More than 7.8 million Romanians who pay contributions to the second level of the mandatory private pension transferred more than 577 million lei in commissions to seven pension fund administrators last year. The government considers unjustified the allowances, which through the AFS propose to cancel the commission on paid contributions – one of the 2 sources of income for administrators. What is behind these numbers and how can it affect us?

Main sources of income for Pillar II administrators: which commissions will be cut and why?

Currently, the income of 7 private pension administrators, who manage assets of more than 92.4 billion lei in Level II alone, comes from the commission for the administration of these assets, which consists of 2 sources:

- a) deduction of the amount from the paid contributions, but not more than 0.5% and

- b) deduction of a percentage from the total amount of net assets of a privately managed pension fund, but no more than 0.07% per month.

On Monday, August 22, the Ministry of Labor released a draft order on emergency situations, which, among other things, proposes: cancellation of commission on paid contributionsone of the two sources of income for Level II administrators.

What motivates the event?

- “The current regulation of the management fee charged by administrators of private pension funds consists of two sources, both paid by members of private pension funds, causes an unreasonable reduction of the non-state pension which must be received at the end of the contribution period,” says the GEO project.

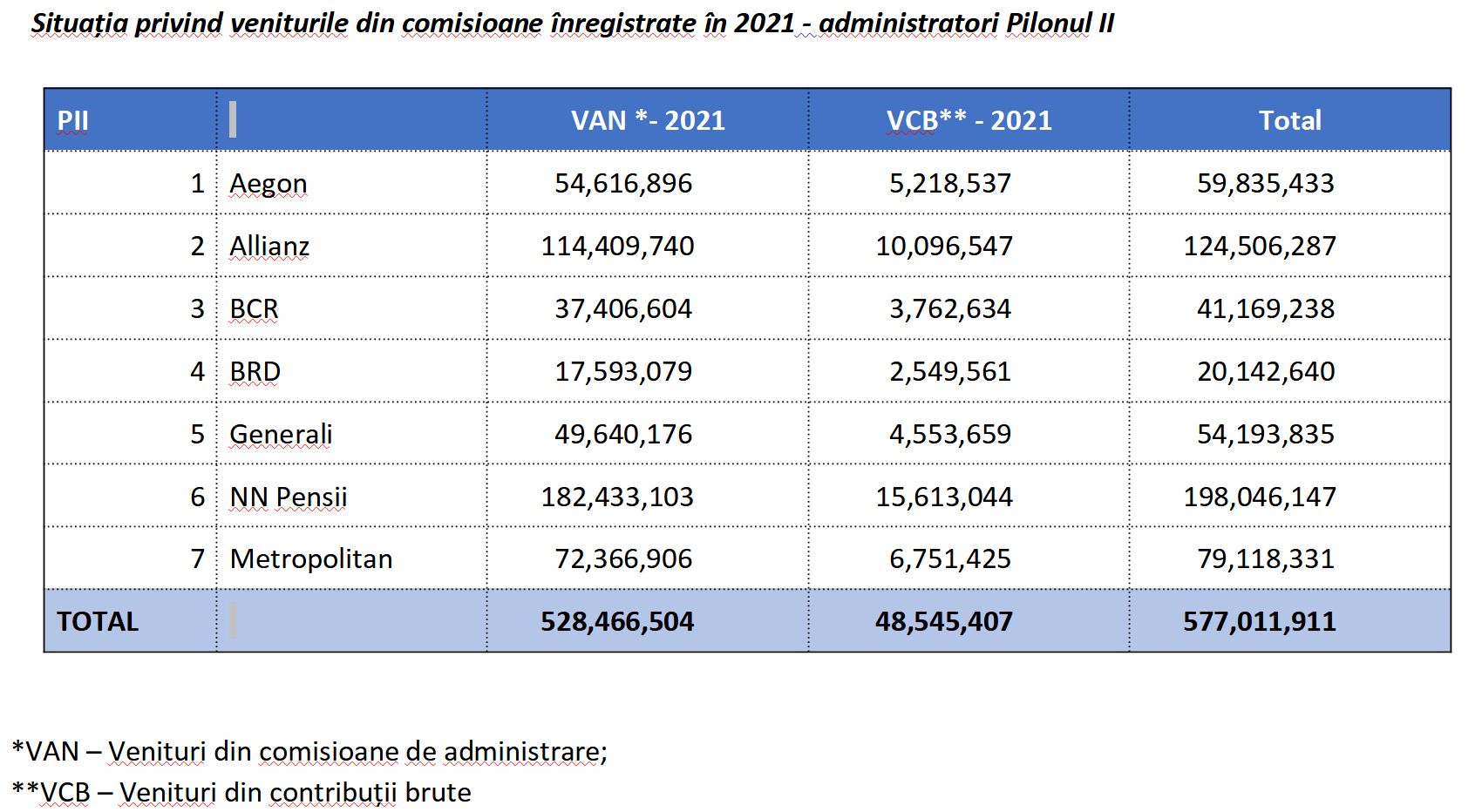

What were the earnings of 7 level II admins from 2 commissions last year and this year

ASF previously told HotNews.ro how much the fund’s administrators earned last year from these 2 types of commissions: more than 577 million lei, of which 48.5 million lei were collected from commissions for paid contributions.

How much did you collect this year?

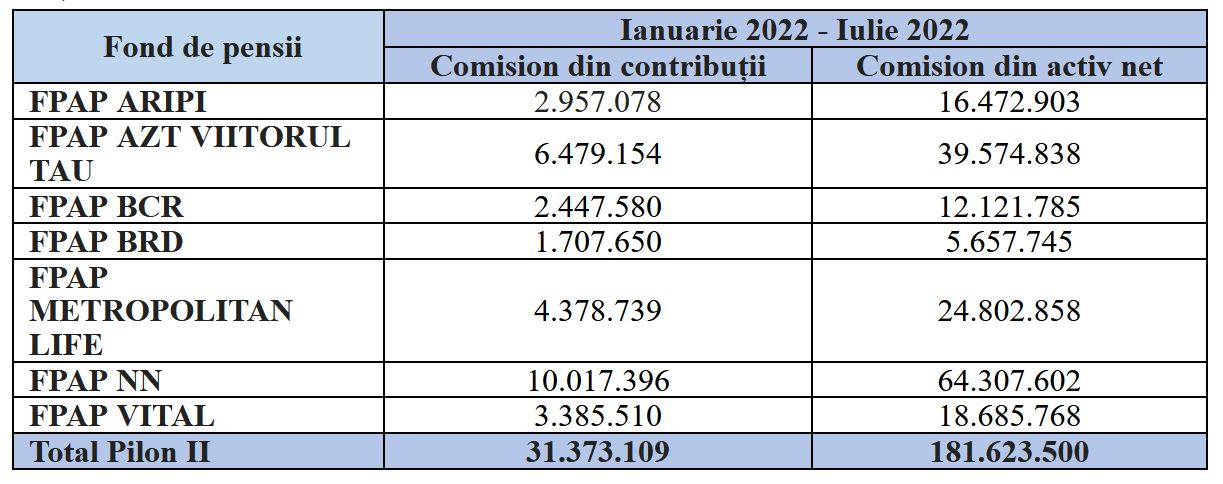

ASF data provided to HotNews.ro show that between January 2022 and July 2022, 7 private pension fund administrators collected 31.37 million lei from contribution fees and 181.62 million lei from net asset fees in 2022 .

It should be noted that, according to the law, the amount of management fee charged by managers of private management funds from the total amount of net assets can be 0.07% per month only if the rate of return of the fund exceeds the inflation rate by more than 4 percentage points.

If the return on funds is lower than the inflation rate, as it is now, this commission cannot exceed 0.02% per month.

From May 2022, the fee charged by private pension funds on the fund’s net assets was 0.02% for all private pension funds, according to the ASF.

ASF, on the reduction of contribution fees: Money will go to the accounts of Pillar II participants

HotNews.ro asked the Financial Supervisory Authority (ASF) to clarify whether this commission reduction could affect the management and investment activities and, ultimately, even the income of second-tier participants.

- “Amounts allocated as individual participant contributions will be fully found in the assets of the fund under management, to which the management fee is applied from the total amount of assets. Thus, the distribution of contributions will no longer be commission-based, the full amount of the contribution will be credited to the participant’s account, which leads to an increase in the number of participants’ fund shares.” This was stated by ASF representatives for HotNews.ro.

In other words, the ASF argues that Romanians will have more money in their Tier II accounts, so private pension administrators should receive more through the only fee that will remain, the net assets fee.

What then worries administrators of non-state pensions?

What 7 second-level administrators fear: the government will force them to operate at a loss, with revenues lower than expenses

Administrators of private pension schemes warned authorities last week that the abolition of contribution charges would further exacerbate this year’s sharp fall in incomes, which may affect the stability of operations in Romania.

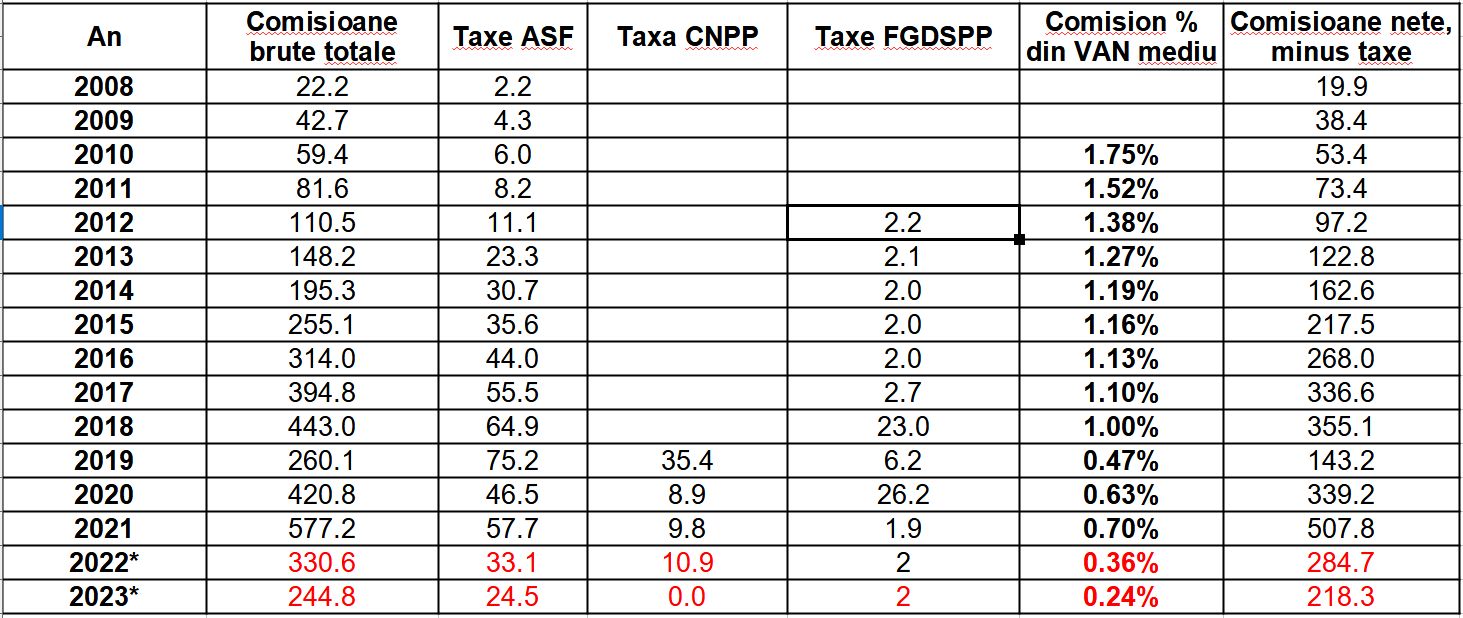

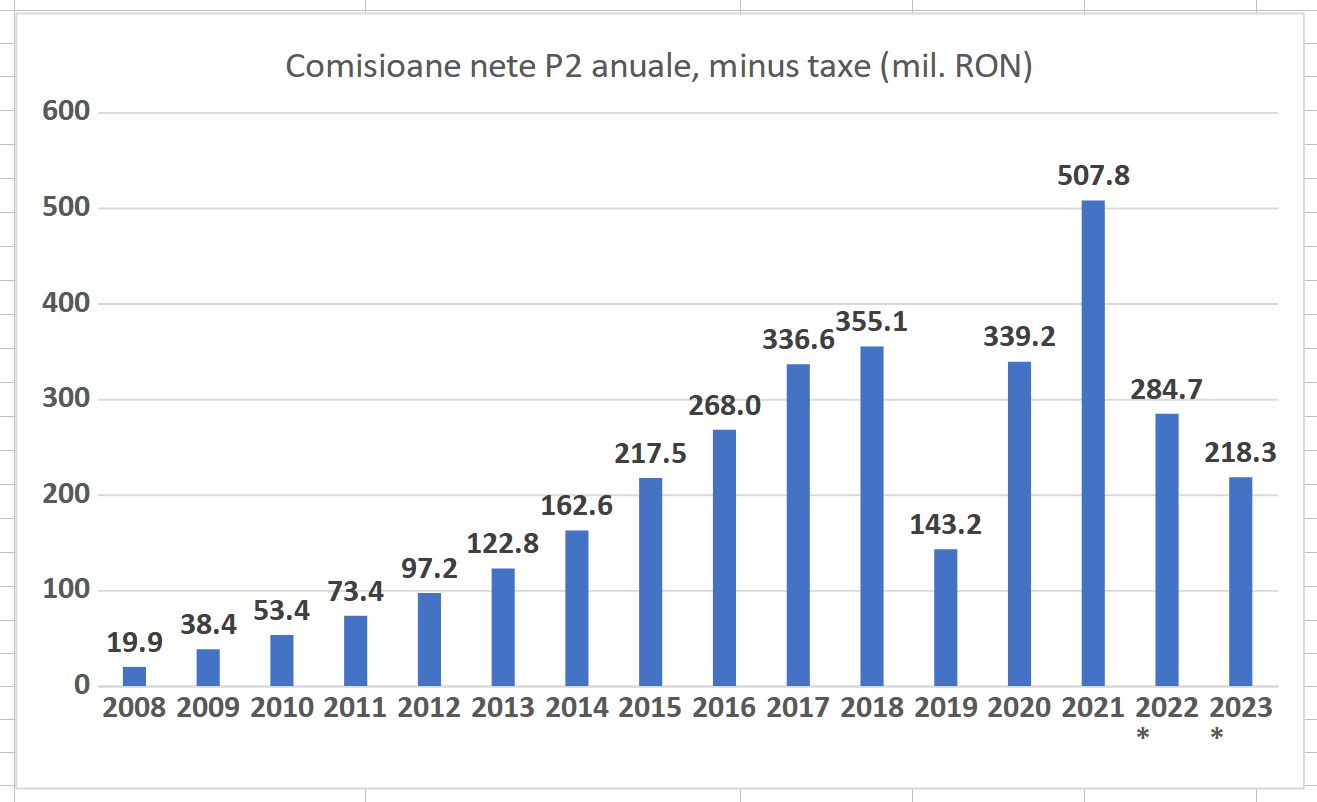

They say that this year, against the backdrop of financial market volatility and an implicit decline in the performance of pension funds, they expect commission income to fall by 43% compared to last year, meaning income of around 330 million lei compared to income of more than 577 million lei in 2021 .

In addition, the abolition of contribution fees, currently proposed by the ASF and the Government, will further reduce these revenues by 15-20%, respectively by approximately 55-60 million lei, according to APAPR estimates.

Public data analyzed by HotNews.ro shows that if commissions were abolished, the 7 pension fund administrators would next year have revenues from Tier II commissions of around 220 million lei, given that annual expenses reach approximately 400 million lei.

Below, we will return to the exact structure of income and expenses of companies that manage assets in Pillar II.

How much would people earn if contributions were abolished? On average, 1 lei per month

I have seen the ASF claim that members will benefit from no longer having to commission the distribution of contributions by crediting the member’s account with the full amount they have contributed.

The latest ASF figures show that at Tier II, the average contribution of participants with contributions remitted on 31 March 2022 was approx. 217 lei/participant.

How much would the average Pillar II member earn if the 0.5% contribution fee were eliminated? A little more than 1 lei. This is 0.5% of 217 lei.

Therefore, the profit for participants will be minimal. The same is true of what the ASF says would be gained by moving money into net assets, where administrators would have to commission more.

55-60 million lei added to the total value of assets exceeding 92.4 billion lei means nothing, it is unlikely to be seen in the additional income that the administrators will collect.

The government does not touch the money ASF withholds from Romanians’ Tier II contributions

Few people know that according to the current legislation, 10% commission income which are used by administrators, go directly to the accounts of the Financial Control.

Another percentage goes to the National Pension Fund (CNPP). Part comes in the form of contributions to the Non-State Pension System Rights Guarantee Fund (FGDSPP).

If we look at the data in the table above, we can see that last year, out of the total income of more than 577 million lei received by administrators through the application of 2 types of commissions, ASF kept 57.7 million lei in the accounts, Building National Pension Fund (CNPP) – 9 8 million lei, and the Guarantee Fund – 1.9 million lei.

In the end, 7 administrators were left with a net income of 507.8 million lei.

GEO Project on Component II completely written by ASFas PSD Labor Minister Marius Budei said, the money ASF withholds from Romanians’ Tier II contributions is not touched at all.

However, as currently formulated in the GEO, the National Pension Fund Commission (CNPP) will be abolished. This is due to the fact that the Pension House currently withholds 0.1 percentage point of the 0.5% commission applied to contributions paid, this commission will be abolished.

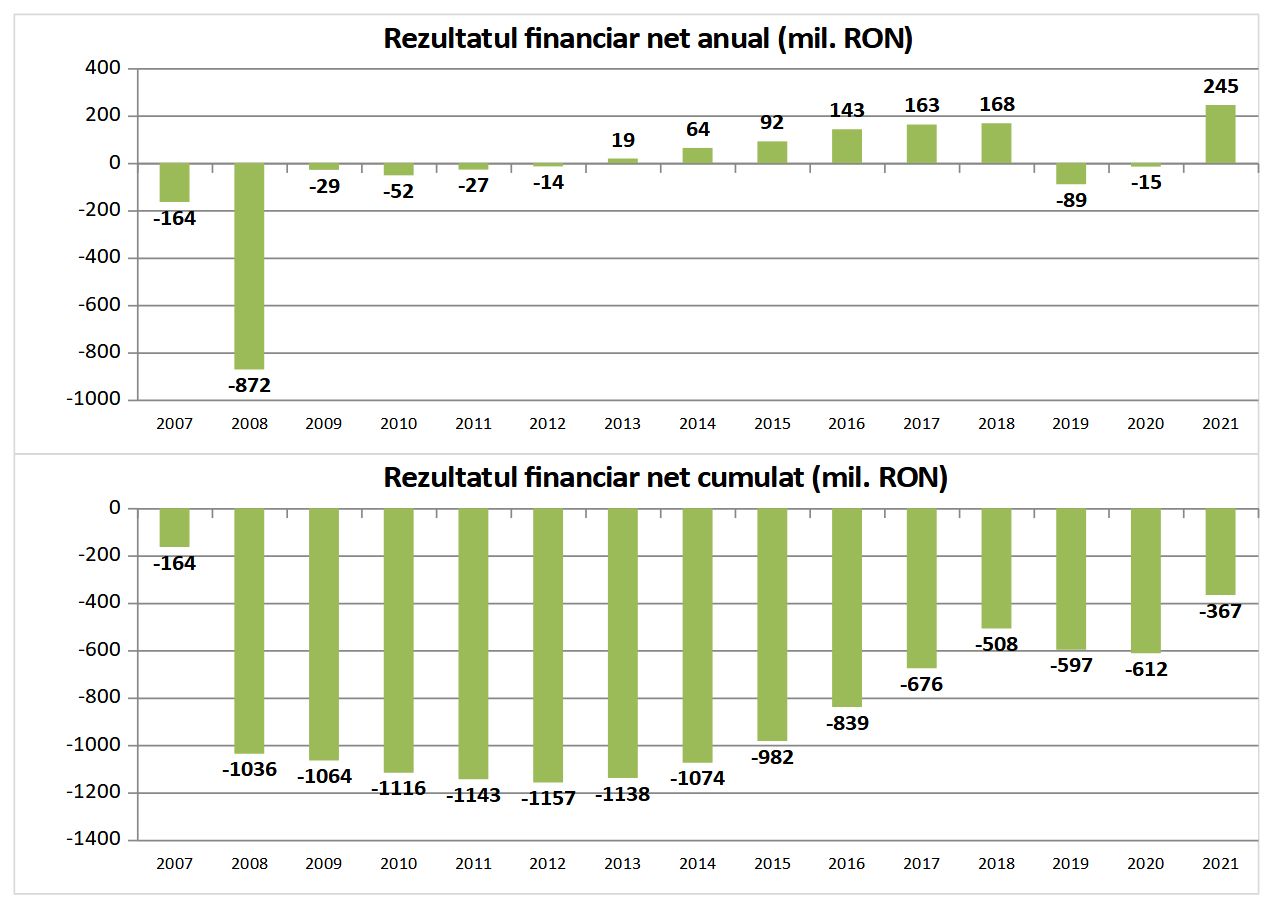

Biggest problem: In 15 years, only 2 administrators have recouped their investment in Pillar II

Another thing that few people know, but which can be seen in the financial results published by the Ministry of Finance, is that during the 15 years of Pillar II’s existence, only 2 trustees have repaid their investments – “NN” and “Metropolitan Life”.

The biggest costs were at the beginning, in 2007-2008, when the campaign to join Pillar II began and when companies invested in agents and a marketing campaign to attract people. For example, Allianz-Tiriac had a net loss of more than 390 million lei in 2008, and 15 years later it is still not in surplus.

Another moment that caused significant costs was the famous Ordinance on Greed (OG 114/2018), which came into force in 2019.

The administrators ended last year with a combined net profit of 245 million lei, but Pilon II’s combined 15-year result shows a net loss of more than 360 million lei.

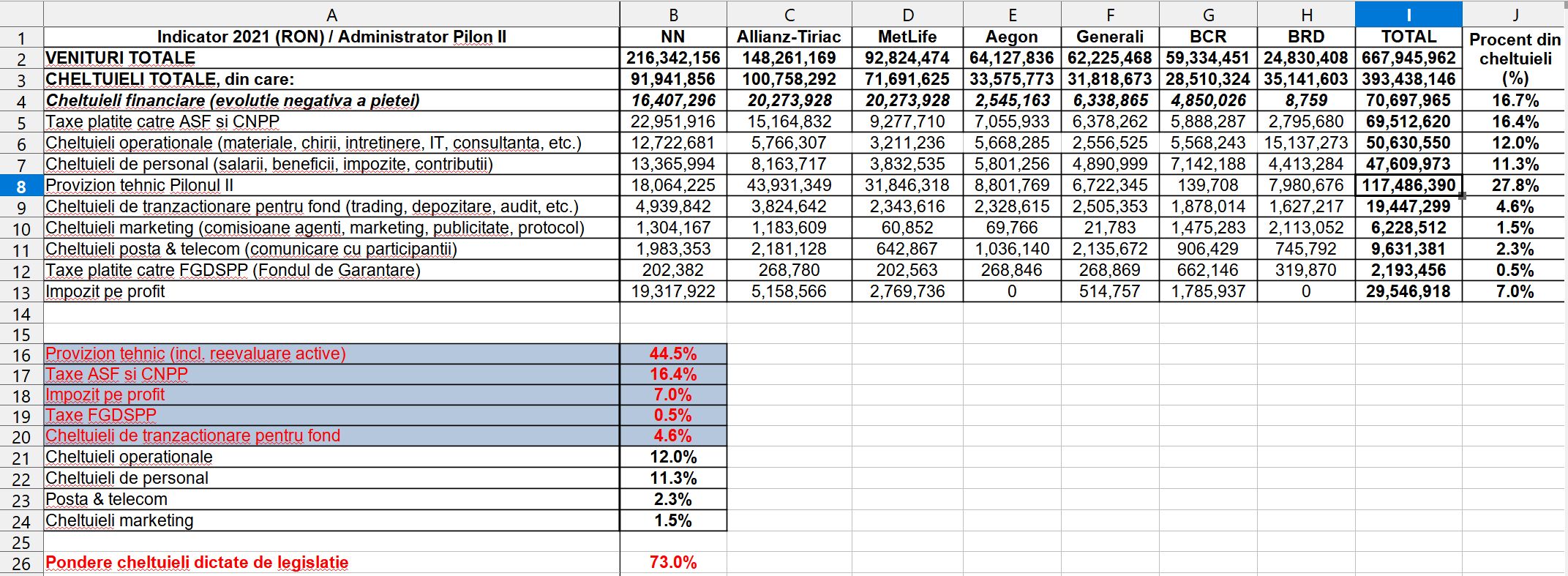

What business did 7 fund managers have last year: Expenses of almost 400 million lei

Public data on the website of the Ministry of Finance also show that last year 7 administrators of private pension funds had total revenues of almost 670 million lei and expenses of almost 400 million lei.

- Carefully! These results apply not only to the II level of pensions, but also to the income received from the activities of the III level of pensions and other financial incomes, which have 7 companies.

Of the expenditure of approximately 400 million lei, 44.5% is for technical reserves, i.e. funds set aside for deposits and government securities, which are used in crisis situations like this year, when asset values have decreased and those who are retiring , will receive less money than they contributed.

As the law forbids it, the fund managers have to make these provisions and the money is used to cover the difference and give people the money guaranteed by the law.

Other costs required by law include taxes to the ASF, the Pension House, the Guarantee Fund and capital market trading costs for the fund. More than 70% of expenses in 2021 are provided by law.

Or in conditions where the annual expenses are somewhere around 400 million lei, and the income from the second level will decrease even more next year to 220 million lei, it is clear that the fund administrators warn that the stability will affect the operations of the entire pension system of the second level. , which will affect us all.

Photo source: Dreamstime.com.

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.