The Financial Supervision Authority (ASF) states in a response to HotNews.ro that, thanks to the emergency resolution that recently opened a public debate, “the commission will be excluded from the gross contributions only in the case of level II (mandatory private pensions) and not in the case of level III (optional private pensions). However, the statement is contradicted by the text of the Decree, which was fully developed by the ASF itself.

On Monday, August 22, the Ministry of Labor released a draft emergency regulation that proposes to eliminate one of the two sources of income for pension fund administrators, namely the commission applied to contributions paid to both the second and third level of pensions.

Since the justification for the urgency of this liquidation of commissions was that they “causes an unreasonable reduction of the non-state pension which should be received at the end of the contribution period,” HotNews.ro asked the ASF for details on the income collected by pension administrators in both Tier II and Tier III.

ASF: As per GEO, commission will be deducted from gross contributions only in case of Tier II and not in case of Tier III

The ASF’s responses are surprising when it comes to the reduction in commissions prepared for Tier III non-compulsory pensions.

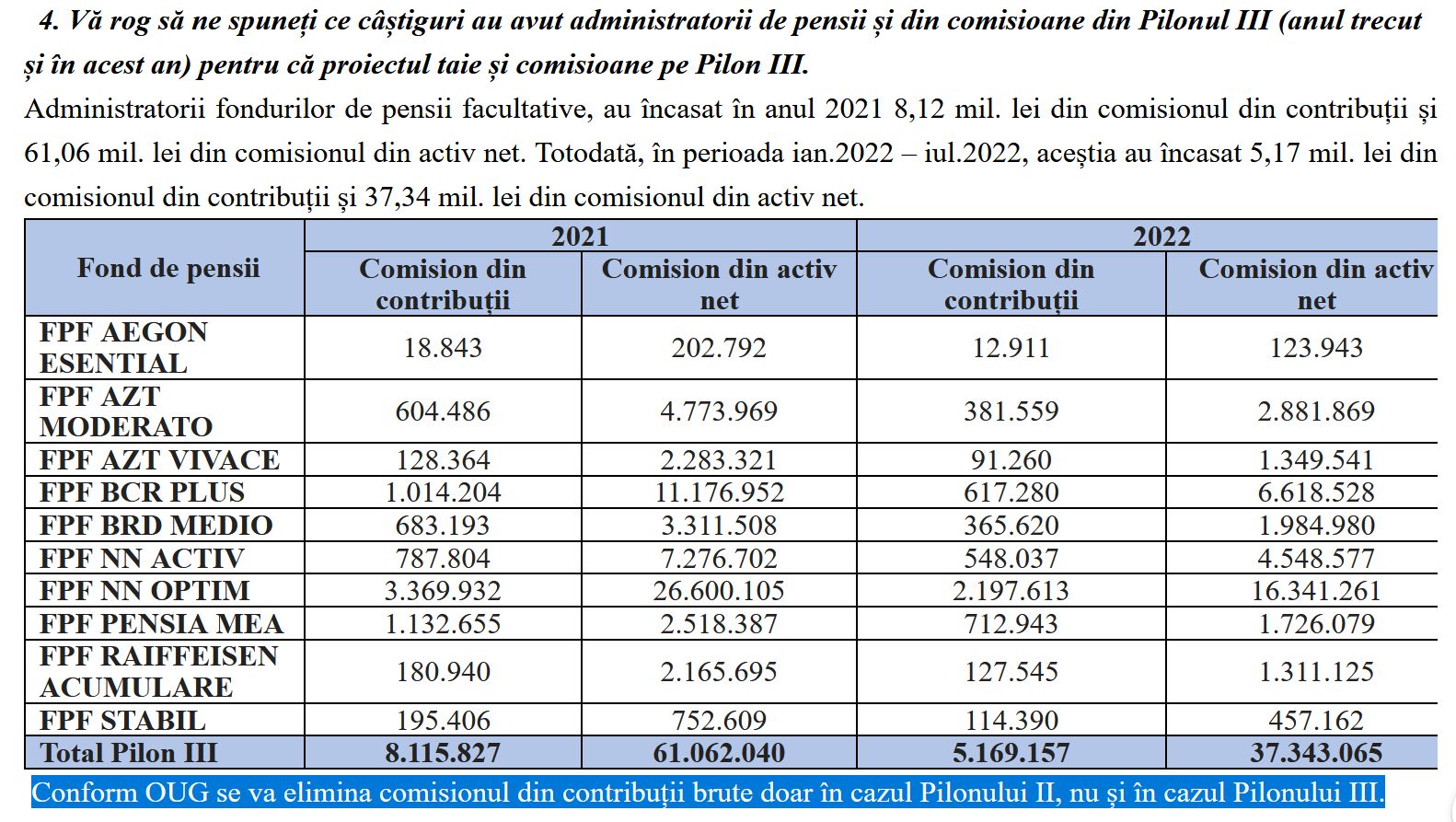

The authority says that administrators of optional pension funds collected 8.12 million lei from the contribution commission and 61.06 million lei from the net assets commission in 2021.

At the same time, in the period from January 2022 to July 2022, they collected 5.17 million lei from the commission on contributions and 37.34 million lei from the commission on net assets.

At the end of this situation, ASF claims that GEO waives the gross contribution fee only in the case of Tier II and not in the case of Tier III.

However, this contradicts even the provisions of the draft regulation, which was fully developed by the ASF itself, according to PSD Labor Minister Marius Budai.

What commissions are currently meeting in Level III and what reductions are envisaged by the Regulation

With the GEO project, both Law 411/2004 (covering Level II) and Law 204/2006 (Level III on pensions) will be amended so that the administrative commission is created only by deducting a percentage of the total assets of the pension fund.

This administrative fee, divided into 2 sources, is currently provided for in Art. 92, par. 2) from Law 204/2006 on the following:

The administrative commission includes:

- a) deduction of the amount from the paid contributions, but not more than 5%, provided that this deduction is made before the contributions are converted into fund units;

- b) deduction of interest from the total net assets of the voluntary pension fund, but no more than 0.2% per month, established by the prospectus of the voluntary pension fund.

What changes does the GEO project make to Component III?

“The second part of Article 92 shall be set out in the following content:

- “(2) The administrative fee is established by deducting a percentage from the total assets of the voluntary pension fund, but no more than 0.2% per month, established by the prospectus of the voluntary pension fund.”

In other words,ASF has also proposed through GEO the removal of the contribution fee from Tier III, contrary to what it currently supports.

According to official data, as of the end of March 2022, there were 577,000 participants in Level III, and the total value of net assets of voluntary pension funds on that date exceeded 3.3 billion lei.

The ASF did not touch the millions it withholds from Romanians’ contributions to Level II and III pensions

It should be noted that although in the GEO project the ASF claims that this commission reduction is necessary because it will unnecessarily reduce the pensions of Romanians, body headed by Nick Mark he did not touch his own income, which he receives from commissions paid by Romanians in II and III levels of pensions.

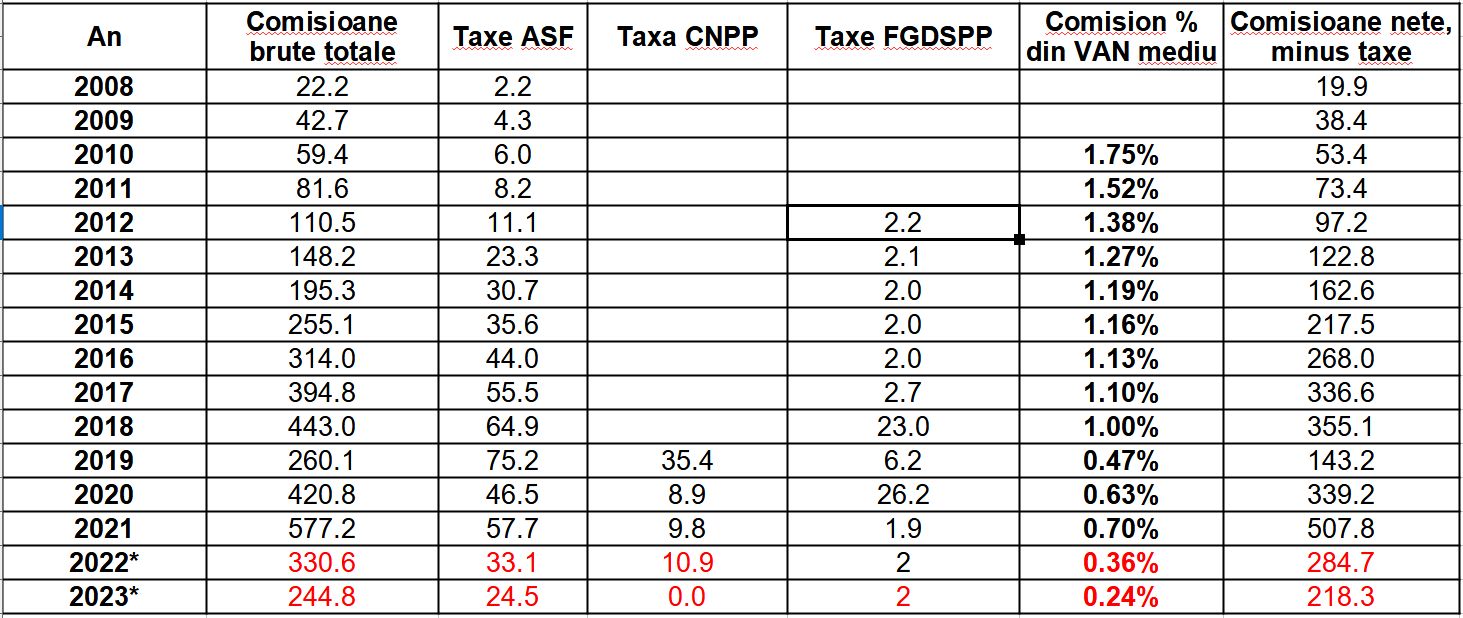

Due to current legislation, 10% of income from commissions applied by administrators they even go to the accounts of Financial Control.

Another percentage goes to the National Pension Fund (CNPP). Part comes in the form of contributions to the Non-State Pension System Rights Guarantee Fund (FGDSPP).

If we look at the data in the table above, we can see that last year, out of the total income of more than 577 million lei received by administrators through the application of 2 types of commissions, ASF kept 57.7 million lei in the accounts, Building National Pension Fund (CNPP) – 9 8 million lei, and the Guarantee Fund – 1.9 million lei.

In the end, 7 administrators were left with a net income of 507.8 million lei.

- Read more: What the Tier II fee cuts will mean: how much money pension administrators are losing, what people will get and what the ASF isn’t telling us

Photo source: Dreamstime.com.

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.