Although Romanians spent more money on insurance products last year, their shortfall in protection against accidents, illness or death increased to 620 billion lei (€126 billion), 5.6% more than in 2020, an analysis by by a group of independent experts. at the request of UNSAR (National Union of Insurers and Reinsurers).

- “The protection deficit, i.e. the difference between the financial resources needed and currently available to a family to support living standards in the event of an unforeseen event, is growing, and the share of this deficit in GDP remains at a high level of 52% (2021).

- For most families, the consequence is a sharp drop in the standard of living and dependence on social assistance from the state,” the insurers claim.

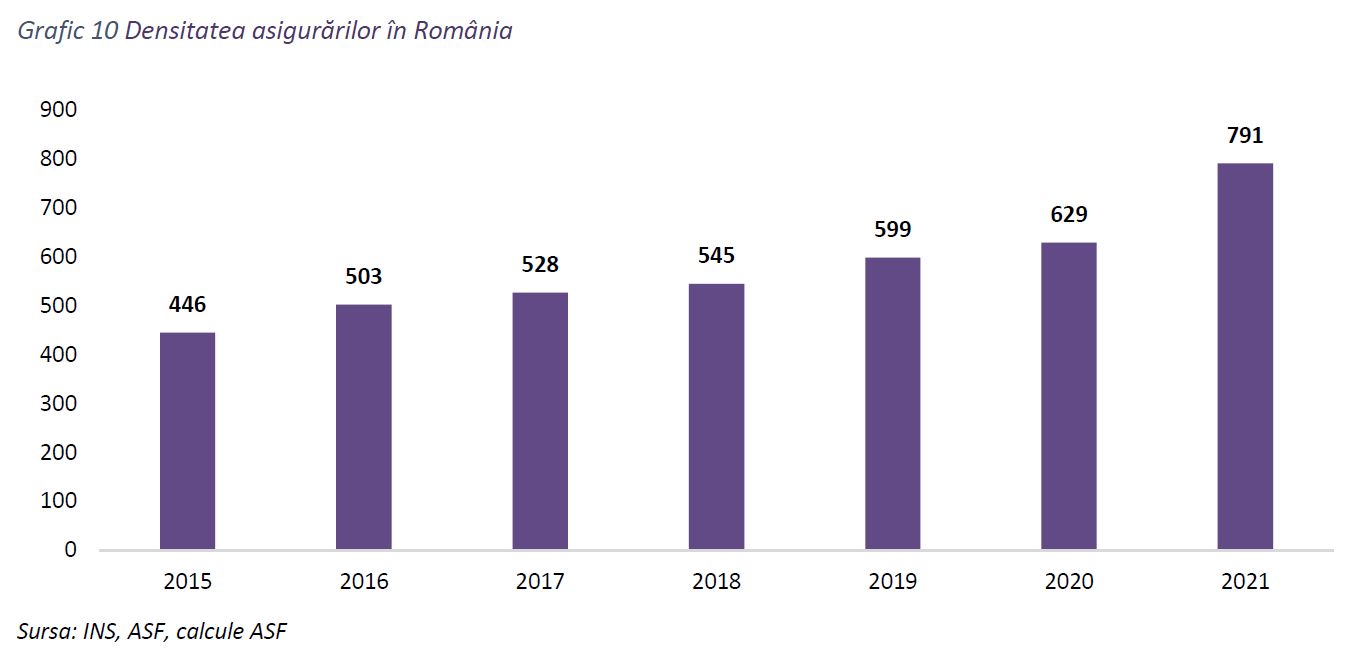

Last year, Romanians spent an average of 791 lei on insurance, which is 26% more

The deficit that insurers are talking about has widened as ASF figures show Romanians spent slightly more on insurance last year.

- VIEW THE ASF INSURANCE REPORT HERE

Here we mean insurance density, a measure calculated as the ratio between the value of gross written premiums and the number of residents of a country, which shows how much the average resident of a country spends on insurance products.

The latest data from the Financial Supervision Authority (ASF) show that in 2021 the insurance density in Romania was 791 lei/capita, which is 26% more than the previous year.

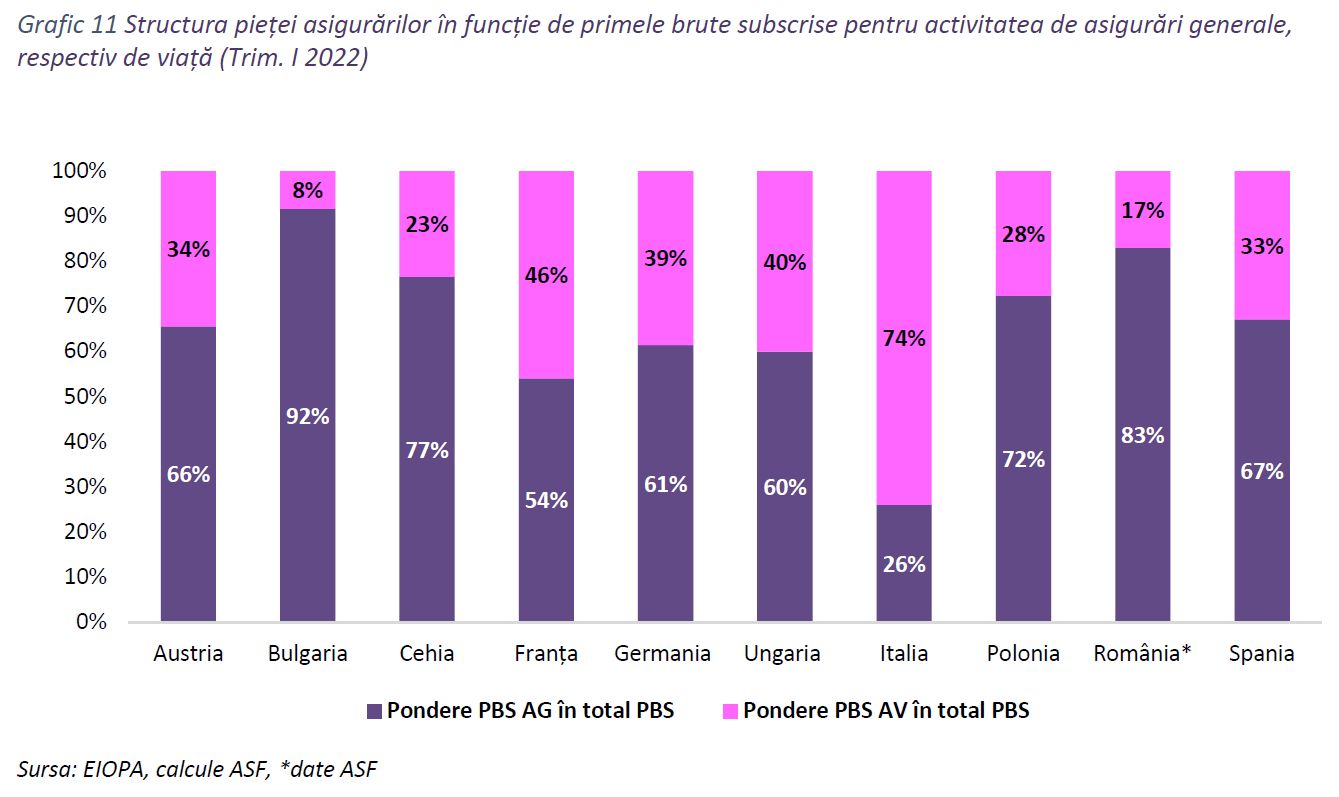

The share of life insurance in Romania is one of the lowest in the region

Despite the fact that the life insurance market grew steadily in the period 2017-2021, the level of coverage in our country remains, however, one of the lowest in the region.

According to ASF data, the share of life insurance activity in the overall insurance sector is at a low level compared to the other EU countries analyzed, although the financial protection received by Romanians through life insurance increased by 11%.

Thus, the life insurance segment accounted for 17% of total subscriptions, compared to approximately 74% in Italy, 46% in France and 40% in Hungary. Bulgaria is worse than us, where the share of the life insurance segment was 8%.

Insurers claim tax benefits when buying life insurance

As a result, to reduce this lack of protection, insurance companies say that one solution would be to provide tax benefits when purchasing life insurance.

- “Most of the OECD member countries, as well as a large part of the European Union member countries, stimulate the development of the life insurance market by fiscal methods.

- In Romania, life insurance policies do not have any tax benefits. In this context, UNSAR and the relevant industry support the need to establish an incentive tax regime for the purchase of life insurance policies with an exclusive protection component.

- Such a measure will have a minimal impact on the state budget, but will bring significant benefits for the protection of the population,” the UNSAR statement also states.

The National Union of Insurance and Reinsurance Companies of Romania (UNSAR) represents 20 profile companies that occupy approximately 90% of the local insurance market share.

Source: Hot News

Mary Robinson is a renowned journalist in the field of Automobile. She currently works as a writer at 247 news reel. With a keen eye for detail and a passion for all things Automotive, Mary’s writing provides readers with in-depth analysis and unique perspectives on the latest developments in the field.