Any exchange is proud of new company listings. He prides himself on new businesses that become strong and valuable enough to be listed on the stock market. When we look at the stock market as investors, we don’t just look at market capitalization, volatility or sectors and the number of companies listed on the market.

We also look at the history and experience of promoting new stock exchange listings through private placements (securities sold directly to individual or strategic investors), but especially through IPOs.

The Romanian stock market is small and has insufficient potential. Somewhat detached from the GDP dynamics we have been used to for several years. The stock market is a direct competitor of the banking system, especially when it comes to long-term capital, investment capital. Romania’s development should rather be related to the stock market, the capital mediated by it has significantly different characteristics from bank deposits managed by banks.

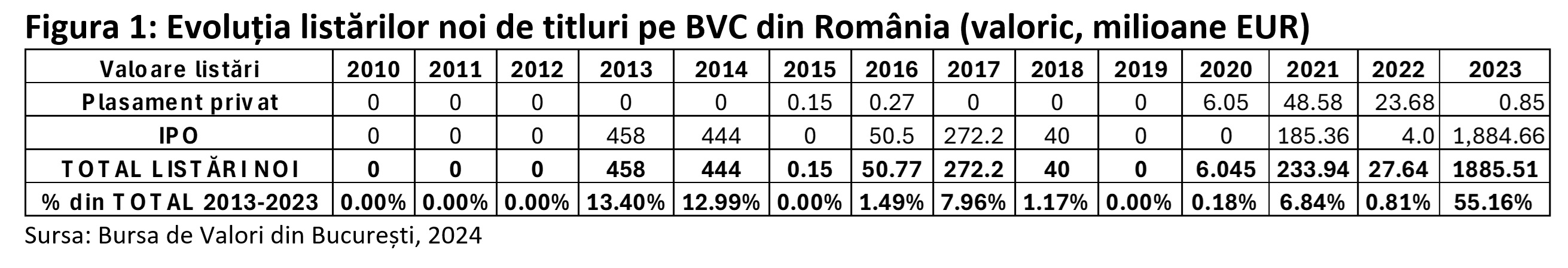

Figure 1: Evolution of new listings of securities on the BVC in Romania (value, EUR million)

Source: Bucharest Stock Exchange, 2024

From the analysis of the evolution of new listings on the Romanian stock exchange for the period 2010-2023 (Fig. 1), we observe the following:

• The highest value IPO in Romania occurred in 2023 and only one IPO took place (Hidroelectrica). The year 2023 accounts for more than half of the value of all new listings on the stock exchange from 2010 to 2023 (55.16% of the total number of listings);

• The majority of new listings on the Romanian stock market occurred through IPOs (97.7%) and less through private placements (2.3%).

• There were years when there was no new listing on the stock exchange (4 years out of the ones analyzed), years when we only had listings through private placements, and years when we only had listings through IPOs;

• The cost of listings subscribed through an IPO is significantly higher than a subscription to a private placement;

• The dominant sectors of IPOs in Romania are: renewable energy, energy, real estate, technology, logistics, financial services, agriculture and medicine.

• Less than half of the IPOs indicated a percentage of the total number of shares above 30% (only 6 of 15 IPOs had a higher percentage, the highest percentage was 51.2% of the total number of shares and only 2 IPOs with a percentage of more than 50%).

• We cannot talk about the leader in the local market in terms of the number of successfully coordinated IPOs (however, the number of IPOs remains relatively small).

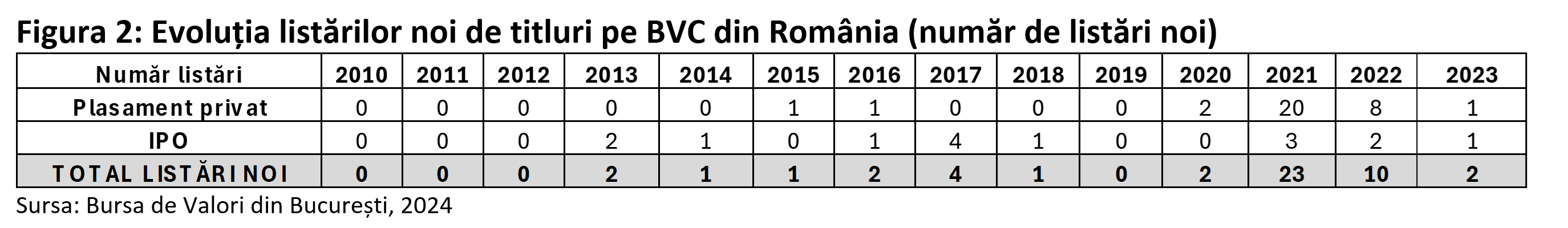

Figure 2: Evolution of new listings of securities on BVC in Romania (number of new listings)

Source: Bucharest Stock Exchange, 2024

Between 2010 and 2023, 48 new companies were listed on the Bucharest Stock Exchange, including 15 IPOs (on the main market) and 33 listings through private placement. The largest number of new listings fell on 2021, almost half of new listings for the analyzed period fall on this year. The average IPO listing value was around €223 million per listing, while the average private placement listing value was €2 million per listing.

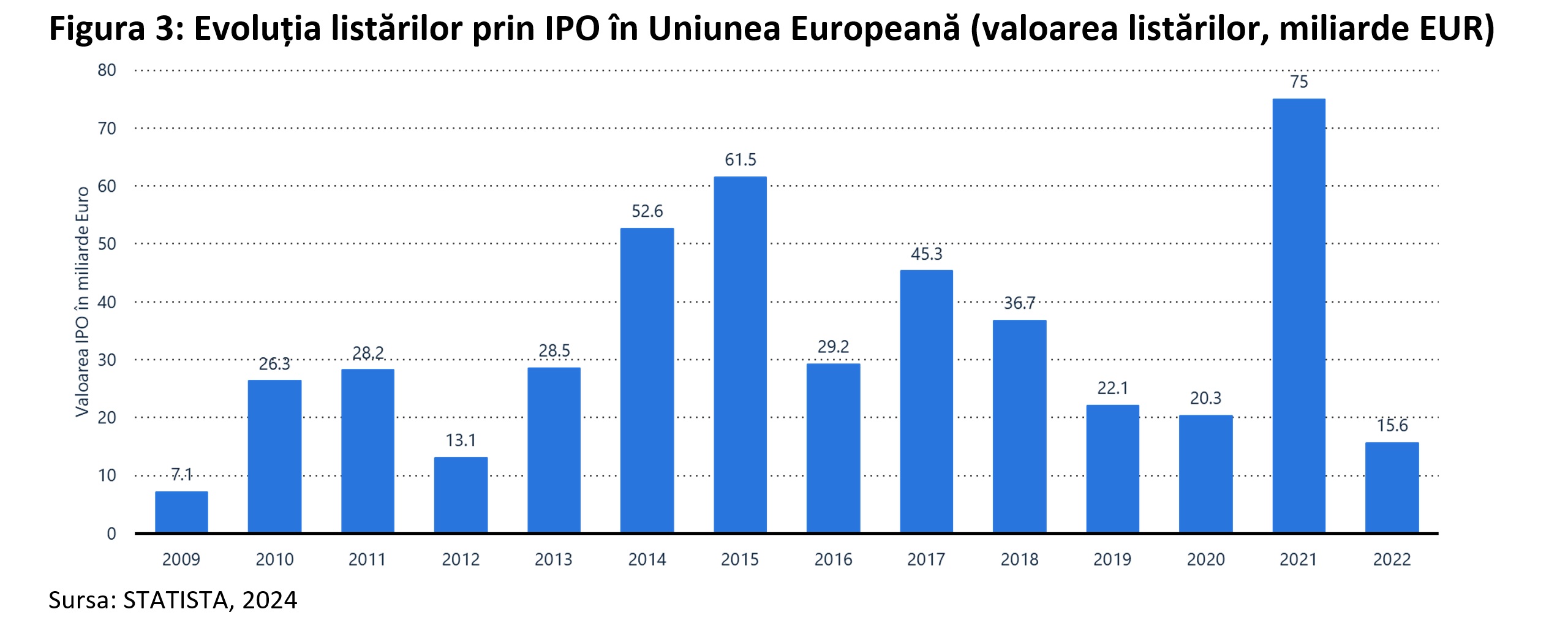

Unfortunately, when talking about the level of IPOs in the European market, the values are still far from the expectations of what a developed market should mean at the OECD or MSCI level. For example, in 2021 (the year of the maximum number of listings), the share of new IPOs in the total number of IPOs in the EU was only 0.25% (by value), and in 2022 – only 0.03% (Figure 3).

Figure 3: Evolution of IPO placement in the European Union (placement value, billion euros)

Source: STATISTICS, 2024

This is even if in terms of the number of IPOs we were slightly better (Figure 4): in 2021 we had 0.71% of the total number of IPOs at the European level and in 2022 we had 1.96 IPOs.

Figure 4: Evolution of IPO listings in the European Union (number of listings)

Source: STATISTICS, 2024

Although earlier this year we announced historical records in BVB (link to access) for the capitalization of listed companies, the value of the BET composite index or the average transaction volume, it is clear that Romania needs to find its rhythm when it comes to new listings , more selected through a public offering, is the most consistent in terms of volume and number of investors involved. Several such interesting IPOs for 2024 have already been announced on the horizon: Bittnet’s (BNET) IT group Fort and Glissando’s agri-food group Glissando Garden Center ( access link ) on Aero. At the beginning of the year, ROCA Industry, the first Romanian construction materials holding company, majority owned by ROCA Investments, which was listed on the BVB main market only two years after listing on AeRO (access link), caught our attention.

These are important steps, even if they are small, that should be continued by other listings and other companies that will come to give consistency to the Bucharest Stock Exchange. IPOs and new listings attract individual and institutional investors and provide important long-term financing opportunities that issuers can then turn into value-added investment projects and economic development. The case of Hidroelectrica should be repeated by other similar companies (not only in energy), privatization and listing of state-owned companies through the stock exchange will increase its attractiveness, not only capitalization. In addition, large infrastructure projects can be developed through public-private partnerships, in which the stock exchange plays a larger role: the project can start with a small number of important investors (including the government and international financial institutions) and then exit after a recovery period investment, which was initially agreed upon, by placing this project on the stock exchange. A good example of this can be the irrigation system in the south of the country, which can be developed, including in combination with an ecological solution for it (solar and/or wind energy).

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.