Interest on deposits is lower than inflation, and we complain about loans because they are expensive. Even Iserescu asked the banks to raise interest rates on deposits. “I told the banks several times that they should raise interest rates on deposits. They didn’t! I will tell them again! If they don’t do it now, we may have to look for other solutions,” said the governor of BNR. HotNews talked to an expert about how banks calculate interest when they lend you money or when you make a deposit.

How does the bank calculate the interest it charges on the loan it just gave, and how does it decide how much money to give you for every hundred lei you deposit in the bank?

Let’s take a loan with a variable rate, – explains the expert consulted by HotNews. There is the starting point of ROBOR. why “Because the principle on which the price of the loan is formed is this: if the customer wants a loan, the banker cannot tell him: “Wait a minute until someone comes and makes a deposit, or wait until I find one.” a deposit from which I can give you a loan!”. I need to provide the necessary liquidity to finance this loan where it is easier for me. That is, from the interbank market. This is my direct source of liquidity and a direct alternative for placing resources,” the specialist explains.

If someone wants to get a loan, the banker first of all goes to look for money in the money market – if he wants to provide reliable and reasonable financing. “Then I add the bank’s risk premium,” says the specialist.

When asked to elaborate, he adds, “You know how ROBOR is calculated. There are 10 contribution banks that have better financial health than others in the market and have been selected by the Central Bank. These 10 impose a risk premium on others that has nothing to do with the customer. It is about the risk associated with the fact that the bank demands money.

Added to this risk premium is the liquidity premium associated with the maturity for which the amount is requested. If the client wants a loan for 10 years, I go to an interbank and borrow at ROBOR for 3 months, but for 10 years. Obviously, the longer the maturities I look for, the higher the liquidity premium,” said the quoted specialist. In addition to them, there is a commercial margin related to the client, a commercial margin that must cover all operating costs, the client’s credit risk (cost of risk), and also allow to achieve the required profitability,” the expert explains.

Technically, this takes into account: the capital requirements (own funds) that the bank must have to meet prudential capital adequacy requirements, the corporate tax rate, since the bank shareholder wants to make a net profit – given that the objective of profitability at profit after tax values and the target financial profitability

In essence, this ROE spread is the required margin that the bank charges the client to achieve the required target profitability. Or it represents the gross profit (earned by that investment) that would reward the shareholder at the target return he set, taking into account capital requirements.

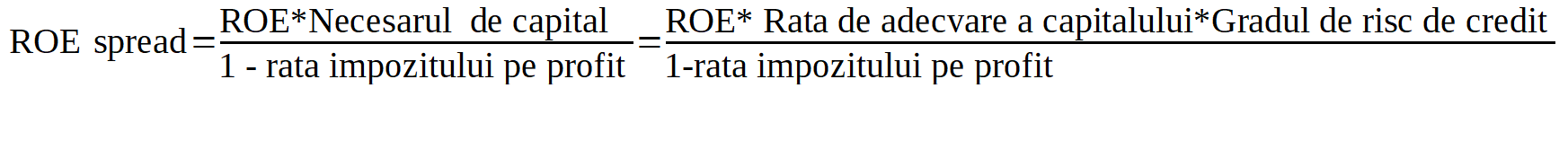

Its formula is as follows:

Essentially, the cost of a variable rate loan starts at ROBOR, adds a credit risk premium associated with the bank, a liquidity premium and a commercial margin. Everything down to the ROE spread are cost elements.

How are we doing with the formation of interest on deposits?

The banker’s judgment regarding a deposit is this: If a client crosses my threshold and entrusts me with a sum of money, my first question is what to do with that money. Maybe they put in the loan right away, but it is not always possible to put all the money in the loan. And further, the most reasonable thing is to place money on the money market. How do I do this? The expert explains: “If I am not a market maker, then I place it on ROBID, from which I subtract the value with a mandatory minimum reserve. What is this cost?

In Romania I have an RMO (minimum reserve requirement) rate of X%. That is, I place X% of deposits in BNR at a much lower interest rate, about 0.2%. From the money entrusted to me, I also reduce the cost of deposit insurance, which is differentiated according to the rating of each bank,” says the expert.

This means that ROBID, ROBOR are not elements of profitability and do not have a direct impact on the interest margin of the loan and deposit.

Explanation of the high margin of loans and deposits in the banking system of Romania:

Loan margins compared to interbank rates are competitive compared to other countries, while deposit rewards are low. It’s not that loans in Romania are expensive, but that deposits are poorly paid.

The margin on loans to individuals compared to interbank interest is more competitive than the margin on loans to companies. The margin on loans to companies is higher in Romania due to the risk of bankruptcy of the company due to low financial discipline, as well as the low capitalization of Romanian companies

The price of loans (in absolute terms) in Romania is higher than in other countries, also due to higher interbank interest rates (but since inflation is higher here than in other countries…), higher operating costs (scale effects are unfavorable – the level of financial intermediation in Romania is much lower than the European average and most operating costs are fixed) and higher risk costs (the level of non-performing loans is higher and debt recovery costs are higher).

Source: Hot News

Mary Robinson is a renowned journalist in the field of Automobile. She currently works as a writer at 247 news reel. With a keen eye for detail and a passion for all things Automotive, Mary’s writing provides readers with in-depth analysis and unique perspectives on the latest developments in the field.