In recent years, there have been three major bankruptcies of insurance companies under the “close supervision” of the Financial Supervisory Authority (ASF): City Insurance, Carpatica Asigurări and Astra Asigurări, all controlled by Romanian businessmen with political connections, leaving behind tens of thousands of people who are not managed to return only a part of the requested compensations.

HotNews.ro asked the Insurance Guaranty Fund (FGA) to present the situation with payment requests submitted by Romanians in the case of 3 major bankruptcies and the amounts paid out so far.

It should be noted that, according to the law, from the moment of the decision on the bankruptcy of the insurer in court, the Guaranty Fund of Insurers (FGA) can make payments only to those injured parties who have submitted claims for payment and have complete files. , and the payment of compensation will be made within 500,000 lei (100,000 euros) under the insurance contract. Injured parties have 90 days to file claims for payment.

Those who want to withdraw more than the maximum limit of 500,000 lei must register in the credit table at the court.

City Insurance bankruptcy: what payments the FGA has made until the end of August 2022

City Insurance, the former leader of RCA, controlled by Dan Odobescu, Adrian Nestase’s son-in-law, filed for bankruptcy last year, with a final bankruptcy order set for April 22, 2022. The deadline for submitting payment requests to the FGA is July 20, 2022.

What compensation have the Romanians demanded so far and how much have they received from the FGA?

Former clients or injured parties have so far collected almost 385 million lei from only 40,000 payment requests approved by the Insured Guarantee Fund, although the number of requests is 6 times higher.

- “As of August 31, 2022, 248,193 payment claims were registered, of which 40,305 payment claims were approved by the special commission. The corresponding payments amount to approximately 385 million lei.

- The total cost of compensation sought in registered claims is not available – it will be highlighted as payment claims are analysed.” FGA representatives informed HotNews.ro about this.

Bankruptcy of Carpatica Insurance: payments of 493.3 million lei for a compensation request of about 770 million lei

The second high-profile insurance bankruptcy was the bankruptcy of Carpatica Asigurări, a company controlled by businessman Ilie Karabulea.

In the summer of 2017, he was sentenced to five years and six months in prison in the Karpatyka case, and was released on parole in 2018.

The final decision on the bankruptcy of Carpatica Asigurări was made in court on March 24, 2017.

What compensation did the former Carpatica victims seek and how much did they ultimately receive from the FGA?

- “Until 31.08.2022, 37,413 payment requests were registered (not in the case of Carpatica Asigurări), of which 37,190 payment requests were approved by the Special Commission. The corresponding payments amount to 493.3 million lei. The requested compensation amounted to approximately 770 million lei,” This was stated by FGA representatives for HotNews.ro.

Bankruptcy of Astra Asigurări: payments of 551.7 million lei for the requested compensation of about 900 million lei

The third major insurance bankruptcy was that of Astra Asigurări, a company controlled by former businessman Dan Adamescu, who died in January 2017.

On Thursday, April 28, 2016, the final decision on the bankruptcy of Astra Asigurari was made.

What kind of compensation did the Astra victims here seek and how much did they end up getting from the FGA?

- “Until August 31, 2022, 67,507 payment claims were registered (not in the case of Astra), of which 67,377 payment claims were approved by the special commission. The corresponding payments amount to approximately 551.7 million lei. The requested compensation was about 900 million lei,” This was reported to HotNews.ro by representatives of the Guarantee Fund of policyholders.

How does the FGA see the evolution of claims and payments made so far in the case of 3 bankruptcies?

- “Received requests belong to the “history” of FGA, with the exception of premium refund requests, which in the case of City Insurance are significantly more than in the cases of Astra Asigurări SA and Carpatica Asigurări SA, taking into account the change in legislative provisions – accordingly, the cancellation of all insurance policies. Therefore, in the case of City Insurance SA, the number of premium refund requests is 77,386 compared to 741 requests in the case of Carpatica Asig SA and 9,855 requests in the case of Astra Asigurări SA.”, – said representatives of the FGA.

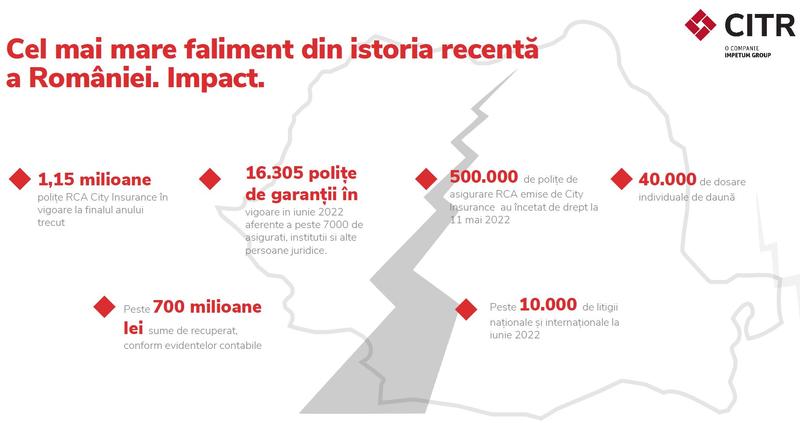

Judicial liquidator CITR: City Insurance – the largest insurance bankruptcy

Of the 1.15 million RCA policies in force at the end of last year, of which 500,000 were automatically terminated on May 11, 16,305 guarantee policies are still in force today covering more than 7,000 policyholders, institutions and other entities, and as well as more than 10,000 national and international disputes, the bankruptcy of City Insurance is the largest in the recent history of Romania, said in June 2022 CITR, the judicial liquidator of the former leader of RCA.

Bankruptcy City Insurance Photo: CITR

CITR completed its report into the reasons for City Insurance’s bankruptcy in four months.

- SEE THE FINAL REPORT ON THE REASONS FOR THE CITY’S BANKRUPTCY HERE

Photo source: Dreamstime.com.

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.