Many believe that if you raise the tax, you will collect more money. Well, in practice, the opposite can happen, as history has seen not only in Romania, but also in other countries.

If you increase taxes on alcohol, in this case the excise duty (which is due to increase significantly from 2023 to OG 16/2022), the effect will be felt in contraband due to significantly higher prices.

Asociatia Patronală Spirits Romania says that while prices have increased, consumption has not decreased. It remained the same, but instead the market for tax-free alcohol flourished.

“We will see in all the bars and discotheques in the Old Center and on the seashore only products, whiskey and vodka, with Bulgarian stamps. We will find spirits, in general, from Moldova, Ukraine, as before, or the production of black alcohol will begin, as it was before,” said Dumitru Tosha, Vice President of Zarea Operations.

He believes that small producers cannot handle all the alcohol they sell.

“Then local brands will start counterfeiting again. National brands will be copied, counterfeited on a large scale,” Tosha said.

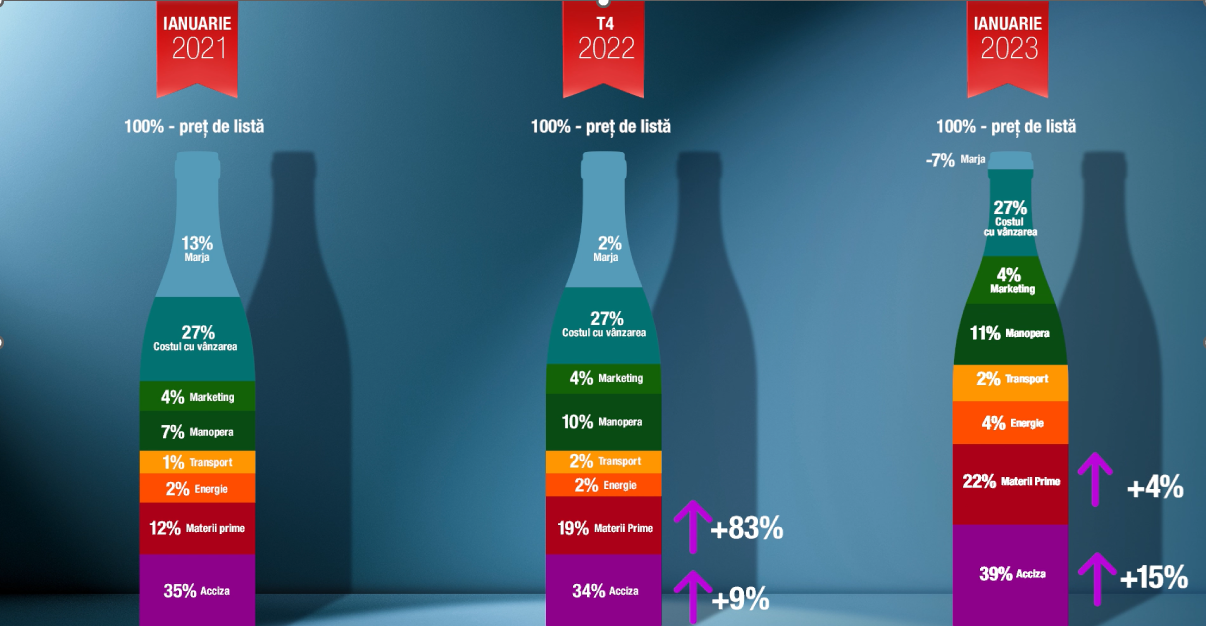

The picture shows how the price of a bottle of table alcohol is formed

The increase in excise duty from January 1 (3.6%), and then from August 1 (by 5%) reduced the profitability of companies in the industry.

After the increase in the excise duty from January 1, 2023, probably by about 15%, the margin would become negative if the weights were maintained, which means that the manufacturers are obliged to raise prices a little more to at least reach zero. or seek to make a small profit.

When excise taxes were raised, the tax-free market went up

According to the association, a 42% rise in excise duty in 2013 led to a 30% reduction in the taxable liquor market in 2013-14, while a 30% cut in excise duty in 2016 led to a decline last year. In 6 years, the tax-free market by approximately 25% and the doubling of state budget revenues, which in 2021 amounted to 171.75 million euros for the entire alcoholic beverage market.

This trend may change after the increase in excise duty introduced by Decree 16/2022, and adulterated alcohol will cause more and more victims, according to producers and importers of alcoholic beverages. In one case, in 2020, 17 people died in Iasi due to consumption of counterfeit alcohol.

“I’ve heard people say that the higher price will discourage the consumption of alcohol, which has a beneficial effect on health. This is absolutely wrong. Only the consumption of taxable alcoholic beverages is being reduced in favor of counterfeit alcoholic beverages, medical alcohol and other products that are actually much more harmful to health,” said Dumitru Tosa, Vice President of Operations at Zarea.

Florin Redulescu, operations director of Prodal, believes that medicinal alcohol cannot be sold in a supermarket.

“I believe that medical alcohol should be sold exclusively in pharmacies. If you look in the shops, they are everywhere. Labels with nurses… it’s nice,” said Redulescu.

“At the end of September this year, the collection of excise duty in the total value in Romania is 2% compared to last year, in lei. This means that if the excise this year compared to last year increased by almost 9%, and in value terms increased by 2%, then we fell by 7% in real terms. This is not very good. Judging by what we see, recently people have started keeping money in their pockets, and we do not have any positive expectations for the end of this year,” said Redulescu.

From next year, staff reduction at alcohol producers

For his part, Tudor Furir said that he thinks they will sell less this year than last year, and that the end of the year will affect the result.

“Prices rose somewhere in the second half of the calendar year. They arrive on the counter with a break of 1-2 months. Our industry has increased prices by less than 10% this year, unlike other industries that have increased prices by 20-30%,” he said.

- We were decent given the same pressure as other industries.

“We cannot say that we buy a bottle cheaper than beer. We are ending this year in the red, about 5%, I say, in terms of volume. Next year, if they leave us as we are now, we will probably fall another 5-10%. Let’s say we adjust our costs and move on. With the increase in excise duty, I am afraid that we will decrease by 30%,” Furir also noted.

Zarea’s Dumitru Tosha says the 30% cut is likely to lead to staff restructuring.

“And that’s why we hardly find people. Once found, they qualify. If it falls by 5-10%, we keep them, and if it falls by 30%… we will have to throw them away,” he said.

The industry demands that the update of the level of excise duty on alcohol and alcoholic beverages, taking into account annual inflation, be postponed until January 1, 2024, and that the annual increase be limited to a maximum of 5%, which will protect the industry from inflationary shocks. .

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.