were rented were the North-West (Cluj), +14%, South-East (Constanța), +20%, South-West Oltenia, +14%.

With increased supply, circumstances are now unfavorable for developers. Sales are low in all price ranges, and the majority of sales reported are homes that were pre-contract, in the early stages of permitting and construction. Several residential projects scheduled to be handed over this year will be handed over late.

A decrease in affordability (due to successive price increases and an increase in the VAT rate to 19% for houses costing 600,000 lei), an increase in interest on mortgage loans (according to the BNR, in the first quarter of 2023, the balance of housing loans decreased by almost one billion lei compared to the previous quarter) and the long term of delivery of new buildings are the biggest obstacles that prevent consumers from making a purchase at this time in a residential project.

The owners do not want to adjust the price yet

Median home sales prices stabilized in the first quarter of 2023, in line with events in the final months of the previous year, according to data compiled by ValorEasy. In Cluj-Napoca at the beginning of last year, 28% of owners reduced the prices asked for the sale of apartments. Instead, in the first 3 months of 2023, the number of those willing to negotiate increased to 35% of the total number of offers.

What are the main reasons why selling and trading prices have not undergone major adjustments? Our answer: Most sales are self-directed (in this segment, demand is not affected by rising mortgage interest rates) and sellers are not forced to undersell. Romania has the highest level of property ownership in the European Union, so sellers of this property prefer to wait or rent a property.

According to Eurostat, in the period from October to December 2022, the annual growth rate at the EU level reached 3.5% against 7.3% in the previous quarter. In Romania, the annual growth rate reached 6.8%, down slightly from 7% in the third quarter. Existing home prices rose 3.9% year over year and new home prices rose 12.8%, compared to 15.4% in the previous quarter.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.