When Mariana Popescu went shopping at the store the following week, she realized that Iserescu kept explaining to her on TV that she didn’t know anything. With more money in your pocket, you buy things much cheaper.

As prices continue to rise, consumers are adopting various coping strategies to manage their money at the supermarket

The basket is adjusted primarily by reducing the amount of food and household goods, and then personal hygiene products. The decrease in purchases in early 2023 (January-May) was -3% lower than the sales recorded in early 2022 (for the same period).

From closely monitoring promotions and adjusting portions to planning shopping trips and finding cheaper alternatives, consumers are trying to adjust to rising prices. And how consumers behave in front of the shelf is a signal for both food producers and governors, and especially for Isarescu, in whose yard lies the stability of the mats.

A combined analysis of RetailZoom’s sales data and the results of a recent Ipsos survey reveals valuable information about the specific actions consumers have taken to mitigate the impact of price increases. This analysis provides a comprehensive overview of the adaptation strategies adopted by consumers in different product categories.

The basket is adjusted primarily by reducing the amount of food and household goods, and then personal hygiene products. The decrease in purchases in early 2023 (January-May) was -3% lower than the sales recorded in early 2022 (for the same period).

Inflation context with (still) two digits

According to the National Institute of Statistics, the inflation rate in Romania in July was 9.4%. Inflation has declined steadily in recent months from a peak of 16.8% in November 2022.

Food products continue to lead the price increase with 18%, followed by services with 11.5%.

Among food products, the prices of sugar (55%), potatoes (32%), butter (31%) and eggs (29%) increased the most compared to June 2022.

In this environment, also complicated by discussions between retailers and the government regarding a voluntary cap on trade mark-ups on basic food products for 3 months, Ipsos and RetailZoom conducted an analysis of how these increases are reflected in prices in the consumer basket. and in consumer perception.

Quantitative purchases (artificial) made in the first 5 months of 2023 (January-May) in international modern trade networks decreased more sharply compared to the last 5 months of 2022 (-10%).

Implicitly, this path shows us the gradual downward adjustment of Romanians’ budgets for purchases made in international retail chains. Even if some of the larger reductions are justified by the different season included in the comparison, certain non-seasonal product categories maintain a downward trend compared to the same period of the previous year. Among them, in the list of permanent declines compared to the period of January-May 2022, we mention: sugar (-36%), canned meat (-33%), oil (-24%), vegetable oil (-28%). and ice tea type juice (-12%).

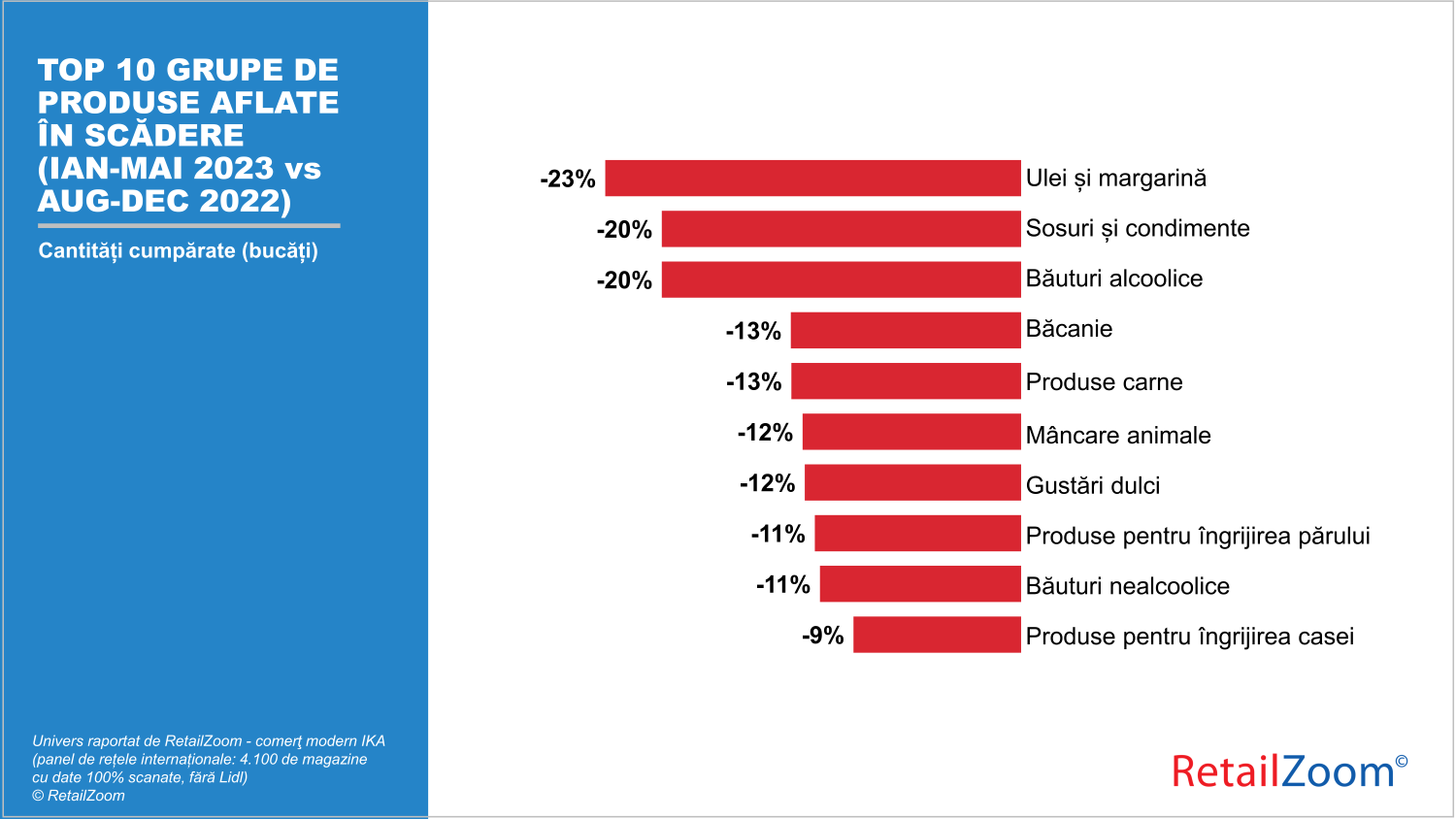

The groups of products that have decreased the most in the purchase options of Romanians in large chain stores at the beginning of this year (January-May 2023), compared to the last 5 months of 2022, are highlighted in the graph below.

Of these, Oil & Margarine, Alcoholic Beverages, and Groceries declined more sharply compared to the first half of 2022 (Jan-May), thus exhibiting a purchasing restraint behavior that is somewhat consolidating towards reduction and abandonment, or perhaps partially shifting to other channels purchases (wholesale or on the markets or directly from manufacturers).

Reduction in consumption, from the point of view of the population

A survey of consumers revealed several strategies for dealing with rising prices. Here are the important takeaways:

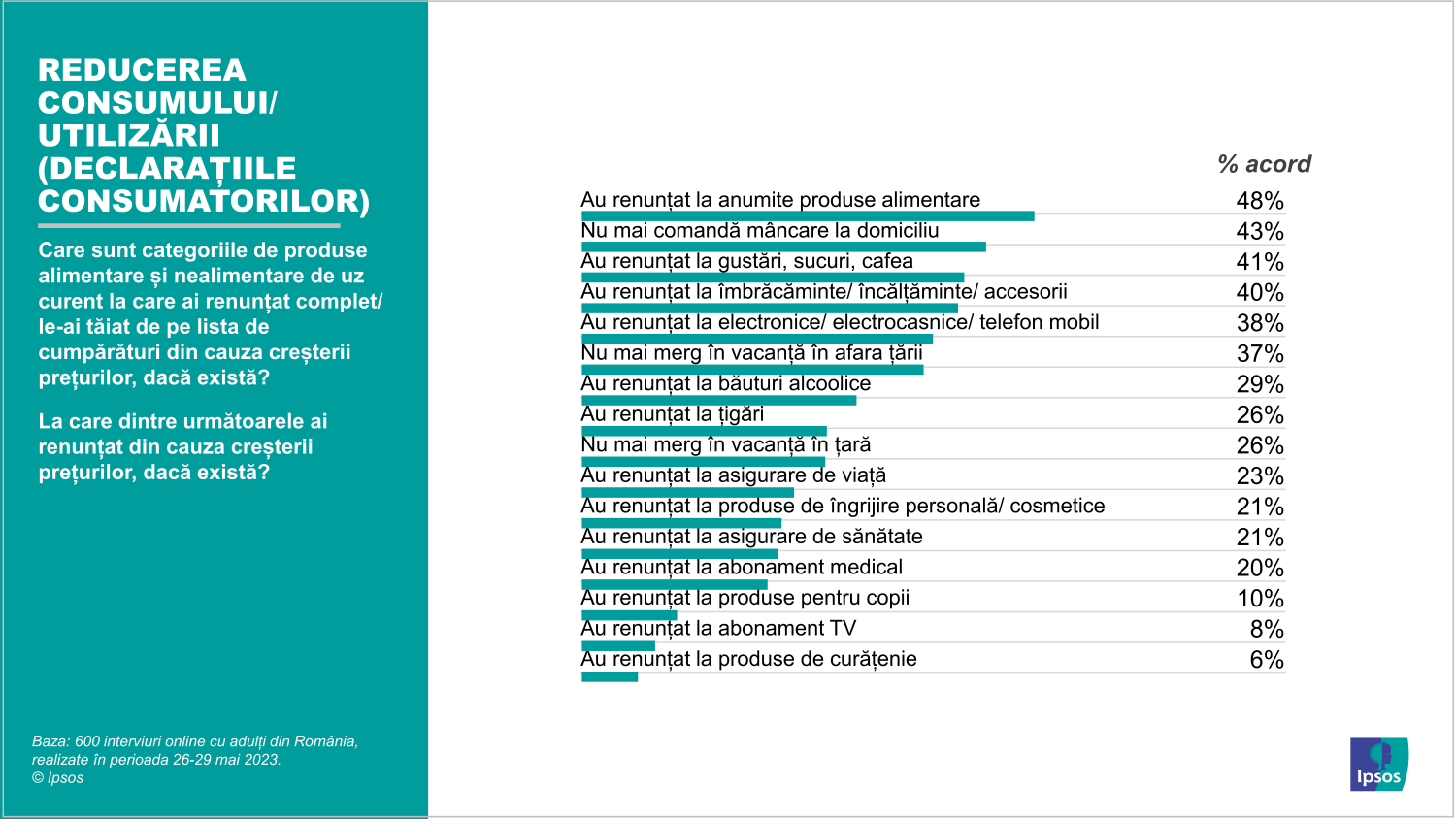

- 1. Key priorities: 48% of respondents said they have cut back on certain foods to compensate for rising prices, indicating a strategic focus on essentials rather than pleasure purchases.

- 2. Eating at home: 43% of survey participants said they no longer order food for home delivery, choosing to cook at home to save money.

- 3. Sacrifice Snacks and Beverages: A whopping 41% of consumers cut out optional snacks, sugary drinks and coffee to reduce their overall spending.

- 4. Clothes, shoes and accessories: 40% of respondents gave up buying clothes, shoes and accessories, preferring basic expenses over discretionary shopping.

- 5. Electronics and mobile devices: 38% of participants refrained from buying electronic gadgets, home appliances and mobile phones in order to manage their budget more effectively.

- 6. Travel Adjustments: In response to price increases, 37% cut back on international travel and 26% cut back or canceled domestic vacations.

- 7. Insurance: 23% and 21% of respondents adjusted their life or health insurance according to budget constraints.

- 8. Additional adjustments: A smaller percentage of consumers made other changes, such as giving up personal care and beauty products (21%) and canceling medical or television subscriptions (20% and 8%, respectively).

What role do promotions play in adjusting purchase budgets?

The focus on recalibrating shopping budgets for consumer goods highlights in the retail sales reports the fact that the share of promotional purchases has increased significantly compared to last year – from 20.5% on average in 2022 to 24% of the total value of sales. for the II quarter of 2023.

Both shoppers and retailers, along with manufacturers, have begun to pay more attention to products on sale – even if sales do not necessarily mean the lowest prices, discounts have once again taken an important place in the shopping budget.

Adaptation strategies

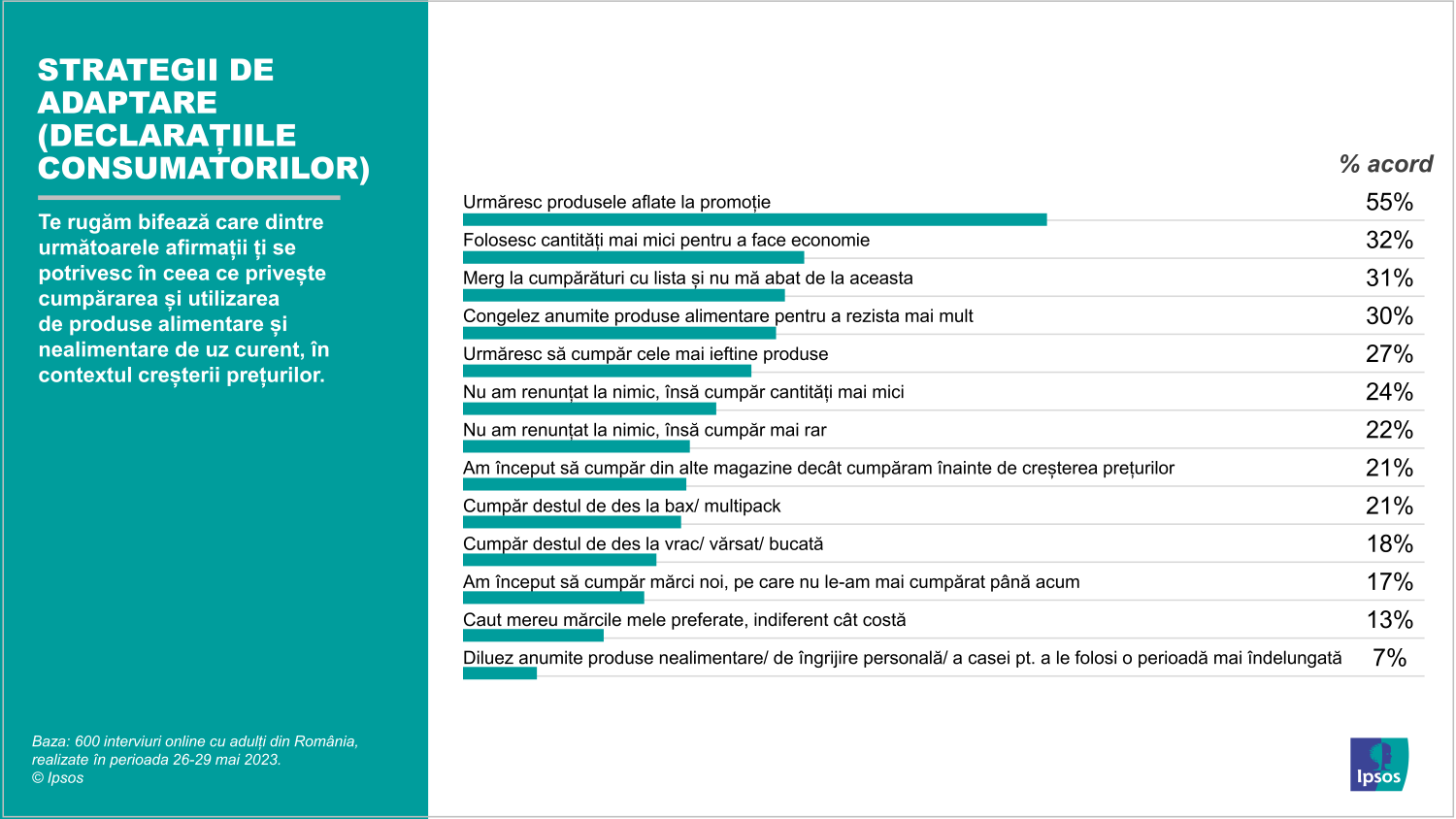

The study showed how consumers use different coping strategies to deal with the impact of price increases. They pay close attention to promotions (55%), use fewer products (32%) and stick to shopping lists (31%) to make more economical choices.

In addition, consumers freeze some products (30%), look for the cheapest options (27%) and regulate the number of purchases (24%). Some consumers also look to alternative stores (21%) and opt for bargain shopping (21%) or bulk shopping (18%) to save money. These strategies reflect their efforts to prioritize major purchases and further increase the budget.

Abroad, the heads of large manufacturers say that in the coming quarters they will reduce the price of products, writes the Financial Times (subscription may be required). The chief executive of Kraft Heinz has assured consumers that prices for products such as Philadelphia cream cheese and Heinz tomato ketchup will stop rising.

After raising prices to pass on inflationary costs for raw materials, energy and labor to shoppers, some of the world’s biggest consumer goods companies have signaled they may be willing to delay further hikes

Nestlé chief executive Mark Schneider said the company, which makes Nespresso and KitKats, would slow price increases in the second half of the year.

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.