Many Romanians have felt the current economic effects: ROBOR, IRCC and Euribor have increased. Mainly, the rates of Romanians with bank loans increased. The problem of money becoming more expensive is also felt by the state, which borrows more and more to pay off previous debts. In practice, this refinancing is more expensive, and we will also pay for it in the future, obviously through higher taxes.

We will give an example, but only in order to understand what happens in practice in the state. Let’s say you bought a house with a loan and your down payment is due. You don’t have the income to pay it off, so you turn to another loan. Such a loan has a higher interest rate. Your house, for example, is worth the same, but it becomes more expensive to you because you took out another loan with interest.

So it is with the state. Previous debts are refinanced with other new debts, but the amount increases much more because the interest rates are also higher. That’s why the debt is bigger.

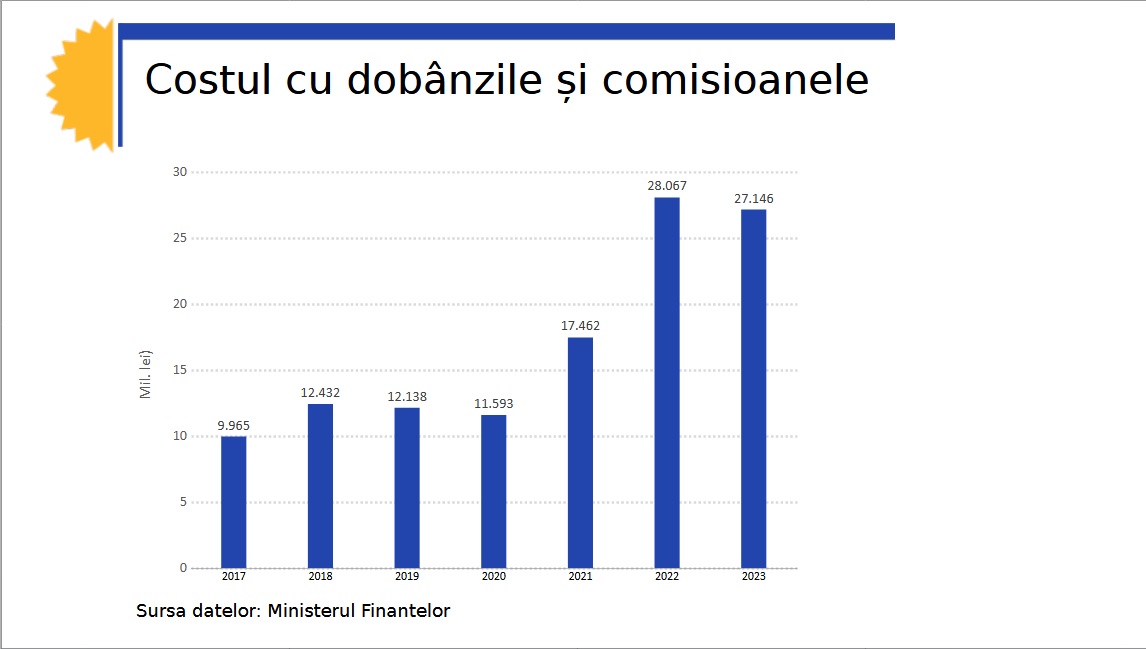

If we look at the data of the Ministry of Finance for the year 2023, we will notice one thing: the cost of interest and commissions over the past 5 years has doubled and almost tripled compared to 7 years ago.

*In the case of 2023, only state estimates are currently available. After the fix, they will change. As happened last year, and the basket went up.

In April, the Ministry of Finance has a peak of payments in terms of rates and interest. It is about a total amount of 14.264 billion lei, of which almost 3.5 billion are interest and commissions.

Public debt today is 49.2% of GDP, below 50%, because nominal GDP has been higher for the past 4 quarters: the effect of massive inflation. It currently stands at 694.9 billion lei, but will soon exceed 700 billion lei.

The state has large expenditures on social assistance, and together with the salaries of state employees, they will account for 63% of total revenues in 2022. Usually compared with tax revenues. If we do that, we will see that they are 26% higher, meaning that they have significantly exceeded tax revenues.

A very large budget deficit for the first two months of 2023

The budget deficit rose to 1.07% of GDP in the first two months of this year, compared to 0.67% in the same period in 2022. Practically, it is higher by 7.5 billion lei.

The data shows that interest expenses increased by 60% to 7.27 billion lei.

The Ministry of Finance says that the deficit increased due to an increase in investment costs, but it is a small amount when it comes to state budget expenditures: +550.6 million lei to 2.59 billion lei. More depends on the share of European funds: +3.5 billion lei (up to 5.83 billion lei).

Another reason referred to by the Ministry of Finance concerns the compensation of bills related to domestic and non-domestic consumption of electricity and natural gas in the amount of 1.6 billion lei, a larger volume of payments for goods and services for medicines.

It is interesting that this slowed down the pace of revenue collection: this is stated in the note of the Ministry of Finance for implementation. In fact, this is an increase of 8.3%. And this is in the conditions of increasing taxes.

In practice, there was a 42% increase in income tax and wages, mostly due to the fact that many micro-enterprises were required to have an 8-hour worker, which led to a sharp increase in the number of minimum wage workers in Romania.

Another impact is the increase in dividend tax revenues (261.2%). As the Ministry of Finance also says: in connection with a significant increase in dividends distributed according to the interim financial statements prepared during 2022, with the withholding tax rate of 5%.

Excise taxes – a decrease of 9.1%.

See full implementation of the budget for 2 months from 2023.

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.