2022 was the most difficult year for Pension Level II, the only one in the red in 15 years of operation, and administrators had to bring money from home to compensate for the losses of some participants, but even then the financial gain was greater than if the transferred amounts were deposited in the bank deposits in lei, updated for inflation or used to accumulate euros, says APAPR – the association of administrators of private pension funds.

2022 – the most difficult year: What money the administrators took to compensate for the losses of some participants

The association emphasizes that 2022 was indeed the most difficult year for Pillar II, the only one in the red in 15 years of activity.

- “The war in Ukraine, record global inflation in recent decades, the energy crisis, extreme volatility in the markets affected all categories of financial investments. The value of Romania’s government securities, as well as the value of the main indices of the Bucharest Stock Exchange, has fallen by around 3% in 2022 after significant fluctuations during the year.

- According to Bloomberg data, the prices of Romanian government securities lost almost 12% in the first half of 2022, at the end of the year quotes gradually recovered, the annual result was -2.7%.

- The decline in the value of government securities is caused by rising inflation and interest rates and is quite cyclical, as all government securities return to their issue value at maturity.” APAPR notes.

On the other hand, out of cyclical downturns in 2022Pillar II has generated significant investment returns throughout its lifetime benefiting almost 8 million Romanians in the system.

Only 0.02% of the total amount of payments made by administrators over 15 years (exact amount: 253,967 RON) are aimed at compensating some marginal losses of individual participants, mainly during 2022, according to APAPR data.

Administrators have reserves of 951 million lei to compensate for other losses

According to Law 411/2004, administrators compensate from their own sources (reserve capital, called technical support, consisting of management fees collected over time) any possible negative difference between the value of the participants’ account and the guaranteed value (gross contributions minus the legal administration fee) when leaving the system (due to early retirement, disability or death).

In other words, says APAPR, even when financial markets go through difficult periods marked by volatility, managers take on the financial burden and offset any downturns.

At the moment, the administrators have formed total technical reserves of 951 million lei, which is significantly higher than the amount actually needed for these compensations.

Level II in 15 years: Net profit over 18.5 million lei for almost 8 million members

According to APAPR data, at the end of 2022, the assets managed by Pillar II reached 96.4 billion lei, which is a historical record for the system. In almost 15 years of operation, gross contributions amounting to 79 billion lei were transferred to level II.

The difference between current net assets and gross contributions, adjusted for payments already made (withdrawals), represents a profit for the exclusive benefit of members of 18.5 billion lei (approx. 3.8 billion euros) after deducting all fees charged. administrators.

- “The above data shows the strength and stability of Tier II of private pensions, and the fact that, after cyclical downturns in 2022, Tier II has generated significant investment returns throughout its lifetime benefiting almost 8 million Romanians to the system,” says APAPR.

Mandatory Private Pension Tier II generated an average annual return of 7.16% throughout its lifetime (20 May 2008 – 31 December 2022), compared to an average annual inflation rate of 4.19% over the same period, that is, reliable real positive indicators of three percentage points for each of the almost 15 years of operation.

During this entire period, pension funds of Rivne II made payments in the total amount of more than 1.1 billion lei to 88,202 participants and beneficiaries (heirs).

Earnings of a Romanian with an average salary who paid monthly contributions to level II for 15 years

According to APAPR calculations, the financial gain received by Romanians from Level II of compulsory private pensions is more than double compared to the update of gross contributions only taking into account the level of inflation during the entire period of almost 15 years of operation of this system.

In addition, the yield of Pillar II exceeded both bank deposits in lei and savings in euros.

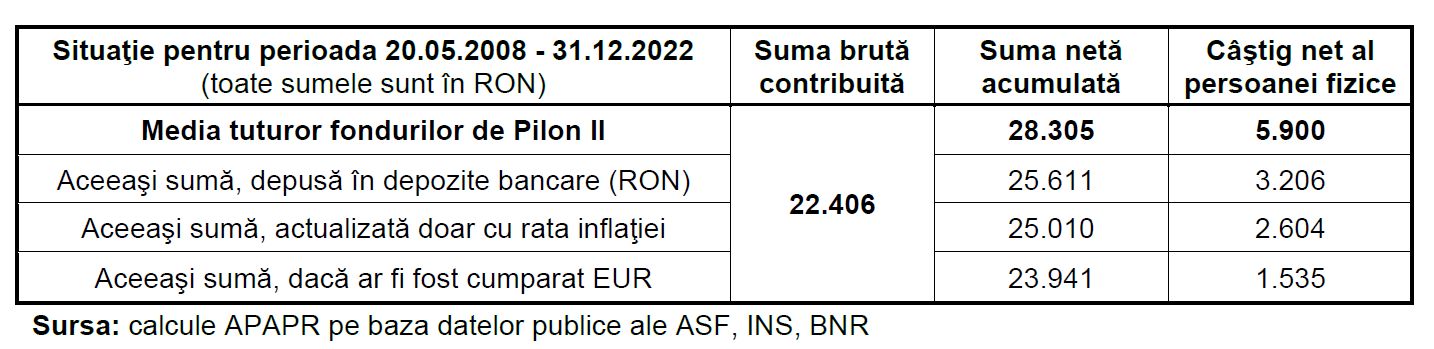

The APAPR represents the situation of a Romanian with an average wage in the economy who has been paying Tier II contributions every month since May 2008 until now.

The data compares the accumulation in Level II with the capitalization of the same amounts in other ways: if they were deposited in bank deposits in lei, if they were updated only taking into account the inflation rate, respectively, if they were used to accumulate euros.

- “For 15 years, the amount of gross contributions transferred to Level II reaches 22,406 lei, while the accumulated amount (average amount of all funds) is 28,305 lei. The difference is represented by an average profit of 5,900 lei excluding all commissions, which is more than double the update of gross contributions only adjusted for inflation and net higher than accumulating through bank deposits or buying euros.”, supported by APAPR.

SEE THE APAPR ANALYSIS OF LEVEL II HERE

Not all Romanians come out on top when they take money from Tier II: what happened last year

HotNews.ro reported last October that almost 5,900 Romanians retired due to the age limit in the first six months of 2022 and collected money from the second level, but amid falling asset values this year, some found their accounts with less. than they contributed.

Since by law you can’t get less than you contributed, the administrators made up the difference, but after paying CASS and income tax, dozens of Romanians took out less than they listed.

According to the ASF, 2.9% of the nearly 5,900 Romanians received less money than they counted after paying CASS and income tax.

We remind you that according to Art. 135 pt. (2) of Law 411/2004, “the total amount of private pension cannot be less than the value of paid contributions, reduced by fines and court costs.”

To ensure that people at least get their contributions paid into the system, the law requires pension fund administrators to maintain a level of technical reserves at all times corresponding to the financial obligations arising from the prospectuses of the administered private pension schemes.

Photo source: Dreamstime.com

Source: Hot News

Mary Robinson is a renowned journalist in the field of Automobile. She currently works as a writer at 247 news reel. With a keen eye for detail and a passion for all things Automotive, Mary’s writing provides readers with in-depth analysis and unique perspectives on the latest developments in the field.