Florian Popescu took out a mortgage for 35 years. Now he has his own apartment and hopes that nothing bad will happen to him for the next 35 years. The fact is that Florian does not know that taking a loan for so many years is not recommended at all. And let us tell you why.

The short answer is that a 30-year mortgage is almost twice as risky as a similar 20-year mortgage. And the risk comes from a combination of two indicators that many people haven’t heard of: LTV and DTI.

LTV (loan to value) represents the share of the loan value in the total market value of the collateral. The indicator determines the maximum amount of credit that the bank is ready to provide to the borrower. In addition, the LTV is directly related to the level of the down payment or down payment that the borrower is required to make in order to be able to purchase the home. House prices change over 35 years, so an apartment you paid 70,000 euros for today could be worth 40,000 euros in a crisis.

DTI (debt to income) shows how much of your income you use to pay off your debts. If you earn €2,000 today and have a rate of €500, this is called a DTI of 25%. If your salary drops to €1,000 per month, DTI instantly rises to 50%.

I know there are countries that offer multi-generational mortgages. Where parents do not leave a house to their children as an inheritance, but some contributions to the bank.

Let’s look at the numbers, I say:

In September 2022, mortgage loans granted for 30 years or more accounted for about 8% of banks’ portfolios by volume, and about 7% by number, National Bank officials told HotNews.ro.

It is true that the average maturity of these loans has decreased over time. If before the previous crisis, Romanians borrowed an average of 25.58 years for a house, last year the average duration of the loan was 23.4 years, after the average mortgage loan was issued for 23.3 years in 2015, representatives of the BNR Stability Office also say.

Does a loan taken for 30 years or more increase housing affordability for the population?

For a 20-year mortgage, the affordability index is 0.91, according to BNR calculations.

“The index on access to the credit market for housing purchase is calculated as the ratio between available income and the optimal income required for arranging a real estate loan on prudential terms.

The higher this indicator, the better the availability. The indicator is calculated for a 2-room apartment (according to imobiliare.ro, national level) with an area of 55 square meters and an average annual net income per economy (according to INS, national level). A loan with a down payment of 25 percent and a debt-to-equity ratio of 45 percent is taken into account. The interest rate used is relative to the flow of new mortgage loans. The estimated date is December 2021,” representatives of the Office of Financial Stability of the BNR informed HotNews.

In the case of a 30-year mortgage, the same index rises to 1.17, and if the loan has a maturity of 35 years, the affordability rises to 1.26.

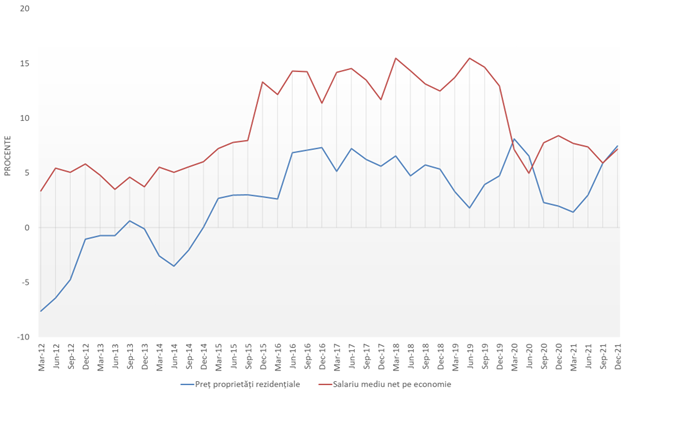

How the average price per square meter of housing has changed compared to the average salary

The dynamics of the annual rate of growth of prices for residential real estate and the average net salary in the economy:

People borrow for 30 or 35 years because that way they manage to get into the debt level limited by the NBR.

Florian wanted an apartment for 100,000 euros, and his salary was 5,700 lei. In order to meet the rate of 40% of income, this meant allocating a maximum of 2,300 lei. And with this money, he only qualified for a 35-year loan. A 25-year-old would have 2,700 lei, and a 30-year-old would receive 2,530 lei every month.

Just like this: after 35 years, you will see that you have returned more than a million lei to the bank for your half-million house (at the rate of 5 lei/euro), while with a 25-year loan you will return 800,000 lei to the bank.

And the rate of principal repayment on a 30- or 35-year mortgage is extremely slow. After 10 years of payment, you will find that the balance of the 30-year loan is 380,000 lei, compared to 280,000 lei for the 20-year loan. This also explains why a 30 or 35 year loan is much riskier.

Although affordability increases with loan tenure, we see a faster increase in average home prices compared to average income. In the 1970s (when the average salary was around 1300 lei according to the INS) you worked for an apartment for about 53 months.

Now the residents of Cluj must make every effort to buy a house with an area of 60 square meters without taking a loan from the bank. They need 139 months of work at the average salary in Cluj, on the absurd assumption that they will save their entire monthly income.

When home prices rise, so does the required down payment (10%, 15%, or whatever the client can offer), given wages that rise (if they rise) much more slowly. In short, the DTI we talked about at the beginning of the article is growing.

Does the loan repayment period affect the change in housing prices?

Macroprudential measures, including those related to limiting the repayment terms of real estate loans, lead to changes in lending standards and adjustment of credit demand, say representatives of the Directorate of Stability interviewed by HotNews.

Given that a significant share of real estate transactions is financed by bank credit (37 percent, September 2022), a decrease/increase in the repayment terms of real estate loans will lead to a decrease/increase in demand for such loans. Market prices are formed at the intersection of demand and supply, so a change in demand for real estate will lead to an adjustment in housing prices in the same direction.

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.