At the end of 2018, when Mr. Ionescu took a loan from the bank to buy an apartment, his rate was low and he did not panic when the day came when it was due. In June 2021, the rate increased to 1,366 lei. After Isarescu rose in price, on August 1, 2022, Mr. Ionescu’s rate suddenly rose to 2,043 lei. The bad thing is that it will continue to grow, because on Friday there is another meeting at the NBR.

The situation of Mr. Ionescu is as follows:

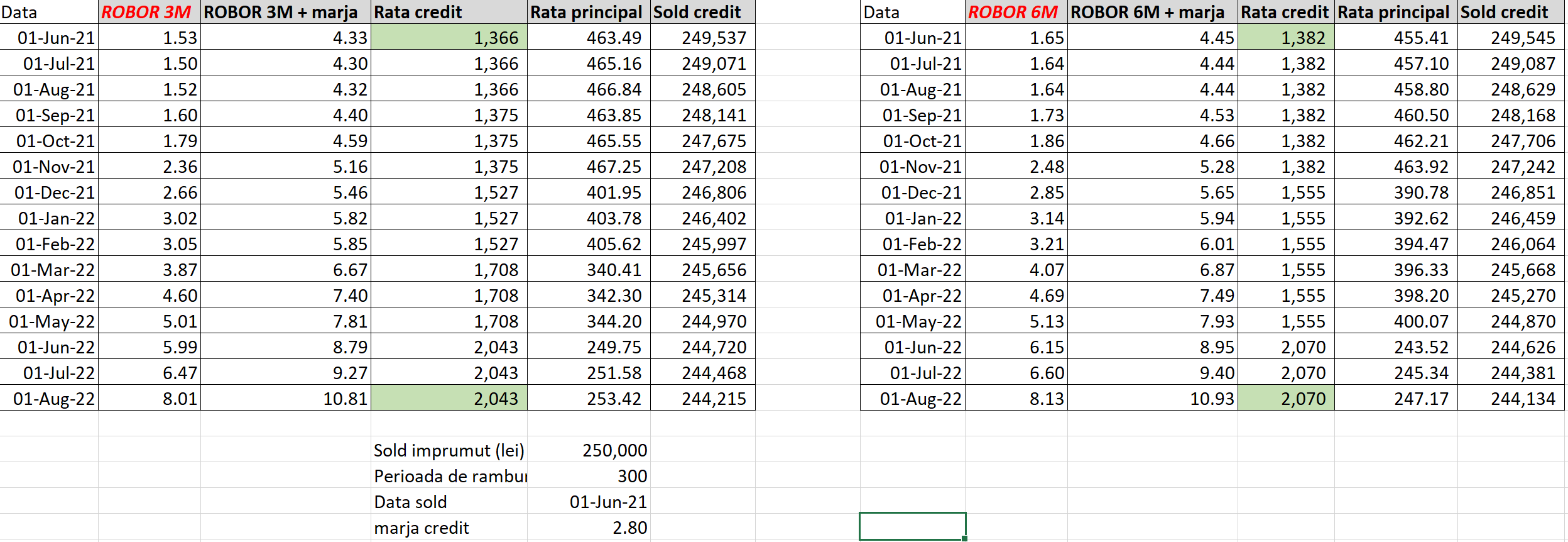

He has a loan granted until 2019 linked to ROBOR, not the newer IRCC, which in June 2021 had a balance of 250,000 lei with a remaining repayment period of 300 months. Credit margin 2.7%, fixed margin.

Mr. Ionescu took it with 6 month ROBOR but others took it with 3 month ROBOR.

- In the case of a loan with ROBOR 6M, the rate on June 1, 2021 was approximately 1,382 lei, while on August 1, 2022 it reached 2,070 lei (an increase of 50%, +687 lei)

- In the case of a loan with ROBOR 3M, the rate on June 1, 2021 was about 1,366 lei, while on August 1, 2022 it reached 2,043 lei (an increase of 50%, +678 lei)

We remind you that ROBOR 3M is updated every 3 months, and ROBOR 6M every 6 months.

The bad thing is that on Friday there will be a new meeting of the Central Bank of the NBR on monetary policy, where the 9 members of the board of directors may raise the key rate again, which will lead to another rate hike.

This year, decisions on monetary policy at the NBR will be made on August 5, October 5 and November 8, according to the calendar published by the National Bank, each of these days can record a new increase in the lei rate.

The ROBOR index has passed the 8% threshold and inflation is above 15%, both indicators showing signs of growth.

Is it better to switch from ROBOR to IRCC?

We are trying to convey that if a customer requests to switch from ROBOR to IRCC and this request is approved by the bank, then this process is irreversible. IRCC has another adjustment period and is a weighted average value that is three months very close to the average ROBOR for the period we are talking about, explained Bohdan Neatsu, CEO of CEC Bank and President of ARB. in discussion from HotNews.

We try to tell clients not to expect IRCC to be frozen. We try to explain them and teach customers to try to anticipate, to look at the horizon a little longer next month. Every bank is trying to find solutions for those periods in our lives when we are going through more difficult times, Neatsu says.

Another option would be to refinance your loans

Banks will support customers who are financially affected by the new context, using any necessary measures to prevent the crisis at the economic and social levels. Consumer-borrowers who have faced temporary financial difficulties can take advantage of individual solutions provided by banks, including on the basis of GEO 52/2016. Banks and consumers work together to identify the causes of financial difficulties and take appropriate action. The advantage of these individual measurements is that they are properly calibrated according to the needs of customers, says Bohdan Neatsu.

Consumers who are in a difficult situation can take advantage of a wide range of banking solutions, such as full or partial refinancing of the credit agreement, extension of the term of the credit agreement, change of the type of credit agreement, postponement of payment of the full or partial amount of the loan. repayment rate for the period, no-payment period offer, short-term rate reduction, etc. The average debt-to-income ratio is 33% for new loans and 42% for the entire portfolio of real estate loans, which provides room for maneuver for customized solutions with which banks approach consumers experiencing temporary financial difficulties.

What does the NBR’s key interest rate hike mean for your money?

We talked about raising credit rates. If you have bank deposits, you will get a better return (but which will still be well below the rate of inflation). Not tomorrow either, but depending on each individual bank.

If you have credit cards, they can suddenly go up in price. But let’s break them down one by one.

People are already suffering from the rising cost of living

When the NBR becomes more expensive, the cost of loans – whether for housing, or for a car, or for a trip after all the years of the pandemic and restrictions – will increase.

By increasing the base rate, the BNR causes a domino effect; directly or indirectly, loans become more expensive, which leads (technically) to a decrease in demand and inhibition of inflation (which is exactly what the NBR strives for).

The increase in interest rates by central banks (as it concerns not only the NBR) is connected with the world economic situation, which is much more difficult than it was just two years ago. A pandemic came that “shortened” supply chains, then the war in Ukraine and sanctions against Russia, which shook the energy markets. And continues to do so.

BNR is getting more expensive this year, let’s be clear. So far, consumers are feeling the rise in inflation more strongly, but the consequences of the NBR’s decisions will be all the more pronounced as the central bank raises the key interest rate.

For banks, the BNR’s decision on Tuesday does not necessarily bring happiness

The more credit rates rise, the more likely it is that people seek to repay loans, and some of them become unemployed, which hurts bankers for money, forced to create financial reserves (provisions) in BNR. If you also take into account that they will have to reward depositors better (that is, take extra money out of their pockets), neither banks nor consumers are happy with the decisions of the board chaired by Mugur Iserescu. And then, why does the NBR keep raising the price of the lei?

What are reference interest rates?

According to the European Central Bank, interest rate benchmarks, also known as “reference interest rates”, “benchmark rates” or “benchmark rates”, underpin all types of financial contracts, such as mortgages, overdrafts and other more complex financial transactions. They play an important role in the financial and banking system, as well as the economy as a whole. But what exactly makes them so important? And for what reasons are they reforming now?

Reference interest rates are used by both individuals and firms throughout the economic system.

Banks use them when providing loans to clients.

Companies may use reference interest rates to evaluate balance sheet positions; in other words, these ratios allow the accountant to more easily calculate what, in the end, is the value of the company (more precisely, the financial assets it owns).

Other uses of reference interest rates include: calculating overdraft penalties on cash accounts, calculating interest on some retail deposits and negotiating interest rates on mortgages and retail loans.

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.