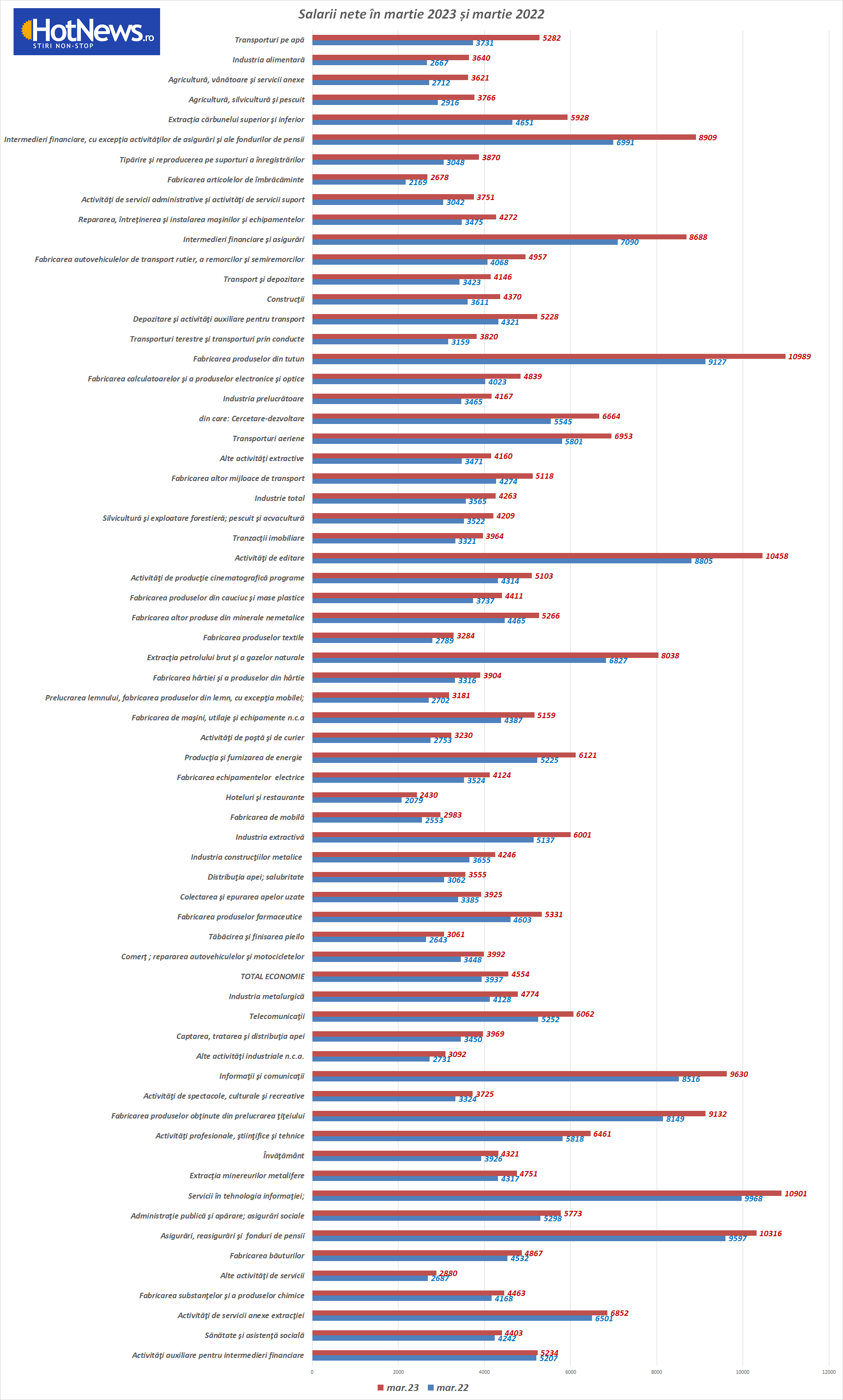

Maritime workers (passenger and cargo) and food processing workers received the largest net pay increases in March, the month that also includes Easter, a holiday that comes with a rule and additional bonuses, INS data showed.

Wages of all employees increased in March, but at very different rates. The smallest increase was seen in real estate transactions, where taxes were only 0.5% higher than in March 2022, causing their purchasing power to fall the most.

At the opposite pole, the wages of workers in the shipping, food industry and agriculture have increased by more than 33% over the past year.

- In March 2023, the average net salary was 4,554 lei, an increase of 284 lei (+6.7%) compared to February 2023.

The highest values of net wages were recorded in the production of tobacco products (10,989 lei), and the lowest – in hotels and restaurants (2,430 lei).

In the budgetary sphere in March 2023, the average net salary increased compared to the previous month in education (+6.8%), public administration (+3.1%), respectively in health care and social assistance (+1.8%) ), mainly as a result of issuing vouchers (vacation vouchers).

With wages rising all over the world, the pressure on employers to “cover” the inflationary costs of workers is enormous

In the US, everyone is watching how Walmart, the largest private employer in the US, pays. He raised the minimum wage to $14 an hour, effectively setting a new wage in many US states.

On the other side of the Atlantic, in Great Britain, wage growth in the private sector was around 7%, and in the public sector – 5.3%. In Hungary and Poland, wage growth reached double digits.

Even in Japan, where many people haven’t seen a pay rise in years, big employers are looking to change their pay structure to keep more money in their hands.

But this pressure on wages is causing headaches for central banks, which are struggling to reduce inflation, largely driven by wage inflation.

“Even after the energy pressure and the pandemic subside. . . Wage inflation will be the main driver of price inflation over the next few years,” warned Philip Lane, chief economist at the European Central Bank.

Central banks have yet to face the US “price-wage spiral” of the 1970s, which was “unraveled” by then-Fed Chairman Paul Volcker, but at the cost of a deep recession.

“We don’t see yet [o spirală salariu-prețuri]. But the thing is. . . as soon as you see that, you’ve got a big problem,” US Federal Reserve Chairman Jay Powell told reporters after the Fed’s latest rate hike, adding: “We can’t let that happen.”

The big unknown now is whether labor markets will slow enough to slow wage growth, or whether central banks will feel the need to raise interest rates further and keep them high for longer to cause job losses and financial pain, the FT writes.

The latest data from France, Germany and Spain also point to continued inflationary pressures in the eurozone. Wage growth was surprisingly weak in 2022, but is expected to pick up this year as unions renegotiate multi-year industry agreements covering large parts of the workforce in some countries.

Christine Lagarde, president of the ECB, said last week that the central bank was “looking at wages and very, very carefully negotiating wages.” Isabelle Schnabel, a member of the executive board, warned that likely wage increases of 4 to 5 percent in the coming years were “too high to meet our inflation target of 2 percent.”

However, in all countries there is growing tension between central banks, concerned about inflation, and governments, which want to protect the living standards of their constituents and avoid any social conflicts.

In Europe, many governments have tried to address this by raising the minimum wage. In 2022, the minimum wage in the EU increased by an average of 12%, which is twice the rate of the previous year. This was partly due to the recovery in Eastern and Central European countries, but the minimum wage threshold increased by 22% in Germany, 12% in the Netherlands and by about 5-8% in the rest of the bloc.

Both France and Germany have also offered tax breaks that encourage companies to offset below-inflation wage increases by offering bonuses.

Taming Inflation: Whose Job Is It?

Some argue that wages must rise to protect living standards. But this could only happen if companies agreed to soften the inflationary shock by accepting lower profits – which is unlikely.

Increasing interest rates remains the standard recipe for combating these pressures, at the cost of slowing economic growth.

Olivier Blanchard, the IMF’s former chief economist, argued that the solution to the price and wage problem should be decided between the government, companies and workers, but in practice, Blanchard notes, central banks are almost always left to resolve the conflict. “One can dream of negotiations between employees, companies and the state. . Unfortunately, that requires more trust, and it just doesn’t happen.”

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.