HotNews asked representatives of several banks to run a simulation for us to see how much bank rates rose after ROBOR topped 8%, just a day before the NBR hiked again. We also discussed to what extent the leadership of the BNR can increase the price of money tomorrow.

Currently, the NBR reference interest rate is 4.75%. At this level, the 3-month and 6-month ROBOR index exceeded 8%. Last year at this time, it was about 1.5% (3-month) and 1.64% 6-month.

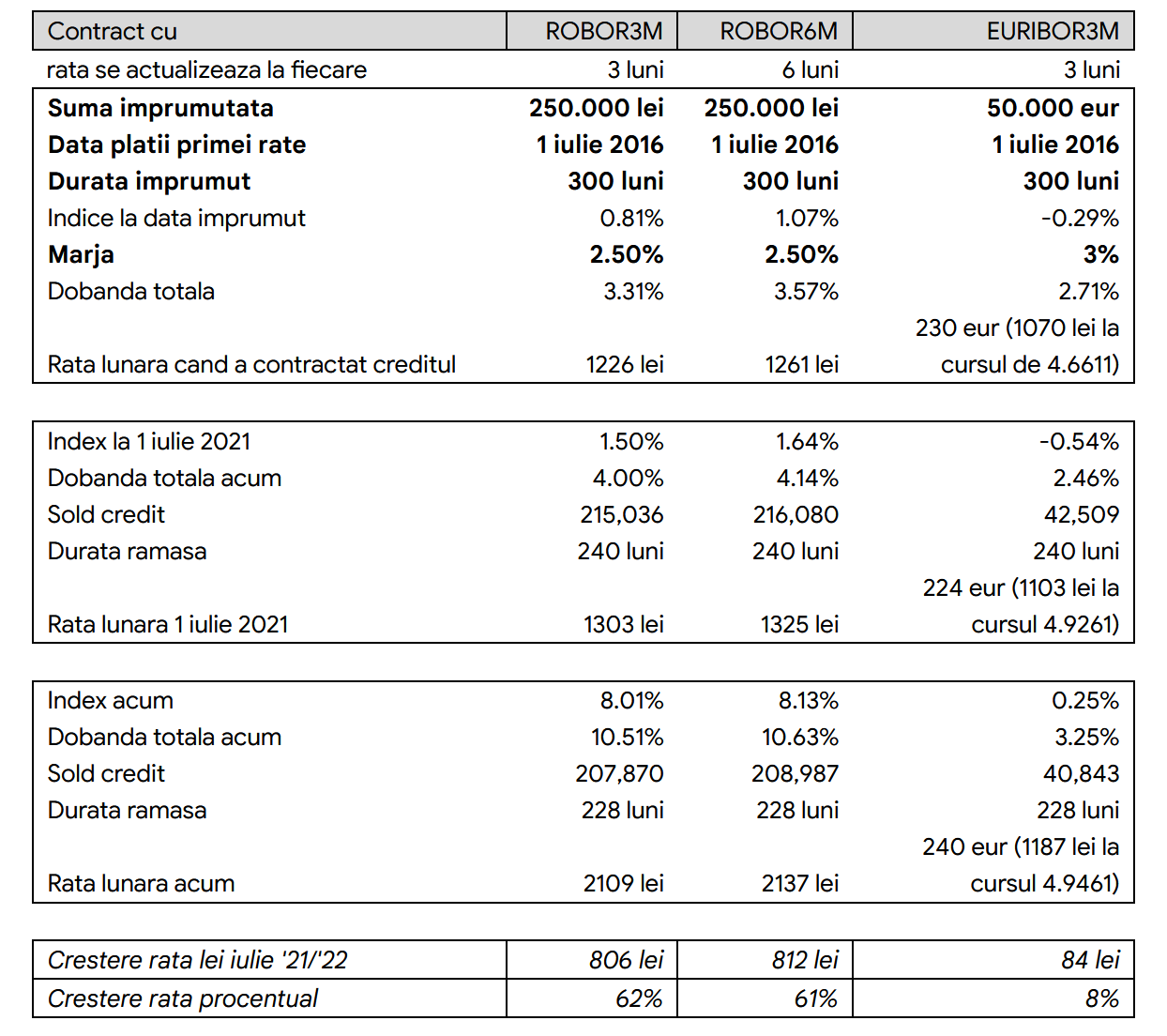

ING: Robor increased the mortgage loan rate by 8% from 1,303 lei to 2,109 lei (62%)

If a customer took out a ROBOR-linked mortgage in 2016, their rate would increase by 62% between 2021 and 2022. (from 1,303 lei on July 1, 2021 to 2,109 lei on July 1, 2022)ING representatives say.

In the case of a mortgage loan of EUR 50,000 with variable interest, with a maturity of 25 years, last year the rate would have been €224 and this year it will rise to €240.

Summarizing the data, you can see in the table below:

Raiffeisen Bank: Mortgage rates increased from 1,000 lei to 1,607 lei (60.7%)

I have done the requested simulation, it is applicable for loan granted before 2019 (from 2019 loans were granted at IRCC and not at ROBOR)

Thus, for a loan with a balance of 250,000 lei and a remaining term of 25 years, the approximate rates will be as follows:

- with the cost of Robor 3M from July 2021 – 1000 lei

- with the cost of Robor 3m from July 2022* – 1607 lei

It is also worth noting the fact that in order to reduce the risk of rising interest rates, our strategy was to constantly offer and promote loans with fixed interest for 5-7 years. Our clients have the opportunity to refinance existing loans with a fixed interest rate (7 years), representatives of Raiffeisen Bank informed HotNews.ro.

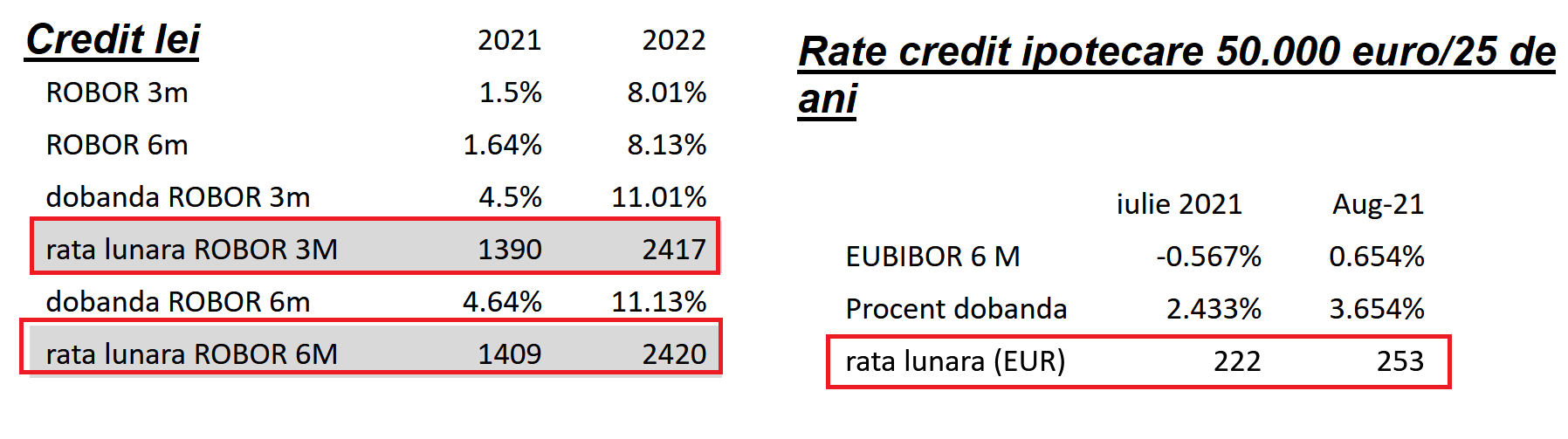

BRD: Credit in lei increased rates in lei from 1409 to 2420 lei, and in euros – by 28 euros

The impact of the increase in ROBOR on the monthly rate, if we look at the growth of the index from 2018 to now, is as shown in the table below.

We assume that the loan was available in July 2021, as it is a loan with an interest rate of ROBOR+3%.

What are the bankers’ expectations regarding tomorrow’s decision of the National Bank of Ukraine

All the main banking economists that HotNews spoke with confirmed that the NBR will make money more expensive on Friday to curb inflation. “We expect an increase of 1 p.p., followed by 0.75 p.p. and 0.5 p.p. in the next meetings, so that the monetary policy interest rate reaches 7% at the end of the year,” said Ionuc Dumitru, chief economist of Raiffeisen Bank, on Thursday.

“We believe that the BNR will raise the key rate by 75 basis points on Friday to reach 5.50%. We are not ruling out the possibility of 100 basis points, but think 75 is more likely. At the end of the year, we see the key interest rate at the level of 6.25% and the interest rate on the credit line at the level of 7.25%, the latter being an appropriate tool for the BNR’s monetary policy,” BCR officials said on Friday.

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.