Romanian Post couriers currently use up to five physical receipts (including reserves) and manually perform all actual pick-up and delivery operations at the customer’s residence/head office, and AWB scanning is performed only before shipping to and, accordingly, when returning from daily routes, which does not provide visibility of delivery in real time.

These are just some of the disadvantages faced by the Romanian Post in the competition with private operators, a battle in which it has begun to steadily lose ground in recent years.

This information is contained in the specifications of the tender announced the other day by the Post of Romania in the electronic system of public procurement (SEAP).

The Post Office recognizes that its courier services fall into the “Other” category.

Romanian Post’s customer home/head office operations are currently carried out with 400 vehicles under limited technological conditions, which has led to a constant decline in service quality in recent years.

- “According to the 2020 ANCOM report, the reorientation of customers to the services offered by competitors has put the courier services of the Romanian Post in the category of “Other”, according to the 2020 ANCOM report, thus CNPR has lost 13% of the market to the players, who invested in technology.” , – reports the national postal operator.

With a network of more than 5,500 postal units, the post office sends out more than 11 million pieces of mail every week, and nationally provides door-to-door courier services in the express category, called Prioripost, in all settlements of the district center and within a radius of 15 km from it .

The company says delivery times for express services are 12 hours to county centers, 24 hours between county cities and towns within the same county, and 36 hours between any other city in the country.

This is an area where Post has significantly lost market share to private couriers.

What problems do courier services of the Post have: All operations are performed manually

In the tender documentation, the Post lists several reasons that put its services in the express category at a lower quality level than other express courier operators.

“Thus, the reasons that led to the perception of the low quality of the above services are the manual execution of all actions related to the transportation and delivery of goods, the lack of optimization of daily routes, the degree of flight congestion. , as well as operating parameters of cars (fuel consumption, average speed, parking, etc.):

- – daily route planning is done manually, without software optimization, as couriers need to configure routes using personal smartphones, entering addresses from mailing lists received each morning, before leaving for the races, a process that does not take into account route optimization in the sense of reaching the maximum level economic efficiency;

- – AWB scanning actions to create statuses communicated to customers are only performed before leaving the field and therefore after returning from daily routes, which does not provide delivery/removal visibility, nor does it provide delivery attempt statistics or real-time statuses of each shipment times;

- – all operations related to the actual reception and delivery of the shipment to the recipient are performed manually, using up to five physical receipts (including reserves), confirming signatures are collected manually and do not ensure their transmission in real time, a fact that prevents the centralization of information for further processing in order to optimize the quality of service provision, as well as generate additional processing time reflected in costs;

- – all actions related to the payment of the shipping or return tariff are performed manually, there are no mobile devices for cash operations, receipt management, issuing cash, receipts, all this is done on paper, the processing times as a result of deliveries/receipts increases.

The acquisition, with the help of which the Post Office wants to change this situation

In this context, Post Romania has announced a tender for the purchase of secure PDAs with Android operating system (minimum version 10), portable thermal printers with Bluetooth and autonomous GPS devices for 400 vehicles (and couriers) in order to optimize, optimize and control the activities of receiving and delivery of goods in the express category.

This purchase provides the following benefits:

- shortening the terms of receipt/delivery of postal items of the express category in real time monitoring of couriers

- updating the statuses of each postal shipment in the express category in real time

- on-site operations with AWB labels (scanning, generation, printing) on-site cash collection with the issuance of a tax receipt with a waybill accurate and automated monitoring of courier activity

- creating complex reports to measure performance and reduce costs

- collection and transfer of receipt signatures

- increasing the level of customer satisfaction and service quality by simplifying, automating and digitizing the operations performed by Posta couriers in the field

The approximate cost of the contract, which is carried out according to the simplified procedure, is more than 1.7 million lei (without VAT). The deadline for receiving tender offers or applications for participation is November 10, 2022. On the same day, a meeting on the opening of tender offers will also be held.

Parcel traffic generates more than 80% of postal services revenues: leading companies

Last year, official data showed that parcel traffic, including small packages, grew by 13% in 2021 to 218 million shipments, contributing 81% to the realization of postal service revenue.

The decline in postal traffic (letters, printed matter) slowed to just 1% (compared to 6% in 2020), thus allowing related revenues to grow by 2%.

- “Fast, easy and close delivery of parcels is the main competitive advantage in the postal sector. Competition in this segment is healthy: at least 5 providers are fighting for 80% of the parcel market,” said Eduard Lovin, vice-president of the communications regulatory body (ANCOM), last month.

Total mail traffic increased by 4% compared to 2020 to 595 million units, and total revenues exceeded 4 billion lei, an increase of 11%, mainly due to the continued growth of parcel traffic.

After strong growth in 2020, parcel and small package traffic grew by 13% in 2021, both in terms of volume and revenue, contributing more than 80% of postal revenue for the first time.

Mail and print traffic slowed to 1% (compared to more than 6% in 2020), while revenues rose 2%.

The average income per referral reached 6.8 lei (from 6.4 lei in 2020); domestic remittances brought an average income of 5.7 lei, incoming international transfers 12.7 lei, and outgoing international transfers 70.5 lei.

Domestic mail and printed products brought in an average of 1.8 lei per shipment, and parcels and small packages – 12.8 lei per domestic shipment.

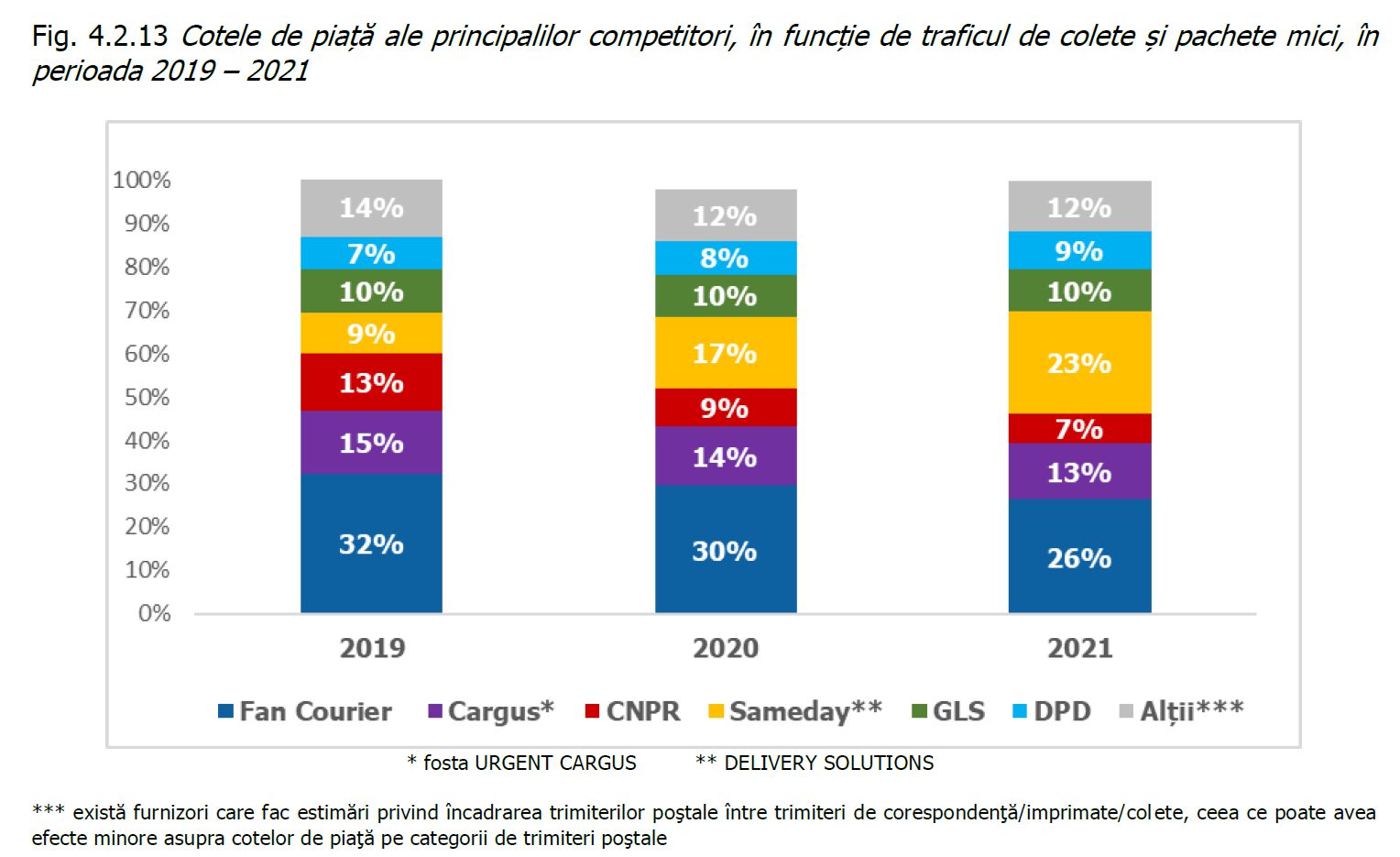

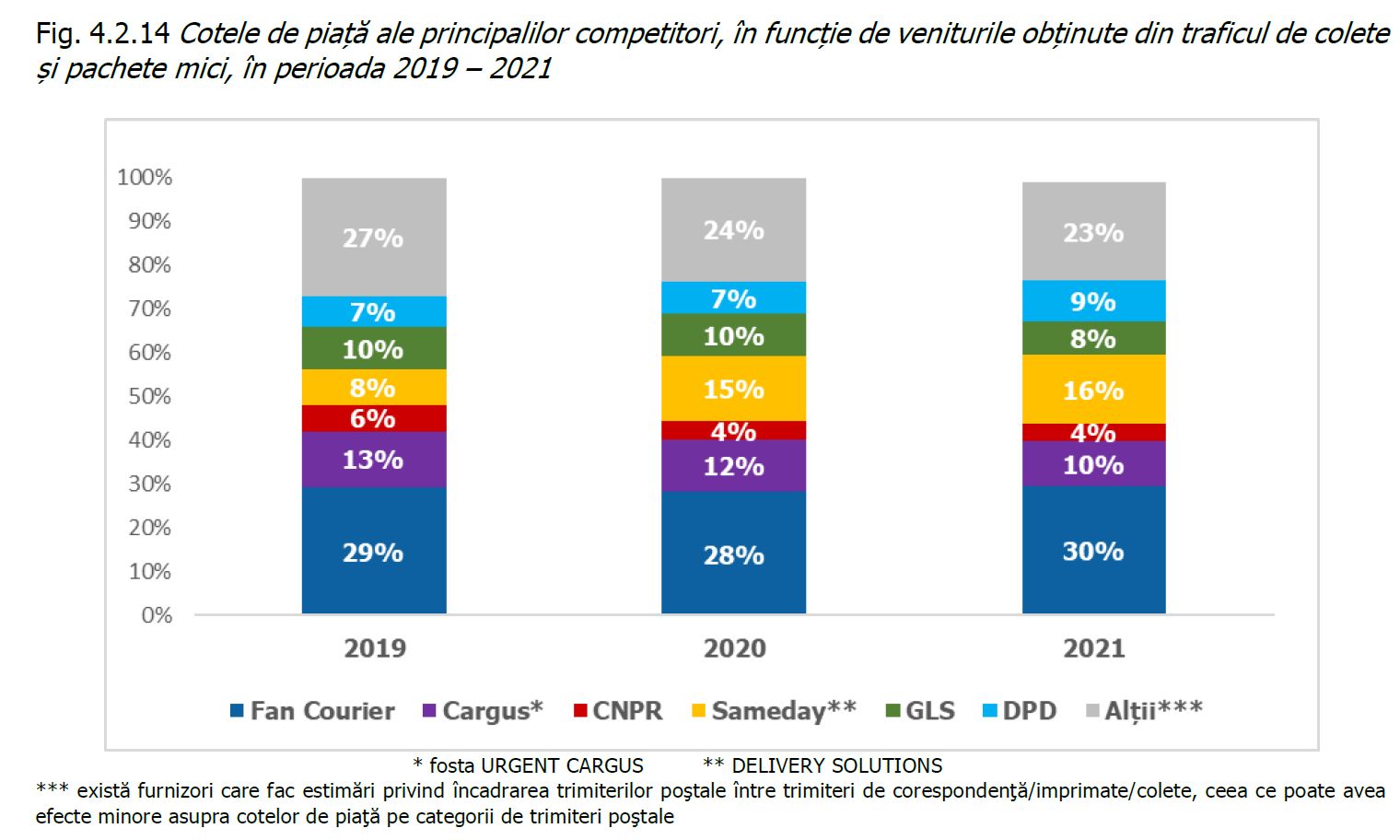

After reaching parcel delivery traffic in 2021, the main competitors were Fan Courier (26%), Sameday (23%) and Cargus (13%).

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.