RCA prices will be capped, starting April 11, for 6 months at the base prices (B0) practiced by insurers on February 28, 2023, to which the price reduction or increase associated with the bonus-malus class will be applied. where each insured person is, after the publication of the Government Resolution on Thursday evening in the Official Gazette.

- SEE HG WITH RCA CEILING IN OFFICIAL BULLETIN

Consumers cannot check rates for February, but the ASF says most will pay less than the base rate

Unfortunately, consumers cannot know what rates each insurer was charging at B0 on February 28, 2023 for each individual category of policyholders, as also reported by the Association of Romanian Financial Users (AURSF).

The Financial Conduct Authority (ASF), which developed this final version of the regulation, says that its analysis found that, in general, the rates charged by insurance companies on February 28, 2023 are lower than the published base rates. March 7, 2023.

- “I said that in general, the average rate for individuals is 12% lower. Indeed, there may be segments where the rates may be close to base rates or perhaps slightly higher, but those segments are fewer.

- It depends a lot on the category of bonus-malus in which the driver is, respectively, on the volume of cylinders, on the age category.

- There may be exceptions or situations where the rates are higher. We are talking about the tariffs applied by insurance companies at the end of February, we are not just talking about a single tariff for each individual category.” Valentin Ionescu, CEO of ASF Insurance, said on Wednesday.

HotNews.ro pointed out to him that there will be transport companies or drivers who do not cause accidents and move to the bonus class, but who will pay more than if the price were limited to the base rate, precisely because they are from cities as big as Bucharest, where the frequency damage is higher.

The criterion of the city of the car owner, which is taken into account by insurers, is not taken into account when setting the base rate, so the prices of many insurance companies exceed the reference rates calculated by an independent auditor and published every 6 months. ASF.

HotNews.ro reported in a detailed article based on insurance brokers’ offers about situations where prices capped at the level of February 28, 2023 are higher than the current RCA base rate:

- read: How much will we pay in RCA in the next 6 months: 8 cases about the “poisoned apple” of the price freeze February 28, 2023

Here is one such example:

Male, 42 years old, from Galati, with a BMW 320D: RCA is 450 lei more expensive than the base rate

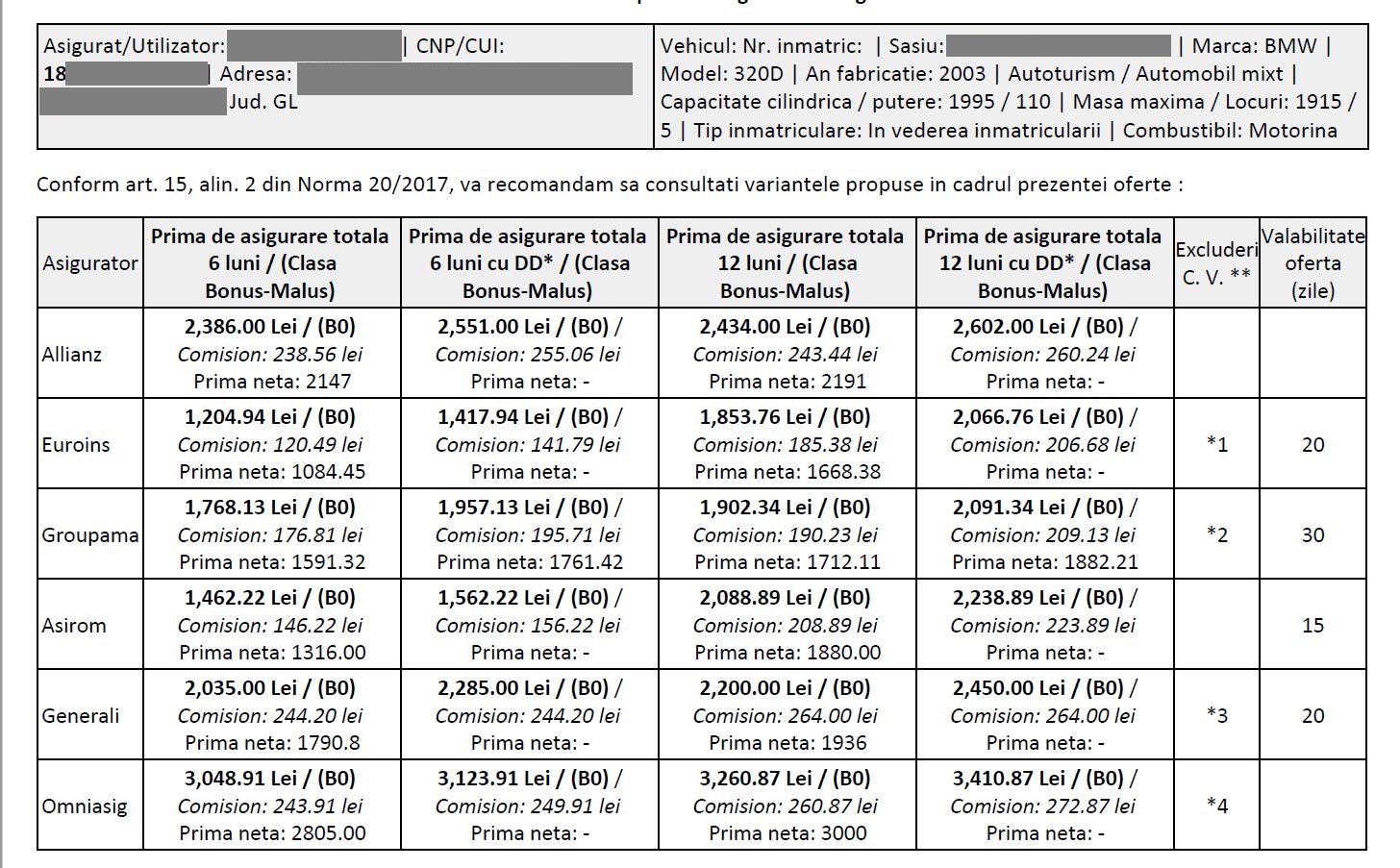

A man (42 years old) from a locality in Galaţi County, with a BMW 320D with a capacity of 1995 cmc, received 12-month offers on February 28, 2023 at RCA at the prices: 1853 lei (Euro) / 1902 lei Groupama and a maximum of 3260 lei at Omniasig.

The estimated RCA rate announced by the ASF on March 7, 2023 is 1,445 lei for people aged 41-50 who drive cars with a cylinder capacity of 1,801-2,000 cm3.

In August 2022, the RCA reference rate for this category was 1261 lei, and in February 2022 – 1140 lei.

- conclusion: The cheapest RCA a driver with such a car will receive will be 1,902 lei, which is 450 lei more than the last base rate announced by the ASF.

Why it’s hard to hope for low prices in RCA: In Bucharest, 7 out of 100 cars get into accidents, compared to other areas where the frequency is lower

The CEO of ASF explained on Wednesday why drivers from Bucharest and other big cities have higher prices in RCA and why it is difficult to have lower prices in RCA in general.

According to him, in large cities, the burden on the tariff calculated by insurance companies is somewhat higher due to the risks and the frequency of losses, which is higher.

- “Usually to have the most reasonable rate, you need as many companies to sell that insurance, as much spread as possible. When there are only a few companies selling RCA, it’s hard to expect a lower rate, given that Romania’s accident rate is much higher than the European average.

- Damage is a very important element in RCA pricing. Over the past 3 years, the average amount of losses has increased from 7,000 lei to 9,500 lei.

- In Bucharest, 7 out of 100 cars get into accidents compared to some regions of the country where the frequency is lower, somewhere around 4%. All these elements must be taken into account when calculating the price of RCA. he declared.

He also noted that there is also a structural problem: RCA is a mandatory product sold by private companies.

- “There are some private companies that have had losses in recent years. One of the largest companies in the Uniqa market left the RCA market due to accumulated losses of hundreds of millions over the past 7-8 years. As you know, after City Insurance exited, Uniqa applied to withdraw from RCA insurance and we may also have such situations.”, Valentin Ionescu also stated.

Those with high prices in RCA can go to BAAR. Here is the procedure

All policyholders – individuals or legal entities – who receive RCA price quotes of 36% above the ASF base rate are considered high risk insured and have only one recourse – to contact the Bureau of Motor Insurers (BAAR) for a slightly lower quote .

What does insured high risk mean?

- A high-risk insured is a driver who, after renewing an RCA policy (without direct settlement and without other caveats and additional coverages), receives at least 3 quotes in a 12-month period from different RCA insurers whose total prices (net insurance premium + broker or insurer distribution fee ) are 36% higher than the current reference rates associated with the risk segment to which each is a part.

BAAR explains on its website the entire procedure by which each of us can know whether we are high risk insured and in that case we can approach BAAR for a cheaper RCA.

The premium for high risk is calculated according to the formula:

- Base factor for the vehicle X factor N (36%) X factor for the bonus-malus class you are placed in

Calculation example:

- Vehicle for which insurance is required: car; working volume of the cylinder: 1461 cm3

- Owner: natural person; 45 years old

- The bonus-malus class you belong to: B4, for which the adjustment factor applied to the premium is 80%

- Received insurance offers representing the total insurance premium (without direct calculation rate and without premium for additional conditions and coverage): 1550 lei, 1480 lei and 1400 lei

- The estimated RCA rate shown by the ASF on March 7, 2023 for people aged 41 to 50 years who drive cars with a cylinder capacity of 1401-1600 cc is 1265 lei.

Premium for high risk = 1265 lei (base rate) X 1.36 (Factor N) X 80% = 1376 lei.

- It follows that the high risk premium is lower than the general insurance premiums from the bids received, so the request falls under the high risk insurance category and the owner can apply to BAAR to appoint an RCA underwriter to underwrite the contract. RCA insurance contract.

In a situation where you are classified as a high risk insured, BAAR further calculates the RCA price it recommends and informs the insurer of the RCA to be assigned as a high risk insured.

Industry sources say that this BAAR recommended price is being followed, even though it is not mandatory, and an insurer that offers or has been randomly selected by BAAR to provide this recommended price will do so at the level set by BAAR.

- But be careful! You need to make these calculations and make decisions beforehand. There are several documents that must be provided, and the transfer to the insurer is made within 20 days of the request, if complete documentation is attached.

On Wednesday, the government approved a 6-month cap on RCA prices at the end of February 2023, with one condition: that during this period the ASF and the Competition Council prepare the necessary changes to the RCA law to avoid further crises. and bankruptcies in the future.

Photo source: Dreamstime.com

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.