The price of compulsory insurance for type A buildings, the most resilient, will increase to 130 lei per year compared to 100 lei per year at the moment, while the maximum compensation in the event of a disaster caused by an earthquake, flood or landslide remains the same at 20,000 euros , the law was adopted on Wednesday in the parliament.

The plenary session of the Chamber of Deputies, the decision-making body, adopted on Wednesday with 169 votes “for”, 62 “against” and 12 abstentions, amendments to the law on mandatory housing insurance (PAD) in case of natural disasters: earthquake, landslides. and floods.

- SEE THE CORRECTED REPORT HERE

One of the changes is aimed at increasing the cost of compulsory insurance of type A buildings, the most durable, from the current 100 lei/year to 130 lei/year. For adobe houses, the price of compulsory insurance remains unchanged – 50 lei per year.

The law will now be forwarded to the president for promulgation.

The price increase will affect Romanians who have credit and live in cities

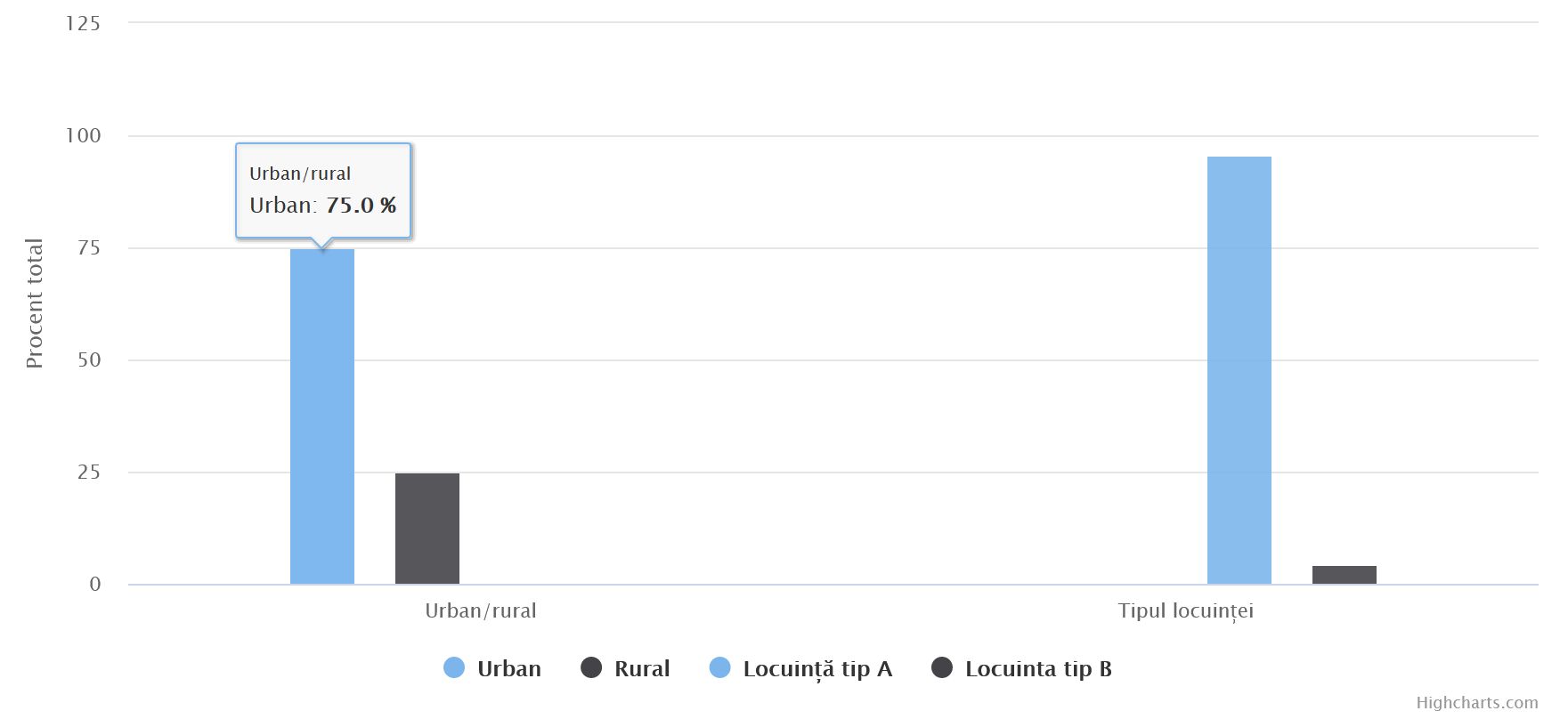

There are currently more than 1.98 million PAD-insured homes against the three natural disaster risks, three-quarters of which are in urban environments. 96% of all compulsorily insured buildings belong to type A.

- Housing type A it is a structure with a strong structure of reinforced concrete, metal or wood or with external walls of stone, burnt brick, wood or any other materials obtained as a result of heat treatment and/or chemicals.

- Currently, it costs €20/year to insure such a home, and the maximum compensation you can receive in the event of a disaster is €20,000.

Insurers cannot take out optional home insurance without first taking out compulsory insurance, so everyone with bank mortgage loans will have to pay a higher total amount of home insurance after this bill is passed.

Who and why proposed changes in the parliament at the last moment

An amendment was recently proposed by the Pool of Insurance Against Natural Disasters (PAID), the insurance company that manages the compulsory home insurance system, to the 2020 bill, which was debated on Tuesday in the Economic Policy Committee of the Chamber of Deputies.

PAID representatives claim that 130 lei remains a modest premium.

The amendment passed by the Financial Supervisory Authority (ASF) was accepted and today the bill was included in the agenda of the plenary session of the Chamber of Deputies, the decision-making body. If passed, the bill will be sent to the president for promulgation.

What motivated the increase in the cost of insurance

The authors of the amendment motivated the increase in the price of mandatory home insurance as follows:

- the increase in reinsurance costs against the background of the growth of global demand for reinsurance in the current conditions of the production of natural disasters at the international level:

- inflationary pressure on the cost of construction materials, which are taken into account when evaluating compensations provided under the PAD

- the fact that since the law was issued (2008) and until now, premiums have not been updated, and the company has absorbed inflation of more than 55%

Why the risk of the storm has decreased: “Slight”

It should be noted that the bill passed by the Senate provided that mandatory home insurance should also cover storm risk, in addition to earthquakes, landslides and floods.

Yesterday, in the Economic Policy Committee of the Chamber of Deputies, this provision was canceled on the grounds that this risk would not be significant.

Here is the rationale:

- “It is proposed to eliminate the risk of storms, given the fact that this risk is not significant for the entire surface of Romania, and there are no studies on the probability of their occurrence.

- It should also be taken into account that the insurance of this risk and the payment of an additional premium by the owners cannot be imposed, if not all residential structures are exposed to this risk.

- Severity at the level of secondary legislation would only be necessary in the event of a storm risk. By removing this risk from the offer, we believe that the current operation of the PAID compensation process provides greater benefit to the consumer,” the report said.

Only one in five houses is insured against earthquakes: how many Romanians insure their houses voluntarily, and how many are forced by bank loans

Thanks to a mandatory law that is not even enforced by the state, Romanians have insured only 1 in 5 houses nationally against earthquakes, floods and landslides, and official figures obtained by HotNews.ro show that things would be worse if some were not forced to take out this insurance when they bought a house with a bank loan.

Homeowners in Romania are required by law to insure their homes against the three risks of natural disasters – earthquakes, floods and landslides (not PAD insurance), but only 1.85 million homes were insured at the end of last month, equivalent to only 20% of residential foundation in Romania.

Not only the population and companies are obliged by law to insure their homes against earthquakes, floods and landslides, but also municipalities that own social or service housing, and official data presented by HotNews.ro show that no state does what is required by law.

It is not surprising, given that fines should be issued by mayors, but in 13 years no local elected official has imposed any fines on citizens in order not to upset the voters.

Only 70% of DPA insurances are issued voluntarily. The rest are related to bank loans

By law, insurance companies cannot voluntarily insure a home that does not have mandatory PAD insurance.

Also, when you decide to buy a house with a mortgage, the bank requires you to insure the property up to its market value, so you pay the mandatory PAD insurance (which covers losses of up to €20,000 caused by three perils). natural disasters), and you will additionally take out a home insurance policy (which will also cover other risks, for example, fire or flooding from neighbors).

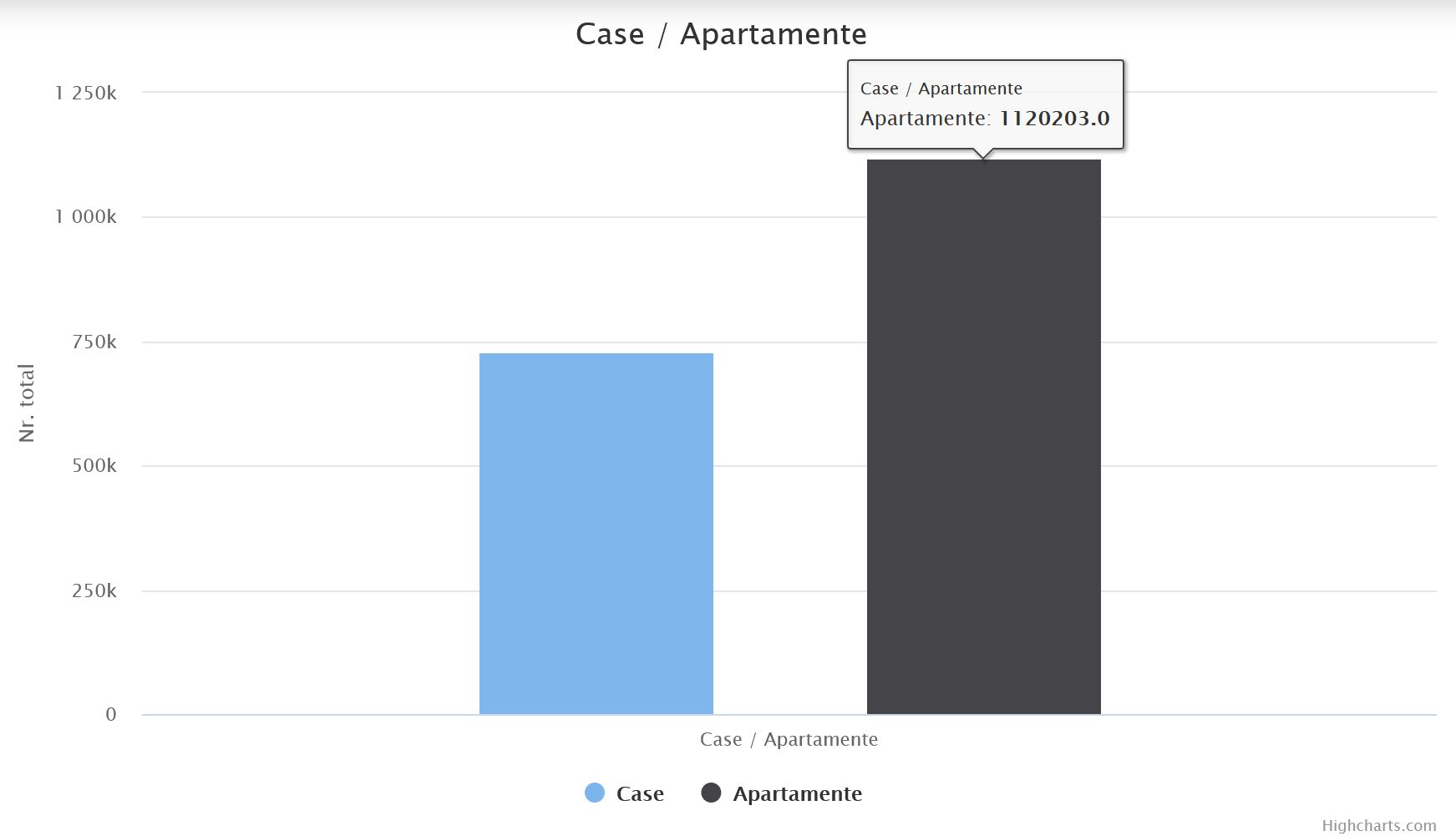

75% of PAD insured homes are in urban areas and over 1.1 million PADs are insured for apartments.

Under these conditions, HotNews.ro turned to the Disaster Insurance Pool (PAID), an insurance company that manages mandatory home insurance, to report how many owners insure their homes on their own initiative, and how many are forced by bank loans.

- “More than 70% of DPA policies are drawn up voluntarily, at the initiative of the insured, without any connection with any secondary obligations (for example, assignment in favor of the bank as a result of a bank loan).

- On the other hand, 525,000 bank transfer policies were issued in 2020, and 566,000 such policies in 2021. For 2022, the analysis is ongoing and will be ready at the end of February.

- The most common way to acquire a home is “for money” or through inheritance. Bank financing is in the minority, although it is hard to believe. Coincidence or not, it seems that the information spread in the press shows that the percentage of buyers financed through banks is still around 30-35% of the total.” Cosmin Tudor, Director of Development of PAID, told HotNews.ro.

According to him, the most policies were assigned to banks: BCR, BT, ING, CEC and BRD. In total, there are more than 20 financiers with almost 600,000 policies.

Some Romanians insure their houses without being forced by the banks / others do not insure them at all

For example, among the 70% of Romanians who insure their home without a bank loan is Development Minister Ceke Attila, who said at the end of a government meeting on Wednesday that he prefers to be insured.

- “Since I bought the house, every year I pay not only mandatory insurance, which is about 100 lei, but also optional insurance. We have had no events, this is my first property and we love this house, I don’t think we will change it.

- I had optional insurance from the moment of purchase. Additional insurance is 700-800 lei per year. The total area is 190 sq.m., the living area is less than 132 sq.m.

- I like insurance. We’re not just talking about floods or landslides here. It could also be a fire spreading from another property. I mean, there can be many things for which I think it is very good to insure our property,” Minister Ceke Attila said on Wednesday.

right declaration of property statusCeke Attila owns a 191 square meter house in Bihor district, purchased in 2013.

At the same event, Secretary of State and DSU Chairman Raed Arafat said he had not yet extended home insurance but would do so as soon as he could.

right declaration of property statusState Secretary Raed Arafat owns an 80 square meter apartment.

- At the opposite pole, there are Romanians who, although they own houses, do not insure them at all. Among the reasons are distrust of insurance companies or the fact that they live in areas safe from the risks of earthquakes, floods and landslides.

- Some of them have already complained about it to the Financial Conduct Authority (ASF). mandatory home insurance would be nothing more than a hidden tax.

Romanians who have insured houses in 16 counties have already declared 139 claims for damages after the earthquakes in Gorja on February 13 and 14, and the reserve for damages established for discovered losses exceeds 700,000 lei, officials told HotNews.ro on Friday PAID.

Read more:

- ‘Your plaster fell off, but not from the earthquake’: payouts against claims denied for homes damaged by last year’s earthquakes

- “Traps” in mandatory home insurance: why some people are denied compensation

- The state that does not do what the state says: even city halls do not insure their houses against earthquakes, floods and landslides

- Romanians would be even less likely to insure their homes if they did not have loans. Some consider it a disguised tax – What does the ASF correspond to?

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.